Bitcoin’s price has been a bit all over the place lately. After a rough three-month dip, the crypto market is still looking shaky. April brought a small bounce back, but nothing strong enough to say, “the bull run is back.” Still, there’s a glimmer of hope, thanks to something interesting happening behind the scenes.

Less Selling = More Confidence?

According to crypto analyst Axel Adler Jr., there’s a key change going on with long-term Bitcoin holders — the people who have held onto their Bitcoin for months or even years.

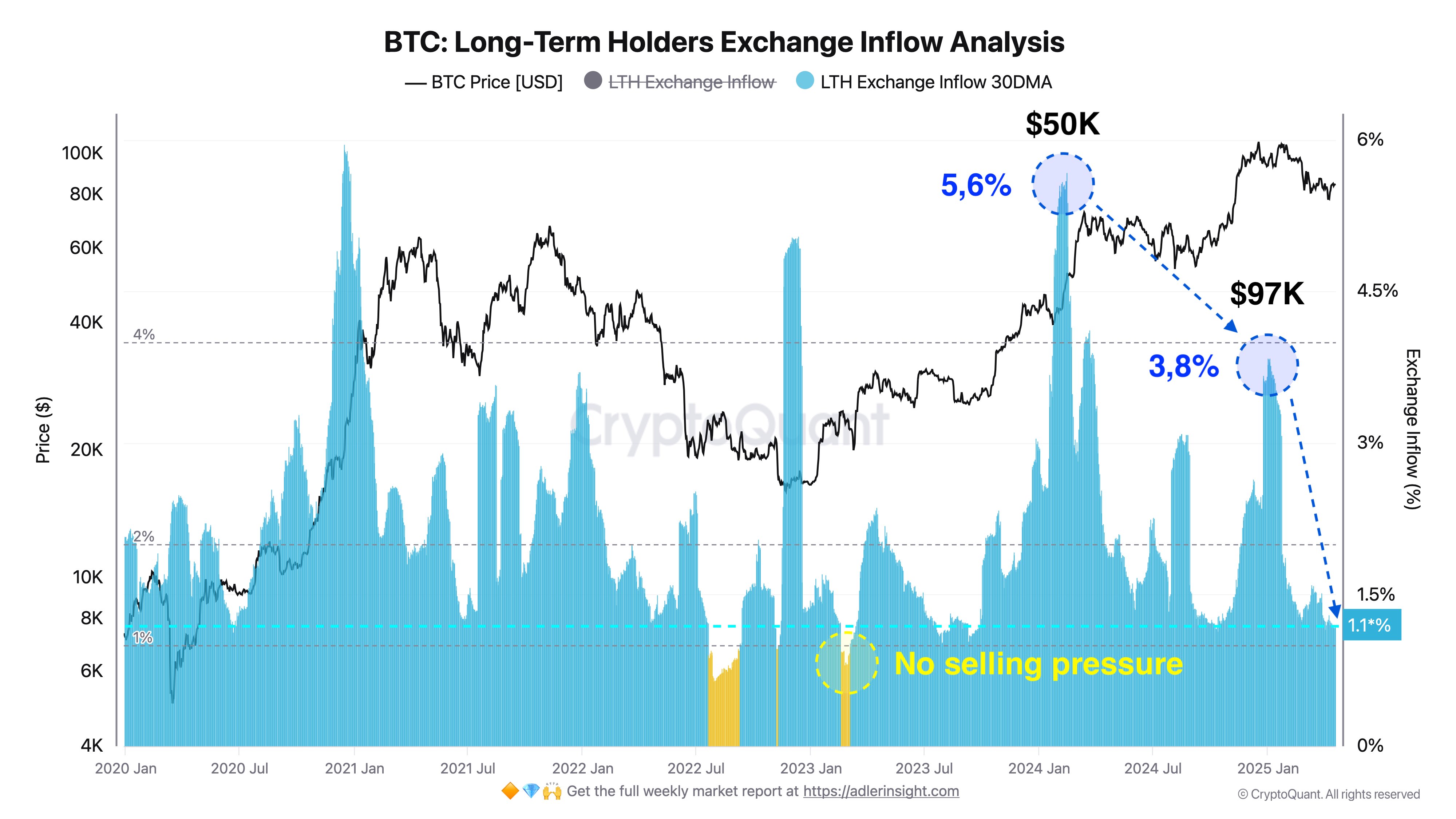

In a recent post on X (formerly Twitter), Adler pointed out that the amount of Bitcoin long-term holders are keeping on exchanges is at its lowest point in a year — just 1.1%. That’s a big deal.

Why? Because when holders move Bitcoin to exchanges, it usually means they’re thinking of selling. But now, they’re doing the opposite — keeping their coins off exchanges, which suggests they’re in no hurry to cash out.

One More Step Could Be a Big Signal

Adler says if that 1.1% drops just a bit more — to 1.0% — it would show that there’s almost no selling pressure at all from these long-term holders. That could attract more buyers and spark new excitement in the market.

Long-term holders are often seen as smart money — people who’ve been through the highs and lows and usually don’t sell unless they think the price has peaked. So, their behavior can be a strong indicator of what’s coming next.

History Repeats?

Adler also shared some past examples:

- Back when Bitcoin hit $50,000 in early 2024, LTH selling peaked at 5.6% — a classic profit-taking move.

- Then again, when Bitcoin hit $97,000 earlier in 2025, the selling rose to 3.8%.

Those two price points seem to be when most long-term holders chose to sell. Now, with fewer of them cashing out, it could mean those who wanted to take profits already did — and the ones left are waiting for bigger gains.

Right now, these long-term holders control a massive 77.5% of all Bitcoin in circulation. That’s a lot of power — and their decision to hold instead of sell might just be what helps Bitcoin gear up for its next big move.

Where’s the Price Now?

As of now, Bitcoin is trading at around $85,226. It’s seen a small daily gain of 0.36% and is basically flat over the week. While that doesn’t sound super exciting, it shows the market is stabilizing after the recent dip.

Over the past month, BTC is up almost 2%, which hints at a possible turnaround. But for a real rally to happen, the market still needs a strong trigger — maybe a major news event, institutional buying, or regulatory clarity.

Bitcoin remains the largest crypto asset, with a market cap of $1.67 trillion, and it holds about 62.9% of the entire crypto market.