BTC’s price might stay stuck in consolidation longer than expected, as recent on-chain data shows that the Bitcoin Coinbase Premium Index has fallen back below zero. What does this drop mean for the leading cryptocurrency?

Is The Bitcoin Price At Risk Of Downward Movement?

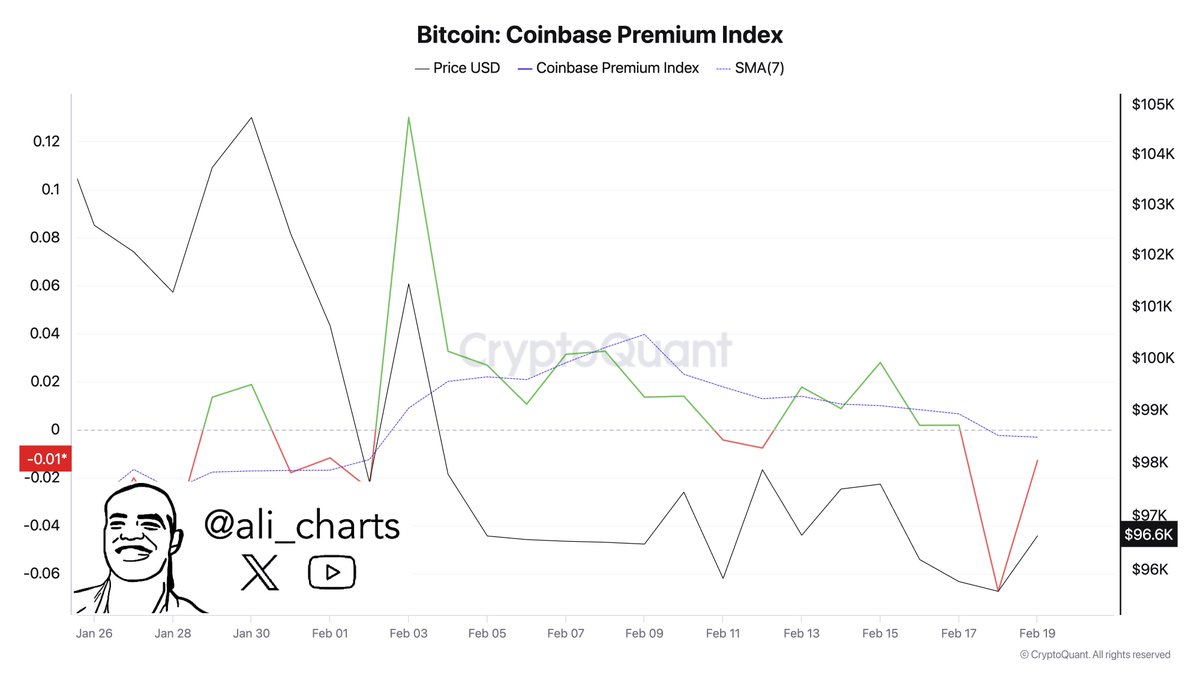

In a recent post on X, well-known crypto expert Ali Martinez shared that the Bitcoin Coinbase Premium Index has been falling and recently dropped below a key level. The Coinbase Premium Index is an on-chain metric that compares the price of BTC on Coinbase (USD pair) to the price on Binance (USDT pair).

This indicator helps show the difference in buying and selling behavior between investors on these two platforms. It reflects the sentiment of US institutional investors (the main players on Coinbase) compared to global investors on other exchanges.

Usually, when the Bitcoin price premium on Coinbase rises or is positive, it means US investors are showing higher demand and are willing to pay more for Bitcoin than global investors. However, when the Coinbase Premium Index drops below zero, it indicates that US investors are buying less Bitcoin compared to traders on global platforms.

This low buying activity is highlighted by the drab performance of spot BTC exchange-traded funds in recent weeks. The latest market data shows that the US Bitcoin ETF market registered a total outflow of $559 million in the past week.

With institutional and large US investors not accumulating Bitcoin at current prices, the market leader could struggle to build any real bullish momentum. Historically, a sustained decline of the Coinbase Premium Index metric has been associated with a consolidation period or even potential downside risk for the BTC price in the near term.

BTC Whales Offload Assets

In another post on X, Martinez pointed out that a group of Bitcoin investors has been reducing their holdings recently. Data from Santiment shows that whales holding between 10,000 and 100,000 BTC have sold 30,000 BTC (around $2.9 billion) over the past 10 days.

This selling activity helps explain why Bitcoin’s price has been slow to move in recent weeks. As of now, BTC is priced just above $96,500, showing a 0.8% increase in the last 24 hours. However, it has dropped by 1.1% over the past week, according to CoinGecko data.