Coinbase has just released its first Ethereum Validator Performance Report, revealing that it now runs 120,000 validators managing a massive 3.84 million ETH in staked assets. This makes Coinbase the biggest single operator on the Ethereum network, controlling 11.42% of all staked ETH.

While this may sound impressive, it also raises some big questions about Ethereum’s decentralization and what it means for everyday users staking their ETH.

What This Means for ETH Stakers on Coinbase

📌 Solid Performance & Security

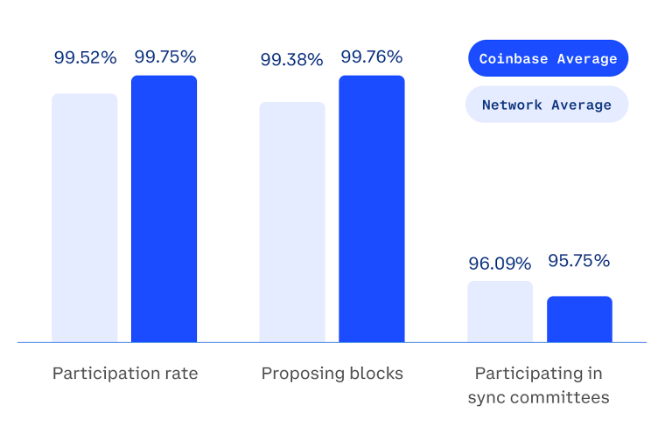

Coinbase reported a 99.75% participation rate and uptime, meaning staked ETH is actively working and earning rewards. Even better, they confirmed zero incidents of slashing or double signing, so users’ funds have remained safe.

📌 Slightly Lower Rewards for More Security

To avoid penalties, Coinbase prioritizes security over maximizing uptime. While this approach helps prevent financial losses from mistakes, it could also mean users earn slightly lower staking rewards than those using high-uptime staking services.

📌 Decentralization Concerns

With 11.42% of all staked ETH under its control, Coinbase has significant power over the Ethereum network. Some experts worry that too much control in one place goes against Ethereum’s decentralized vision.

One user on X (Twitter) warned:

“A single entity holding 11.42% is risky for network security. Transparency is good, but decentralization is better.”

Is Ethereum Becoming Too Centralized?

Ethereum was designed to be a decentralized network, meaning no single company or entity should have too much control. But over time, large operators like Coinbase and Lido have gained major influence over staking.

📌 Lido vs. Coinbase: Who’s Bigger?

Ethereum educator Sassal pointed out that while Coinbase is the biggest individual staking operator, Lido still stakes more ETH overall—but through multiple smaller operators rather than a single entity.

📌 Past Cases of Centralization Issues

This isn’t the first time concerns about Ethereum’s decentralization have come up.

- In 2021, people worried about Binance’s growing validator share and the risks of exchange-controlled staking.

- In 2022, after Ethereum’s transition to Proof of Stake (The Merge), discussions flared up over Lido holding over 30% of staked ETH at one point.

If one entity controls too much of Ethereum’s staking, it could lead to security risks, governance issues, or even network manipulation in extreme cases.

What’s Next for Coinbase?

Despite concerns over its influence, Coinbase remains committed to transparency and spreading its validators across different locations and cloud providers like AWS and Google Cloud to prevent failures.

📌 Regulatory Wins & Business Growth

Coinbase recently got good news from the SEC, as the regulator dropped a lawsuit against them. This could be one reason they’re now focusing on promoting their staking services.

📌 New Features for Stakers

To attract more users, Coinbase has launched Verified Liquidity Pools, aimed at making trading smoother for both small and big investors.