After weeks of investors pulling money out, Bitcoin exchange-traded funds (ETFs) are finally seeing some positive movement. On March 17, Bitcoin ETFs brought in $274.6 million, the highest single-day inflow in over a month.

While one good day doesn’t mean a full recovery, it does raise an important question—are investors getting interested again, or is this just a short-term break from the recent selloff?

Bitcoin ETFs Attract Big Investments

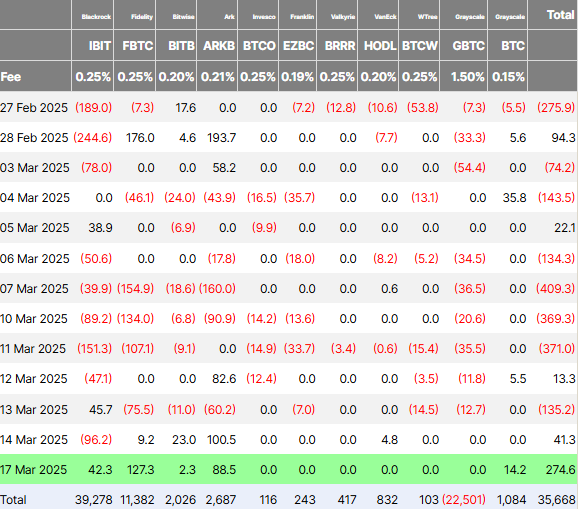

According to data from Farside Investors, some of the biggest Bitcoin ETFs saw strong inflows:

- Fidelity’s Bitcoin ETF (FBTC) had the largest gain, pulling in $127.28 million.

- ARK Invest’s ARK Bitcoin ETF (ARKB) followed with $88.5 million in new investments.

- BlackRock’s iShares Bitcoin Trust (IBIT) added $42.3 million.

However, not all Bitcoin ETFs saw gains. Grayscale Bitcoin Trust (GBTC), which has been losing money for weeks, did not receive any new investments. Since converting to a spot ETF in January 2024, GBTC has lost billions of dollars as investors moved to cheaper options.

Meanwhile, Ethereum ETFs continued to struggle, recording their ninth straight day of outflows, with $7.3 million leaving the market. This suggests that some investors might be shifting from Ethereum to Bitcoin ETFs.

One user on X (formerly Twitter) summed it up:

“Bitcoin ETFs bring in $275 million, while Ethereum ETFs keep losing money. Looks like investors are making their choice.”

Bitcoin ETFs Have Been Struggling for Weeks

This inflow comes after a tough few weeks for Bitcoin ETFs. Over the past four weeks, these funds lost more than $4.5 billion as investors took profits and reacted to regulatory concerns and uncertainty in the economy.

The wider crypto market also took a hit, with large investors pulling out over $800 million last week alone. This shows that many big investors have been cautious about putting their money into crypto.

With that in mind, Monday’s $274 million inflow is a good sign, but it’s too early to say if this is the start of a real comeback.

Is This Real Demand or Just Market Tricks?

Some experts think that big investors—like hedge funds—are just moving money around to take advantage of short-term price swings rather than making long-term investments.

Crypto investor Kyle Chassé believes some of the demand for Bitcoin ETFs comes from large funds playing the market rather than real long-term buyers.

“Some of the demand for Bitcoin ETFs was real, but a lot of it was just investors moving money around to make quick profits. Until we see true long-term buyers, Bitcoin’s price will keep jumping up and down.”

This raises an interesting question—are new investors really buying Bitcoin ETFs, or is this just big players shifting money around to make quick cash?

What’s Next for Bitcoin ETFs?

Investors are also watching what the Federal Reserve (the U.S. central bank) does next. Some people believe the Fed will start cutting interest rates and pumping more money into the economy, which could make Bitcoin more attractive.

However, financial expert Nic Puckrin warns that this idea might be wrong. He pointed out that the Fed’s interest rate is still between 4.25% and 4.5%, and in the past, they only start printing more money when rates are close to zero.

“People thinking the Fed will flood the market with cash are dreaming. If any country is going to do that, it’ll be China or Europe, not the U.S. Investors should prepare for another rough week.”

Bitcoin ETFs have finally stopped their losing streak, but it’s too soon to say if this is a real comeback or just a temporary bounce.

With Bitcoin still trading above $82,000 and investors uncertain about what comes next, the big question is—will demand for Bitcoin ETFs continue to grow or slow down again?

What do you think? Are Bitcoin ETFs back on track, or is this just another short-lived rally?