Today is a big day for the crypto market. Around $3 billion worth of Bitcoin and Ethereum options are set to expire, and that could lead to some price swings. If you’re a trader or investor, it’s a good idea to keep an eye on what happens, especially around 8:00 AM UTC, when these options officially run out.

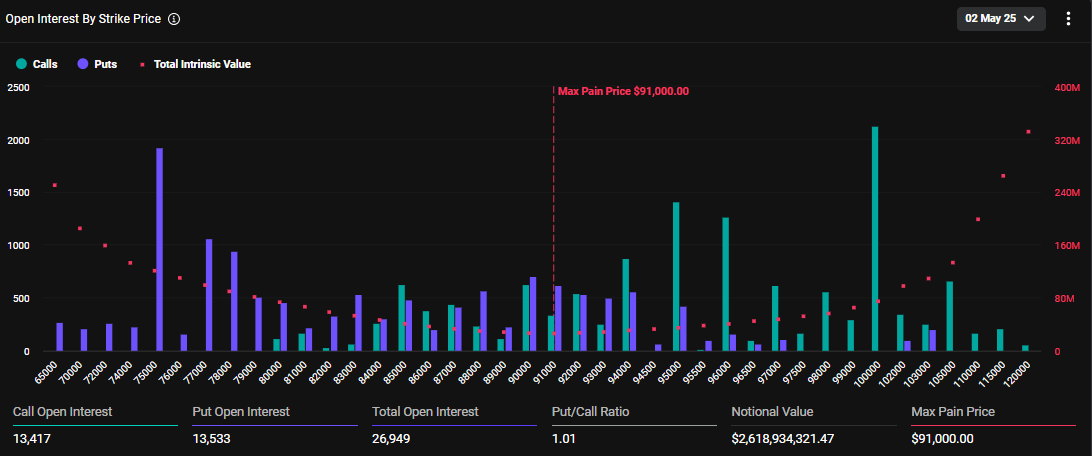

Bitcoin Options Worth $2.6 Billion Expiring

Data from crypto platform Deribit shows that almost 27,000 Bitcoin options contracts will expire today, adding up to about $2.6 billion.

The “max pain point” for Bitcoin is $91,000. This is the price where most option holders would lose money, because many of the contracts would end up worthless.

There are slightly more people betting that Bitcoin will drop than those betting it will rise. This is shown by the put-to-call ratio being 1.01—a sign of some nervousness in the market.

However, not everyone sees it that way. Some analysts say the market is still mostly bullish, meaning many traders expect Bitcoin to keep going up—possibly even hitting $100,000 soon.

They’re watching price levels like $94,400 and $96,000 closely. These are important because that’s where a lot of buying and selling is happening.

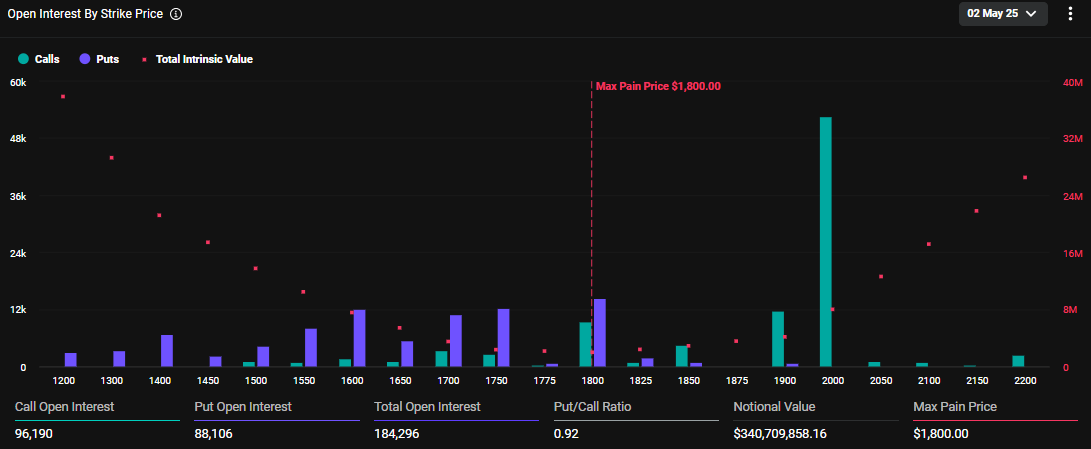

Ethereum Options Worth $340 Million Also Expiring

Ethereum isn’t being left out. Around 184,000 Ethereum options contracts (worth about $340 million) are also expiring today.

For ETH, the max pain point is $1,800, and the put-to-call ratio is 0.92. That means more people are betting on Ethereum going up, compared to those expecting it to fall.

Ethereum’s price has already gone up by about 2.27% since Friday and is currently trading around $1,848.

What Usually Happens When Options Expire?

When this many options expire, we often see short-term price changes. This is because traders rush to close or adjust their positions.

For example, last week, over $8 billion worth of crypto options expired, which caused some brief price dips before things calmed down.

Right now, Bitcoin is trading above $97,000, up about 3% in the last 24 hours. A lot of traders are placing big bets on it going even higher, especially above $95,000.

Some traders think Ethereum will fall compared to Bitcoin and are shorting it (betting it will go down). Others are preparing for price swings later this summer, hoping to profit when the market becomes more active.

In quieter markets like now, some traders make money by selling options and collecting fees, since prices aren’t moving much. This strategy works best when the market stays calm.