Both crypto and traditional markets are facing uncertainty again — thanks to global tensions and big swings in prices. This has sparked new talk that the U.S. Federal Reserve (Fed) might go back to using a strategy called Quantitative Easing (QE) — basically pumping money into the economy to keep it from crashing.

If that happens, it could be a big deal for crypto. Many traders believe it might lead to a sharp recovery and possibly a major bull run like we saw in 2020.

Why People Think the Fed Might Step In

Analysts are pointing to several warning signs that suggest the Fed might take action soon.

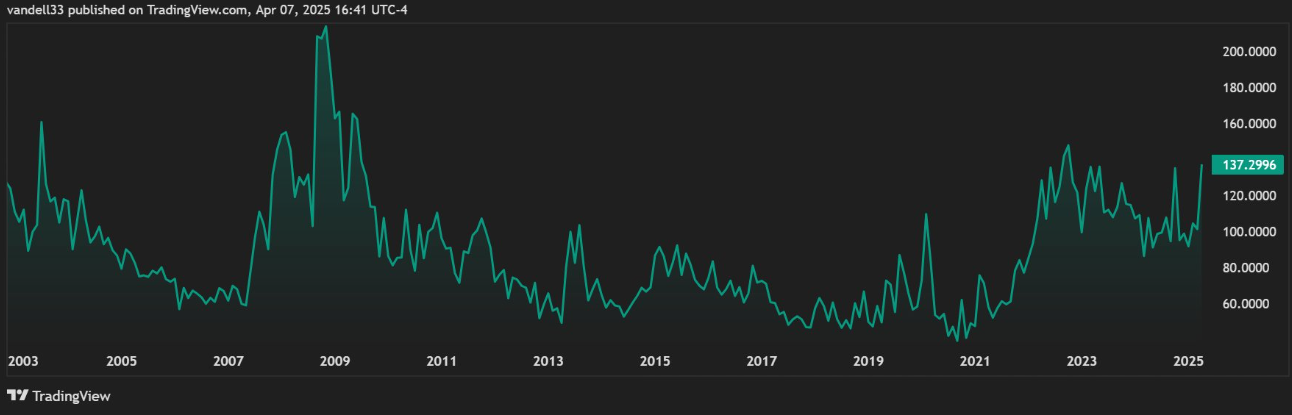

One of those signs is the MOVE Index, which is like a “fear gauge” for the bond market. It’s currently at 137.30 — and when it hits between 130 and 160, the Fed has often stepped in during past crises.

“If the Fed doesn’t act now, they’ll have to cut rates soon anyway — just to manage the country’s massive debt,” said Vandell, co-founder of Black Swan Capitalist.

There was also a closed-door Fed meeting on April 3, which raised eyebrows. While nothing official came out, many believe the Fed is feeling the pressure to act — especially with growing talk of a possible recession.

Some believe former President Trump’s talk of new tariffs is adding to that pressure. Big banks like JPMorgan now expect a U.S. recession, and that could force the Fed to react even before their next scheduled meeting in May.

What Happens if QE Returns?

If QE comes back, crypto could benefit a lot.

In the past:

- During the 2008 financial crisis, the Fed introduced QE to stabilize the economy.

- In 2020, during COVID-19, the Fed printed over $4 trillion, and Bitcoin jumped from around $3,800 to nearly $70,000 over the next year.

This time, Arthur Hayes, the former CEO of BitMEX, thinks the Fed might pump around $3.24 trillion into the economy. Based on past trends, he believes Bitcoin could shoot up to $1 million.

Another analyst, Brett, added that QE usually follows rate cuts, so the Fed might first reduce interest rates before turning on the money printer.

What This Could Mean for Crypto Traders

Crypto analyst Aaron Dishner says now is a good time for traders to watch closely.

“If QE happens, everything changes. There may be some ups and downs, but don’t miss the recovery rally,” he said.

Meanwhile, altcoins (smaller cryptocurrencies) could also see a big boost if money starts flowing again. In 2020, when QE began, many altcoins went up more than 100x by the time it ended in 2022.

Some traders are now eyeing May as a possible start for another “altseason” — a period when altcoins outperform Bitcoin.

Is a Big Rally Coming?

According to Polymarket, there’s a 92% chance the Fed will cut rates in 2025. Some traders think QE could follow, especially if the economy shows signs of weakening.

Even if it doesn’t happen in May, many believe it’s just a matter of time.

“If not May, then later in the year. QE is coming — and when it does, crypto will rally,” wrote one trader from “Our Crypto Talk.”