Bitcoin had a strong April, doing better than the stock market even as financial conditions were shaky. A report by investment firm VanEck shows that while Bitcoin acted like a “safe bet” for a short time, it’s still mostly moving with traditional markets like stocks.

Bitcoin Went Up While Stocks Dropped

In early April, Bitcoin’s price rose from $81,500 to over $84,500. This happened just after former U.S. President Donald Trump announced new tariffs, which made global markets fall. While the S&P 500 and gold went down, Bitcoin went up — a sign that some investors may be looking at it as a backup plan when markets get rough.

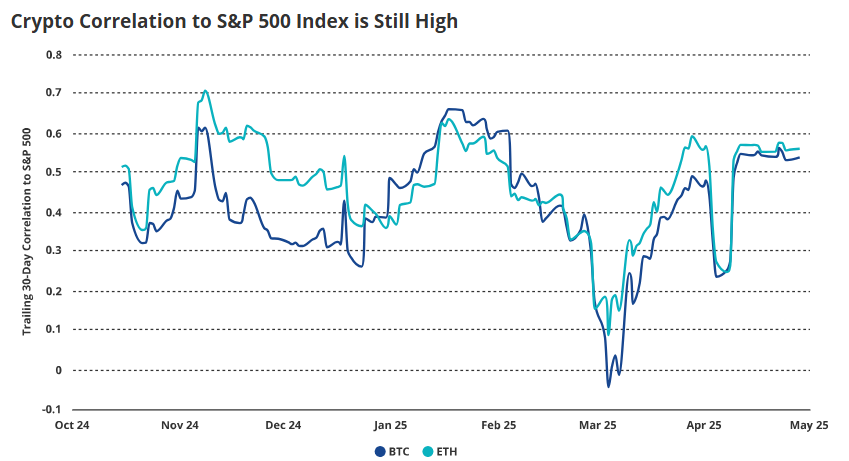

But that didn’t last long. By the end of April, Bitcoin’s price started moving in the same direction as the stock market again. According to VanEck, Bitcoin’s link to the S&P 500 dropped early in the month but then climbed back — showing that it’s still tied to how the stock market behaves.

Bitcoin Still Came Out On Top

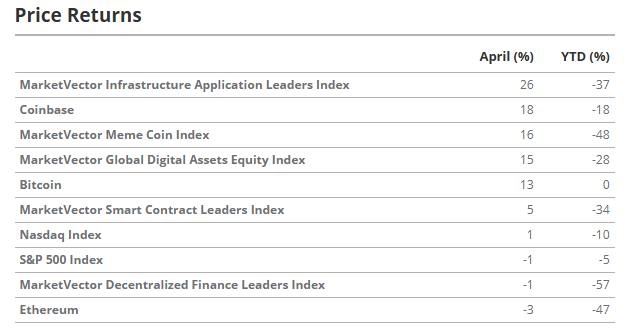

Even though it followed the stock market again later, Bitcoin still gained 13% for the month. That’s much better than the NASDAQ, which lost 1%, and the S&P 500, which didn’t move much.

What’s even more surprising is that Bitcoin became less volatile in April — meaning its price didn’t swing as much. That’s the opposite of what happened in the stock market, where price swings increased due to global uncertainty.

VanEck thinks this could be a sign that Bitcoin is maturing and may slowly become more independent from traditional finance. They mentioned that countries like Venezuela and Russia have started using Bitcoin in trade, which shows it’s gaining more trust globally.

Big Companies Are Buying More Bitcoin

In April, some well-known companies added more Bitcoin to their holdings. MicroStrategy (now known as Strategy) bought 25,400 more BTC. Other companies like Metaplanet and Semler Scientific also joined in.

On top of that, big financial names like SoftBank, Tether, and Cantor Fitzgerald launched a new company called 21 Capital, which plans to buy $3 billion worth of Bitcoin.

Standard Chartered Bank also said Bitcoin is becoming a way for investors to protect their money from risks in traditional finance and U.S. government debt.

Other Cryptos Didn’t Do As Well

While Bitcoin had a good month, many other cryptocurrencies struggled. Meme coins, AI-related DeFi tokens, and major platforms like Ethereum and Sui dropped in value.

VanEck’s Smart Contract Index — which tracks popular crypto platforms — dropped 5% in April and is down 34% for the year. One exception was Solana, which gained 16% thanks to upgrades and growing interest from big investors.

Sui also did well, with a 45% jump in daily trading activity and higher earnings. On the other hand, Ethereum fell 3%, and its earnings from transaction fees have dropped sharply compared to two years ago.

Meme coins also saw a huge drop in interest. Trading volume fell 93% between January and March, and meme coin values are down 48% this year.

What’s Next?

April showed that Bitcoin can sometimes move on its own and act like a safer asset. But for now, it’s still closely tied to the stock market. That said, growing interest from companies, countries, and investors could help Bitcoin break free and act more like a long-term store of value in the future.