Today’s a big day in the crypto world — over $2.5 billion worth of Bitcoin (BTC) and Ethereum (ETH) options are set to expire. For traders and investors, this is a moment to watch closely because events like this can cause sudden price swings, especially when markets are already jumpy.

What’s Actually Happening?

Let’s break it down:

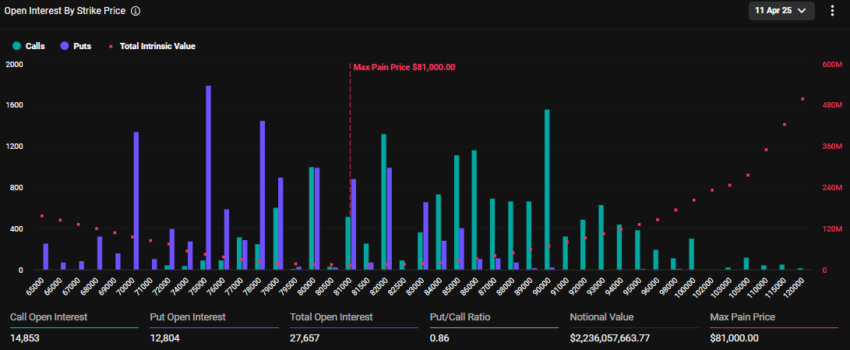

- Around 27,657 Bitcoin options, worth $2.23 billion, will expire today.

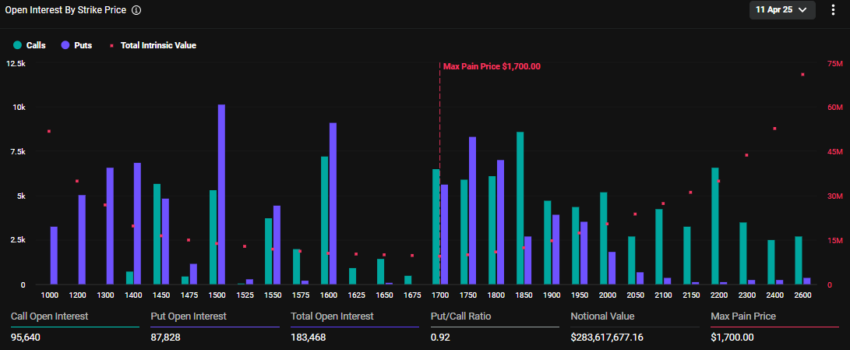

- Alongside that, 183,468 Ethereum options worth $283.6 million are also expiring.

In simple terms, these are contracts traders made to buy or sell BTC or ETH at certain prices, and once they expire, those positions close — which can create buying or selling pressure, depending on where prices stand.

What Are “Put-to-Call Ratios” and “Max Pain Points”?

These are trading terms, but let’s simplify them:

- Put-to-call ratio tells us if more people are betting the price will go down (puts) or up (calls).

- For Bitcoin, it’s 0.86 – meaning more people are expecting a price increase.

- For Ethereum, it’s 0.92 – slightly more balanced, but still leaning toward bullish.

- Max pain point is the price where most of these options expire worthless – basically, the price where traders lose the most money.

- For Bitcoin, that point is $81,000.

- For Ethereum, it’s $1,700.

Currently, Bitcoin is trading at around $80,622, and Ethereum is at $1,543 — both below their max pain points. This could trigger some volatility as traders adjust their positions to cut losses or lock in profits.

What Does This Mean for the Market?

According to analysts at Deribit, one of the biggest crypto options platforms, the expiry could influence short-term price moves. And with markets already nervous due to the US-China tariff drama, the timing adds even more tension.

Deribit even asked traders directly:

“With recent market volatility and ongoing tariff developments, how do you think these expiries will impact price action?”

What’s Causing All This Nervousness?

Much of it comes from uncertainty in global markets, especially due to tariffs and trade tensions stirred up by former President Trump’s recent announcements. Investors tend to get cautious during these times — and crypto, being naturally volatile, feels that even more.

Cardano’s founder, Charles Hoskinson, says these tariff threats are already “priced in” and probably won’t affect crypto much going forward. But not everyone agrees.

Traders Are Playing It Safe Until September

Deribit’s analysts are noticing a change in behavior:

- Traders are buying more puts (betting on price drops) in the short term.

- The demand for calls (betting on price increases) is only coming in for options expiring in September or later.

In other words, people don’t expect much upside in the next few months — and they’re preparing for more price drops.

Volatility Tells the Story

Another clue comes from what’s called Implied Volatility (IV) — a measure of how much price movement traders expect.

- Bitcoin’s IV has dropped to around 50% across most timeframes, showing traders expect less dramatic swings.

- But Ethereum’s IV is still high, near 80%, especially in the short term. This means traders see ETH as more unpredictable — and possibly more risky — right now.

This also makes selling ETH options more attractive in the short term, as sellers can charge higher premiums.

A History Lesson: We’ve Been Here Before

Options expiries have triggered major market moves in the past:

- In March 2021, a $6 billion BTC options expiry led to a sharp dip, followed by a quick rebound.

- In June 2022, ETH saw a big sell-off right after options expired, as bearish bets paid off.

These moments often act like a reset button — but they can also bring pain if traders aren’t positioned well.

What Should Traders Do Now?

Analysts from Greeks.live, another crypto trading platform, say the market is nervous:

“Sentiment was more panicky this week, with Trump’s frequent switching of tariff policies making the market extremely risk averse.”

They also warn that a lack of new money and new stories in crypto is dragging down enthusiasm. They recommend strategies like:

- Buying protective puts to guard against big drops.

- Switching into stablecoins to reduce exposure.

- Avoiding overly risky bets in the current climate.

“In this kind of market, where bulls are fading and bears are growing, the chance of a surprise crash — a ‘black swan’ — is much higher,” they added.