Today, a massive $8.05 billion worth of Bitcoin (BTC) and Ethereum (ETH) options contracts are expiring. This big event could shake things up in the crypto market, at least in the short term.

Why does this matter? When a lot of options expire at once, it often leads to price swings. Traders keep a close eye on these days because it can give clues about where prices might go next.

Bitcoin Options Expiry Breakdown

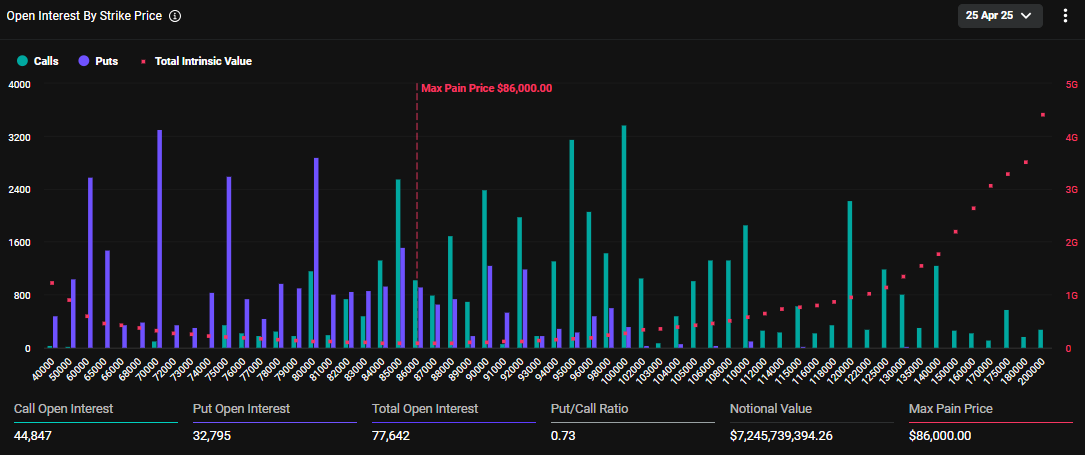

Out of the total, $7.24 billion worth of Bitcoin options are expiring today. According to Deribit (a major crypto options exchange), there are 77,642 BTC contracts set to expire. The “put-to-call” ratio is 0.73, which means more people bet on Bitcoin going up (calls) than down (puts).

Another key number is the “max pain point” for Bitcoin, which sits at $86,000. This is the price that would cause the most losses for option traders—it’s like the balance point where the most people lose money. Interestingly, Bitcoin is trading above that level today, at around $93,471.

This kind of setup isn’t new. Back in March 2022, when over $6 billion in BTC options expired, Bitcoin also saw some short-term volatility around its max pain point before stabilizing.

Ethereum Options Also in Focus

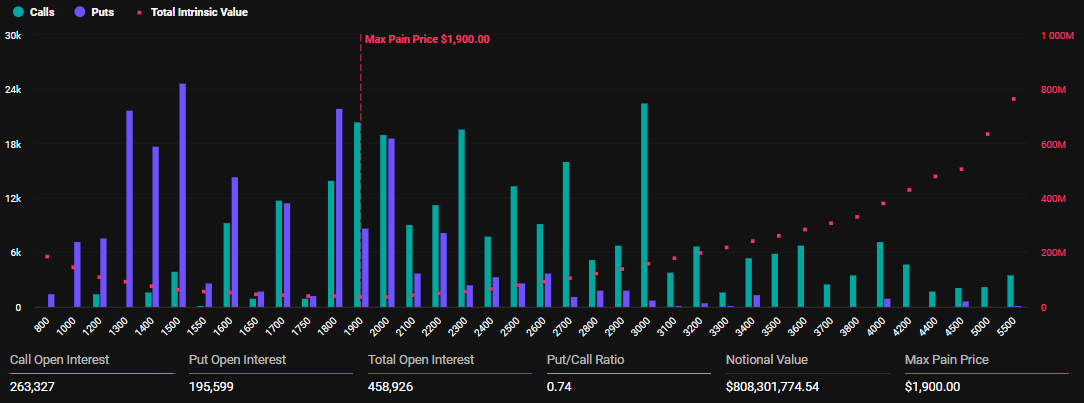

It’s not just Bitcoin—Ethereum has 458,926 contracts expiring today, worth about $808 million. The put-to-call ratio here is 0.74, again showing more bullish bets. The max pain point for ETH is $1,900. Right now, Ethereum is trading below that at around $1,764.

Compared to last week, today’s Ethereum options volume is way up. Just a week ago, only 177,130 ETH contracts expired, worth $279 million. That means this week’s volume is more than double, which could lead to bigger price reactions.

What Traders Are Doing

According to Deribit, traders are positioning themselves very close to these max pain levels. For Bitcoin, that’s between $80K–$90K, and for Ethereum, it’s between $1,800–$2,000. This clustering usually hints at sideways movement or short-term price jumps.

Some traders are using a smart strategy called “selling cash-secured puts.” Basically, they’re betting that Bitcoin won’t fall too much, and in return, they earn a steady income in stablecoins. This approach shows that many investors still believe in Bitcoin’s long-term growth.

What About Bitcoin Hitting $100K?

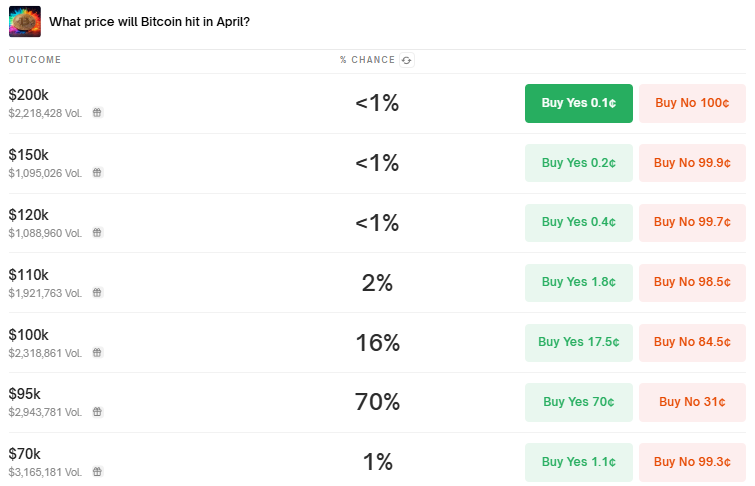

There’s a lot of buzz around whether Bitcoin will reach $100,000. Data shows the highest number of BTC options contracts are at this level. That means a lot of people are hoping for it. But prediction markets like Polymarket only give it a 16% chance of happening this month.

Still, long-term optimism remains. Deribit says more people are buying BTC call options (bets that prices will rise) for April to June 2025, targeting $90K to $110K levels. A similar wave of bullishness happened in early 2021 before Bitcoin’s run to its all-time high of nearly $69,000.

Behind the Scenes: What Might Be Moving Prices?

One hidden factor is the “cumulative delta” across BTC and ETF options—it hit $9 billion. This number shows how sensitive the market is to Bitcoin’s price changes and can also suggest increased volatility.

Analysts like Kyle Chassé also point out that big hedge funds often don’t care about long-term BTC gains. Instead, they take advantage of short-term strategies to earn safe profits. When those trades end, they pull their money out quickly, which sometimes causes sudden price drops.

Another interesting angle: some analysts believe Bitcoin’s recent price jump was partly helped by a policy change. When former U.S. President Trump rolled back tariffs earlier this month, it reduced global financial stress. That may have pushed investors to move money from gold to crypto.

However, not all the buying activity was new cash. Half of it came from traders adjusting their old positions—basically moving their bets to match the current market mood.