Bybit, the world’s second-largest cryptocurrency exchange by trading volume, has released its latest weekly crypto derivatives analytics report in partnership with Block Scholes. The latest edition highlights a six-day streak of gains in risk-on assets, driven by encouraging signals around potential US trade deals. The report provides in-depth analysis of macroeconomic indicators, spot market activity, and derivative trends across futures, perpetual contracts, and options. It reflects a market lifted by renewed confidence, yet still navigating recent volatility and heightened risk awareness.

Key highlights:

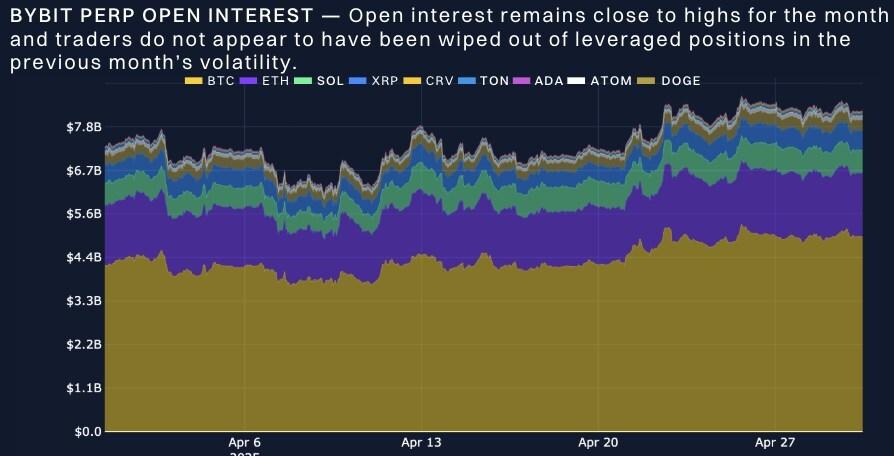

Perp at Multi-Month High; Traders Remain Cautious

After surging from $75,000 to over $95,000 in early April, Bitcoin has been trading sideways near $94,000 this week. Open interest has remained steady for April, hovering near all-time highs at $8 billion, while daily trade volumes have declined to $10 billion. Lower volumes have coincided with reduced realized volatility. Perpetual futures positioning suggests that traders are holding off on major bets, potentially awaiting the next breakout while remaining wary of recent sell-offs.

Bitcoin Volatility Drops to 18-Month Low

Bitcoin’s volatility has declined toward a key support zone between 35% and 40%—a range from which it has repeatedly rebounded over the past 18 months. Implied volatility has followed suit, dipping in line with a 10-point drop in realized volatility to just above 30%, the lower bound of its 18-month range. Options flows currently show a preference for puts, while the spot price remains stable. The volatility smile skews toward out-of-the-money (OTM) calls for longer-dated options, whereas short-dated options are close to neutral.

BTC Volatility Smile Tilts Toward OTM Calls

Bitcoin’s volatility smile now favors out-of-the-money (OTM) calls across all tenors, marking a reversal from the put-heavy skew seen earlier in April. Ether shows a similar short-term recovery, although longer-dated skew for ETH remains modestly bearish. Despite positive funding rates for ETH, longer-dated option smiles still lean toward puts, indicating mixed sentiment. In contrast, BTC derivatives markets reflect stronger bullish signals, including positive funding rate spikes, upward-sloping futures curves, and a renewed skew toward OTM calls.

Access the full report

The full report is available here.

#Bybit / #TheCryptoArk /#BybitResearch

About Bybit

Bybit is the world’s second-largest cryptocurrency exchange by trading volume, serving a global community of over 60 million users. Founded in 2018, Bybit is redefining openness in the decentralized world by creating a simpler, open and equal ecosystem for everyone. With a strong focus on Web3, Bybit partners strategically with leading blockchain protocols to provide robust infrastructure and drive on-chain innovation. Renowned for its secure custody, diverse marketplaces, intuitive user experience, and advanced blockchain tools, Bybit bridges the gap between TradFi and DeFi, empowering builders, creators, and enthusiasts to unlock the full potential of Web3. Discover the future of decentralized finance at Bybit.com.

For more details about Bybit, please visit Bybit Press

For media inquiries, please contact: [email protected]

For updates, please follow: Bybit’s Communities and Social Media

Discord | Facebook | Instagram | LinkedIn | Reddit | Telegram | TikTok | X | Youtube

[ad_2]

Source link