Ethereum (ETH) just hit its lowest point compared to Bitcoin (BTC) since 2020. The ETH/BTC ratio has dropped to 0.01791, which simply means 1 ETH now buys you less Bitcoin than it used to.

So, what’s going on? A big part of this has to do with major holders — known as “whales” — cashing out.

Big Players Are Dumping ETH

Large companies and foundations that own tons of ETH are moving their coins to exchanges, which usually means they’re planning to sell. And when big investors sell, prices often drop.

On April 22, Galaxy Digital moved 5,000 ETH (about $8.1 million) to Binance. Just days before, they had already moved $100 million worth of ETH to exchanges. That’s a lot of selling pressure.

Other names are doing the same:

- Paradigm sent 5,500 ETH (around $8.6 million) to Anchorage Digital.

- An address tied to the Ethereum Foundation moved 1,000 ETH to Kraken.

These aren’t random moves — they show that some of the biggest players in the space are either cashing out or getting ready to.

Ethereum Is Losing Ground to Bitcoin

At the same time, Bitcoin is close to hitting $90,000, while ETH has dropped to around $1,574 — down 2.5% in a day. This growing gap is pushing more people to choose Bitcoin over ETH, which makes things even harder for Ethereum in the short run.

To make things worse, this isn’t the first time the Ethereum Foundation has sold ETH. Back in late 2021, they sold 20,000 ETH, and not long after that, the market dipped. So these recent moves are definitely raising eyebrows.

Ethereum Staking Falls Behind Rivals

Only about 28% of ETH is currently staked — much lower than Solana’s 65%. That means fewer people are locking up their ETH to support the network and earn rewards. For investors, that’s not a great sign, especially when staking returns are lower than what other networks offer.

Bitcoin also continues to dominate the overall crypto market. Its market share is now the highest it’s been in four years, which shows that a lot of the money is moving out of altcoins like Ethereum.

Is There Still Hope?

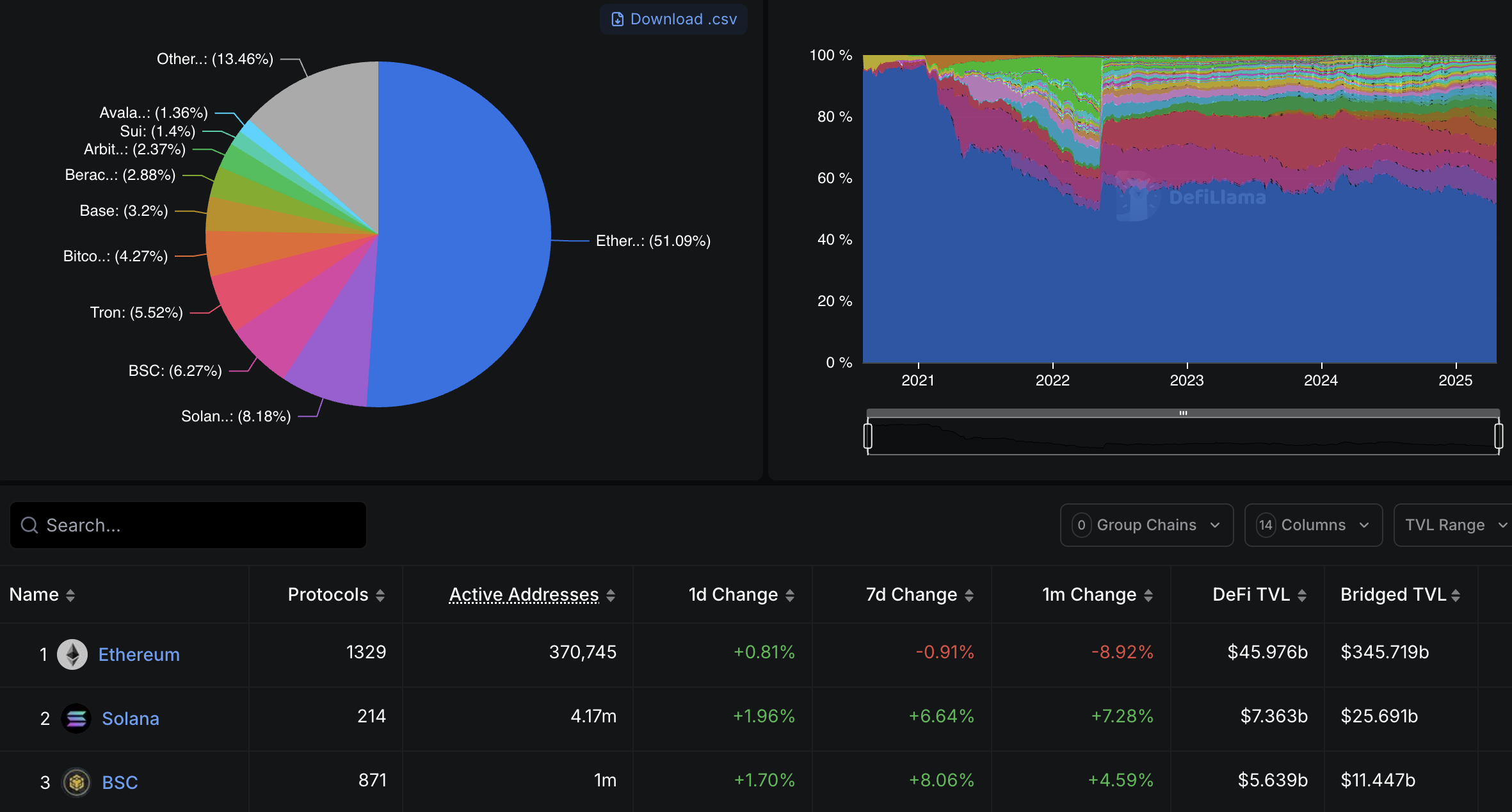

Yes — despite all this, Ethereum isn’t dead. In fact, it’s still the number one platform for things like DeFi (decentralized finance) and NFTs. Right now, over $45 billion is locked in Ethereum-based apps, according to DefiLlama.

And don’t forget, Ethereum is still evolving. With Ethereum 2.0 and the switch to a more energy-efficient system, there’s still potential for a strong comeback.

Bottom Line

Right now, Ethereum is under pressure. Big investors are selling, and it’s losing ground to Bitcoin. If this trend continues, we could see more downside in the short term.

But Ethereum still has a strong base. It might just be a rough patch — and if the upgrades deliver, ETH could bounce back.