Are you watching the crypto market with bated breath, wondering what global events could trigger the next big wave? Well, keep your eyes peeled on the latest developments in the US-China trade saga! Former U.S. President Donald Trump recently shared his optimistic view on the ongoing trade negotiations with China, and this sentiment could have ripple effects across the crypto market. Let’s dive into what this could mean for your digital asset portfolio.

Why Trump’s Optimism on Trade Negotiations Matters

In a recent Cabinet meeting, as reported by Walter Bloomberg, Donald Trump expressed confidence that tariff negotiations with China are progressing positively. This comes on the heels of an announcement where the U.S. postponed reciprocal tariffs on countries other than China for 90 days. Furthermore, there was a clarification regarding tariffs on China itself, with the White House indicating a total tariff rate of 145%, not 125%. But why should crypto enthusiasts care about these seemingly traditional economic policies?

- Global Economic Interconnectedness: The cryptocurrency market, while digital and decentralized, is intrinsically linked to the global economy. Major economic events, especially those involving global powerhouses like the U.S. and China, can significantly influence investor sentiment and market movements.

- Risk-On vs. Risk-Off Assets: Positive news regarding trade negotiations often leads to a ‘risk-on’ sentiment in traditional markets. This can sometimes spill over into the crypto market, as investors become more willing to explore riskier assets like cryptocurrencies.

- Currency Fluctuations: Trade tensions can cause fluctuations in fiat currencies. In times of uncertainty, some investors turn to cryptocurrencies as a hedge against currency devaluation or economic instability. Conversely, positive trade news can stabilize fiat currencies and influence crypto valuations.

Decoding the Impact of China Tariffs

China Tariffs have been a significant point of contention in global trade for years. Understanding the nuances of these tariffs is crucial to grasping their potential impact:

| Aspect | Impact of Increased Tariffs | Potential Impact of Eased Tariffs (Positive Negotiations) |

|---|---|---|

| Consumer Goods Prices | Increased prices for consumers in the tariff-imposing country. | Potential decrease in prices, benefiting consumers. |

| Business Investment | Uncertainty for businesses, potentially leading to reduced investment and supply chain disruptions. | Increased business confidence, potentially leading to higher investment and smoother supply chains. |

| Market Sentiment | Negative market sentiment, increased volatility in financial markets. | Positive market sentiment, reduced volatility and increased investor confidence. |

| Crypto Market (Potential) | In times of high tariff uncertainty, some might seek refuge in decentralized assets like crypto. | Positive sentiment from traditional markets could spill over, increasing investment in crypto as part of a broader risk-on approach. |

While the direct link between China Tariffs and the crypto market isn’t always linear, the overall economic climate they create plays a significant role in investor behavior across all asset classes.

Navigating Trade Negotiations and Market Volatility

Trade Negotiations are complex and can be a source of significant market volatility. Here’s what you need to consider as a crypto investor:

- Stay Informed: Keep a close watch on news related to US-China trade talks. Reputable economic news sources like Walter Bloomberg, financial news outlets, and cryptocurrency news platforms can provide timely updates.

- Diversify Your Portfolio: Diversification is key in volatile times. Don’t put all your eggs in one basket. Spread your investments across different cryptocurrencies and potentially other asset classes to mitigate risk.

- Manage Risk: Understand your risk tolerance. Trade negotiations can lead to rapid price swings. Use risk management tools like stop-loss orders and consider position sizing to protect your capital.

- Long-Term Perspective: Remember that the crypto market is inherently volatile, and external events like trade negotiations can amplify this volatility. Maintain a long-term perspective and avoid making impulsive decisions based on short-term news cycles.

The Broader Impact on the Global Economy

The outcome of these Trade Negotiations extends far beyond just tariffs. They have profound implications for the global economy. Positive resolutions can lead to:

- Increased Global Trade: Eased tensions can stimulate international trade, benefiting businesses and consumers worldwide.

- Economic Growth: Reduced trade barriers can boost economic growth in participating countries and globally.

- Reduced Inflationary Pressures: Lower tariffs can help to ease inflationary pressures by reducing the cost of imported goods.

- Improved Investor Confidence: A stable and predictable trade environment fosters investor confidence, encouraging investment and economic activity.

Conversely, stalled or failed negotiations could lead to continued trade tensions, economic uncertainty, and potential market downturns. This uncertainty is a key driver of market impact across all sectors, including the cryptocurrency space.

Understanding Market Impact: Crypto’s Reaction to Trade News

The market impact of trade-related news on the crypto sphere can manifest in various ways:

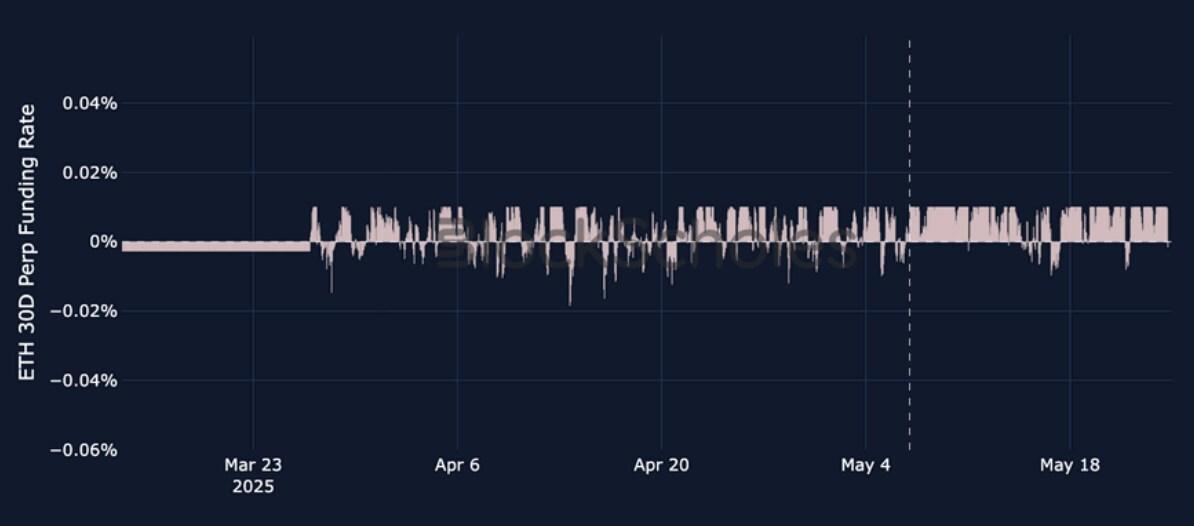

- Price Fluctuations: Expect to see increased volatility in cryptocurrency prices as news breaks and market sentiment shifts.

- Trading Volume Surges: Periods of uncertainty or optimism can lead to increased trading volume as investors react to the news.

- Correlation with Traditional Markets: While crypto was once considered uncorrelated, it has shown increasing correlation with traditional markets, especially during times of economic shifts. Positive trade news could see crypto move in tandem with stock markets, for instance.

- Safe Haven Narrative: In times of severe economic stress due to failed trade talks, the narrative of Bitcoin and other cryptos as ‘safe haven’ assets might gain traction, potentially leading to increased demand.

It’s important to note that the crypto market’s reaction is not always predictable and can be influenced by a multitude of factors beyond just trade negotiations. However, understanding the potential linkages is crucial for informed investment decisions.

Actionable Insights for Crypto Investors

So, what should you do with this information? Here are some actionable insights:

- Stay Agile: Be prepared to adjust your investment strategy based on evolving trade news. Agility is key in the fast-paced crypto market.

- Conduct Thorough Research: Don’t rely solely on headlines. Dig deeper into the details of trade negotiations and their potential economic consequences.

- Consider Dollar-Cost Averaging (DCA): In volatile times, DCA can be a less stressful approach to investing. It involves investing a fixed amount at regular intervals, regardless of price fluctuations.

- Seek Professional Advice: If you’re unsure how trade negotiations might impact your crypto investments, consider consulting with a financial advisor who understands both traditional and crypto markets.

Conclusion: Navigating the Trade Winds in the Crypto Sea

Trump’s optimistic comments on China Tariffs negotiations offer a glimmer of hope for a more stable global economy, which could indirectly benefit the crypto market. While the market impact is complex and multifaceted, understanding the potential linkages between trade news and crypto movements is essential for navigating the volatile crypto sea. By staying informed, managing risk, and maintaining a long-term perspective, you can better position yourself to capitalize on opportunities and weather any potential storms.

To learn more about the latest crypto market trends, explore our article on key developments shaping Bitcoin price action.

[ad_2]

Source link