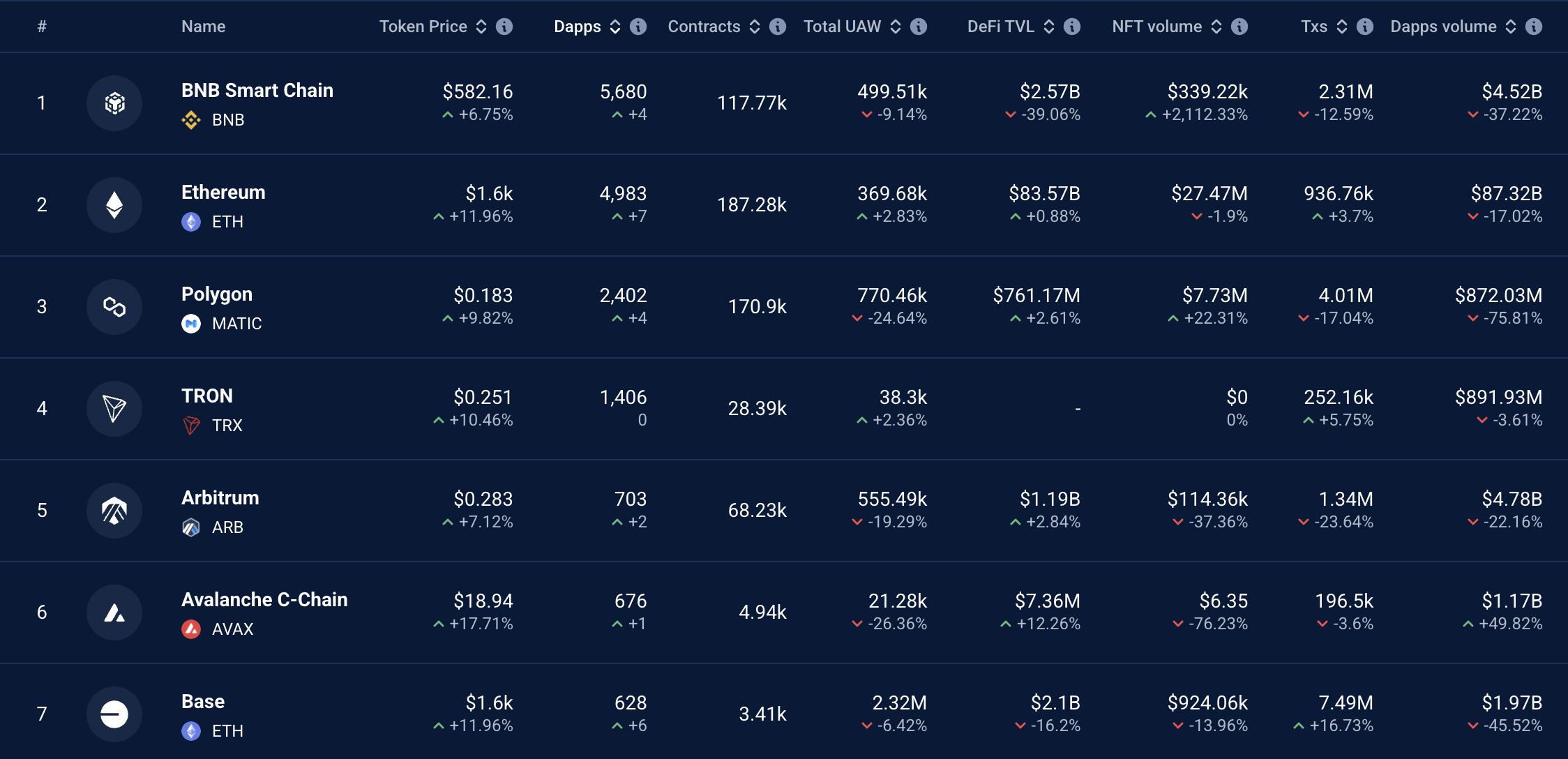

Ethereum has kicked off 2025 with a bang, pulling in over $1 billion in DApp fees in just the first quarter. That’s more than five times the revenue of its closest competitor, and it’s a clear reminder that Ethereum isn’t giving up its spot at the top anytime soon.

This data comes from Token Terminal, and it paints a pretty convincing picture of Ethereum’s continued dominance in the decentralized app space.

Who Else Made the Leaderboard?

Other blockchains did alright too, but none came close to Ethereum’s numbers. Here’s a quick breakdown:

- Base (Coinbase’s Layer-2) – $193 million

- BNB Chain – $170 million

- Arbitrum – $73.8 million

- Avalanche C-Chain – $27.7 million

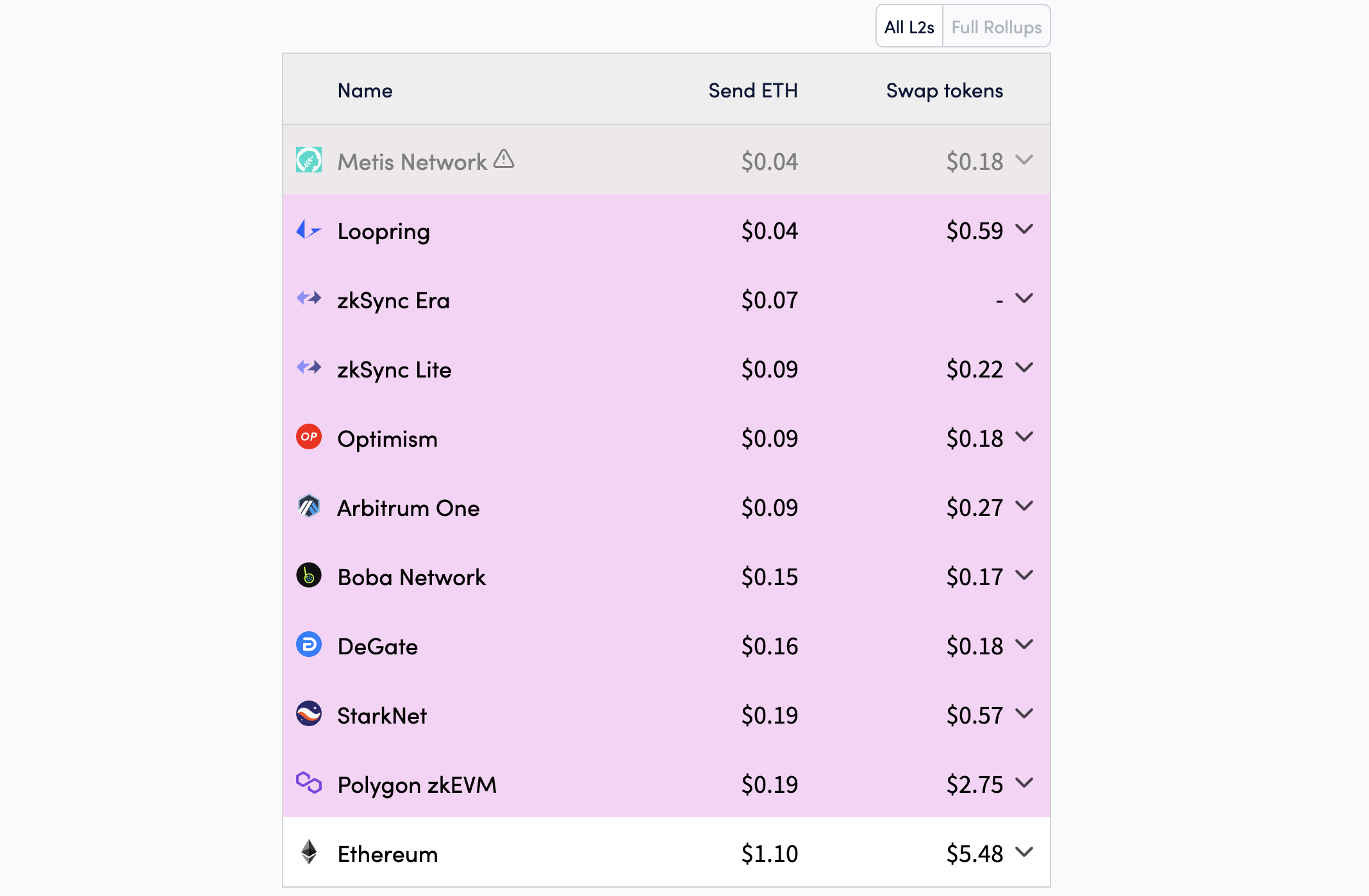

Most of these chains are working hard to grow their ecosystems — especially Layer-2s like Base and Arbitrum — but Ethereum is still far ahead when it comes to user activity, app volume, and fee generation.

Why Ethereum Still Leads

There are a few reasons Ethereum keeps pulling ahead, even with newer and faster chains on the rise:

DeFi is still huge here. According to DefiLlama, Ethereum still holds over $46 billion in Total Value Locked (TVL), which is more than half of all DeFi activity across blockchains.

It got there first. Ethereum was the first to introduce smart contracts, which gave it a huge head start. Many of the biggest and most trusted apps (like Uniswap, Aave, and OpenSea) were built here first.

It’s still the most secure. Developers and users trust Ethereum, even if the fees can get high. That security comes at a cost — but it also means fewer hacks, more uptime, and better reliability overall.

It’s getting better. Last year’s Dencun upgrade helped lower fees on Layer-2s and improved scalability, which has made it easier (and cheaper) for people to use Ethereum-based apps.

How Does This Compare to the Past?

Ethereum’s performance this quarter isn’t just good — it’s historic.

- In early 2023, Ethereum was pulling in around $500–600 million per quarter in DApp fees.

- Fast forward to Q1 2025, and that number has crossed $1 billion — that’s nearly double in just two years.

This kind of growth, especially during a time when the crypto market is still finding its footing post-bear market, is pretty impressive.

Worth Noting: Other Chains Aren’t Sitting Still

While Ethereum remains the leader, chains like Base are growing quickly. Base, for example, saw a 45% jump in DApp fees compared to Q4 2024. That kind of growth means more competition is coming — and that’s good for the space.

BNB Chain still has its loyal user base thanks to low fees and apps like PancakeSwap. Arbitrum and Avalanche are carving out niches in gaming and NFTs. But for now, Ethereum is still the go-to network for serious DApp activity.