Ethereum, the world’s second-largest cryptocurrency, is seeing its influence in the crypto market drop to levels we haven’t seen in five years. But while that might sound bad, some analysts believe it could actually be a golden opportunity for investors.

Ethereum’s Market Share Keeps Falling

Ethereum’s market share — known as ETH dominance (ETH.D) — has steadily gone down over the past two years. In June 2023, ETH made up 20% of the total crypto market. Today, it’s around 7.3%.

This decline means that Ethereum is no longer the main focus for many investors. Instead, people are shifting their money into Bitcoin or other altcoins like Solana and XRP.

But according to well-known crypto analyst Rekt Capital, this situation might not be all bad. In fact, he says Ethereum has dropped into a “green zone” on the chart — an area where, historically, it tends to bounce back and regain strength.

He asked his followers:

“Can Ethereum repeat history? Because every time it hits this zone, it usually stages a strong comeback.”

Another analyst, CryptoAnup, also sees this as a rare buying chance.

“ETH Dominance seems to have found a bottom—rebound soon!” he wrote, pointing out that previous lows in ETH.D were followed by price surges.

But Some Whales Are Still Selling

Despite this optimism, not everyone is holding. On-chain data shows that big investors — often called “whales” — are still offloading their Ethereum. In fact, addresses holding between 100,000 and 1 million ETH sold about 1.19 million ETH recently, worth over $1.8 billion. These large sales are putting more pressure on the price.

This kind of whale activity was also seen during the 2022 market crash, when ETH fell below $900 before bouncing back later that year.

ETH Profit Levels Drop to Lowest in 4 Years

Another key stat is how much of the current ETH supply is actually in profit. Right now, only 40% of ETH holders are in profit — the lowest in four years. Back in December 2024, that number was a whopping 97.5%.

Analyst Venturefounder said if this number falls below 30%, it would signal an ultra-rare buying opportunity — one that has only happened a few times in Ethereum’s history, usually before big rallies.

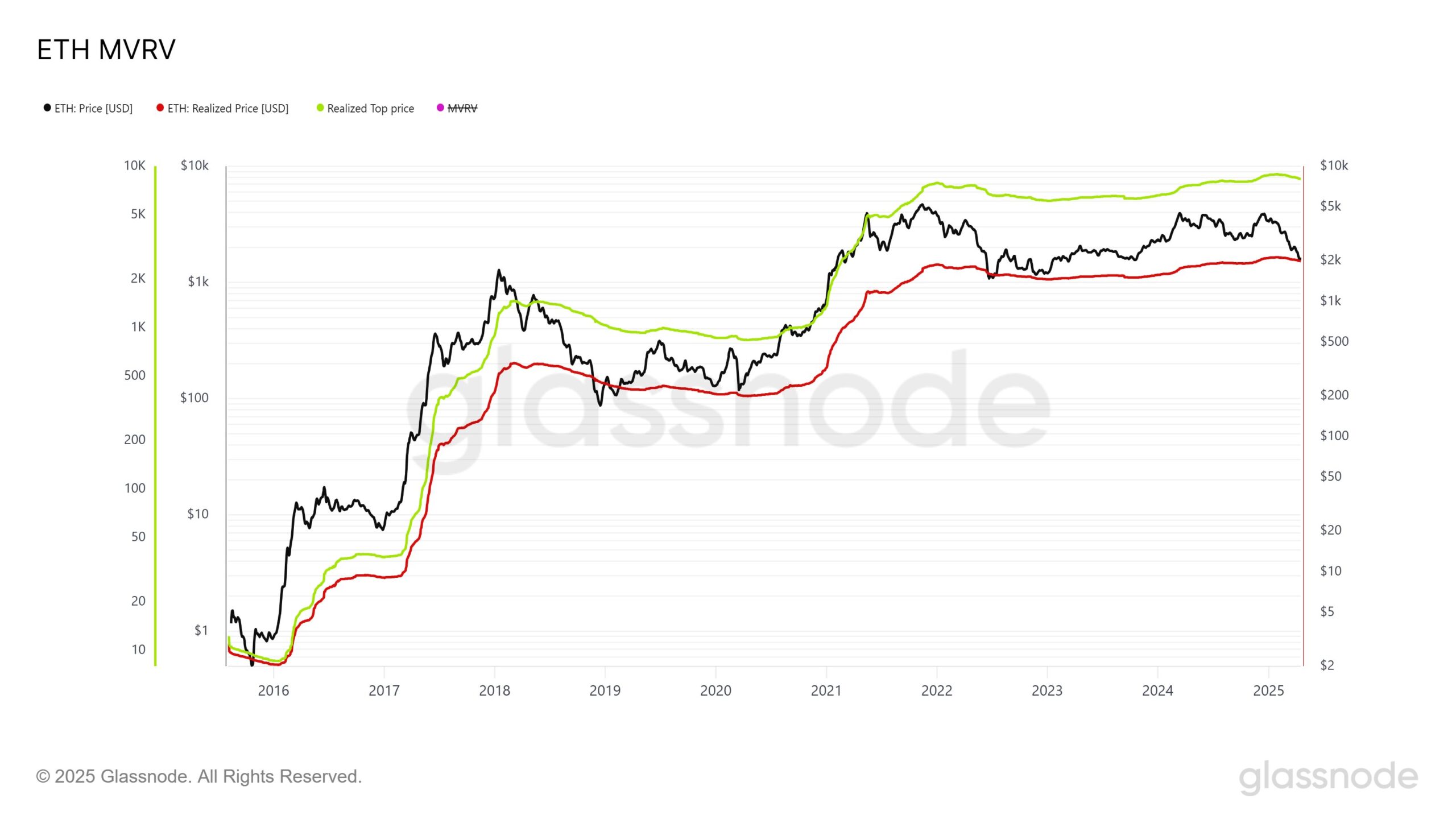

He also noted that ETH’s current price has dropped to match its realized value — a measure of the average price at which all ETH was last moved. Historically, when ETH trades at or below this level, it’s been a good time to buy.

“Looking at this chart — be honest — does it make you want to buy or sell Ethereum?” he asked.

Ethereum Still Leads in DApps — And Upgrades Are Coming

Even with its price down about 60% from the late-2024 highs, Ethereum is still the top platform for decentralized apps (DApps). In Q1 2025 alone, Ethereum-based apps generated over $1 billion in fees, proving that the network is still actively used.

Plus, two major upgrades — Pectra (due May 2025) and Fusaka (later this year) — are expected to make Ethereum faster, cheaper, and more scalable. These improvements could help restore confidence and bring new interest from investors., it often signals a rare buying window. Historically, such moments tend to precede strong price rallies.