Julien Bittel, a market expert at Global Market Investor, has shared his thoughts on Bitcoin’s recent price drop. Even after last week’s big fall, he believes Bitcoin is likely to bounce back, linking the drop to bigger economic changes.

Did Bitcoin’s Fall Below $80K Signal the End of the Sell-Off?

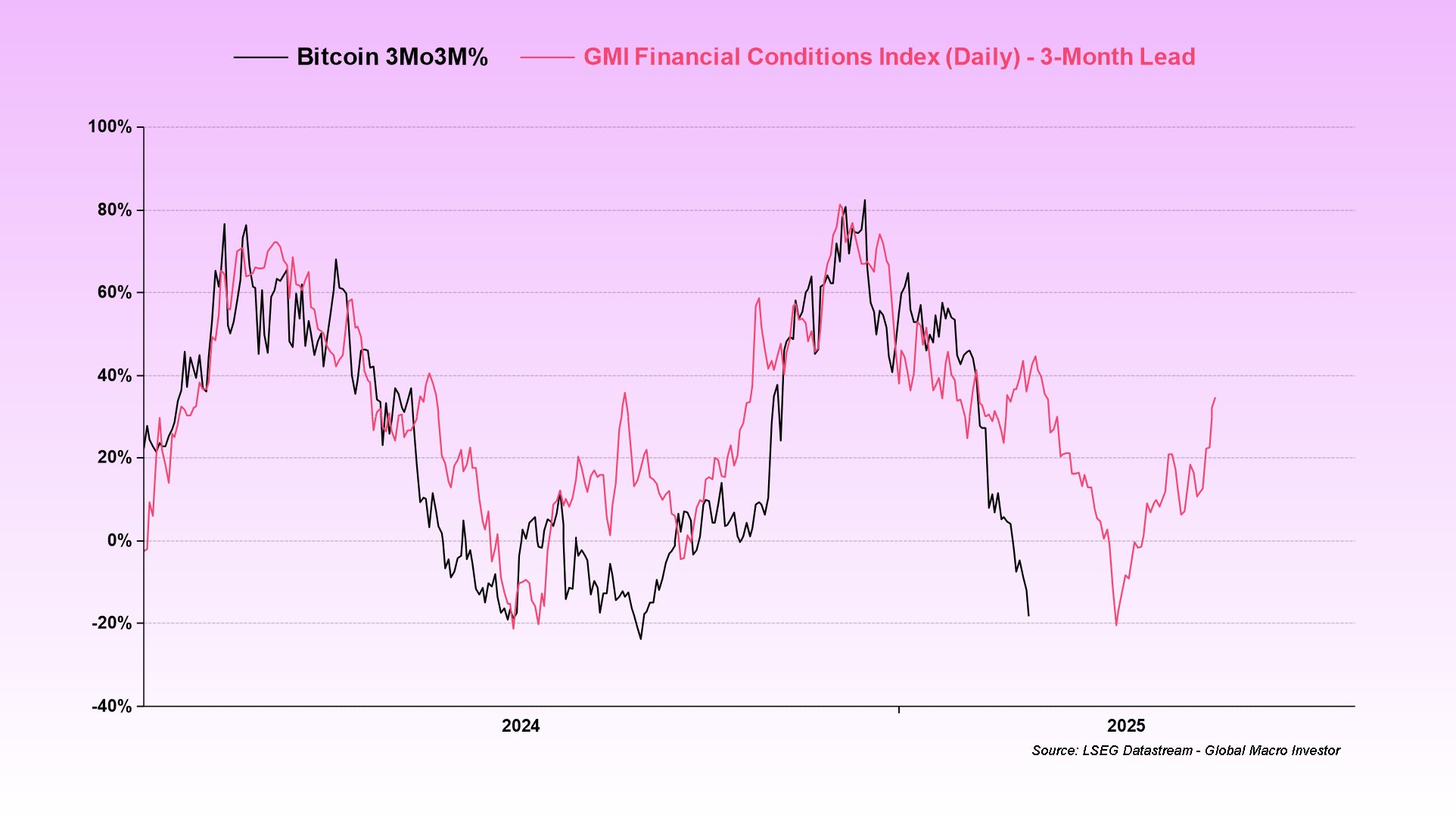

Bitcoin’s price took a hit last week, dropping from over $96,000 to below $80,000. In a post on X (formerly Twitter) on February 28, Bittel said this happened because money became harder to access in late 2024. With less cash flowing in, risky investments like Bitcoin struggled to keep rising.

When there’s less money in the market, the economy slows down, people worry about a possible recession, and investors become more careful. However, Bittel believes this cautious mood will start to change in March, giving Bitcoin a chance to recover.

The analyst says that market conditions have been improving quickly over the last two weeks. This can be seen in a weaker dollar, lower bond returns, and falling oil prices. These changes suggest that more money is coming back into the market, which could boost confidence and help Bitcoin recover.

For example, in past cases, when bond yields and oil prices dropped in late 2023, Bitcoin saw a strong rebound shortly after. A similar pattern happened in mid-2021 when fears of a market crash were high, but Bitcoin bounced back once liquidity improved.

Since Bitcoin recently fell below $80,000, Julien Bittel believes the effects of tight money conditions have already been felt. While there’s still a chance of a further drop, market signals show there isn’t much room left for big losses. For example, Bitcoin’s Relative Strength Index (RSI) recently hit 23, its lowest level since August 2023. Historically, whenever RSI drops this low—like in June 2022 and September 2023—Bitcoin has usually rebounded within weeks.

A Chance to Buy Bitcoin While Others Are Scared?

Bittel advises investors not to be too negative. Instead of following the crowd and expecting more losses, he suggests this might be a good time to buy while others are afraid.

This has happened before—during the market crash of March 2020, many traders panicked and sold their Bitcoin, but those who bought during the fear saw huge gains later that year. Similarly, in December 2018, Bitcoin hit a low of $3,200, and most people expected more losses. However, within months, Bitcoin surged past $10,000.

Blockchain research firm Santiment also notes that traders often guess wrong—when most people expect Bitcoin to fall, it usually rises, and vice versa. If history repeats itself, the current market might actually be a good opportunity to buy, even though many fear prices will stay low..

As of now, Bitcoin is priced at $84,750 after gaining some value on Friday due to a positive US inflation report. With a total market value of $1.68 trillion, Bitcoin is still the biggest cryptocurrency, holding a strong 60% share of the market.