Over the past few months, fewer people have been using the Ethereum network. Because of this, a lot less ETH (Ethereum’s cryptocurrency) is being burned, and that’s starting to affect its price.

Why Burning ETH Matters

Ethereum has a system where some ETH is permanently destroyed (or “burned”) every time someone makes a transaction. This helps reduce the number of ETH coins in circulation, which can help keep its value up over time.

But this only works well when the network is busy. When fewer people use Ethereum, less ETH gets burned. That means more ETH is added to the market instead of being taken away.

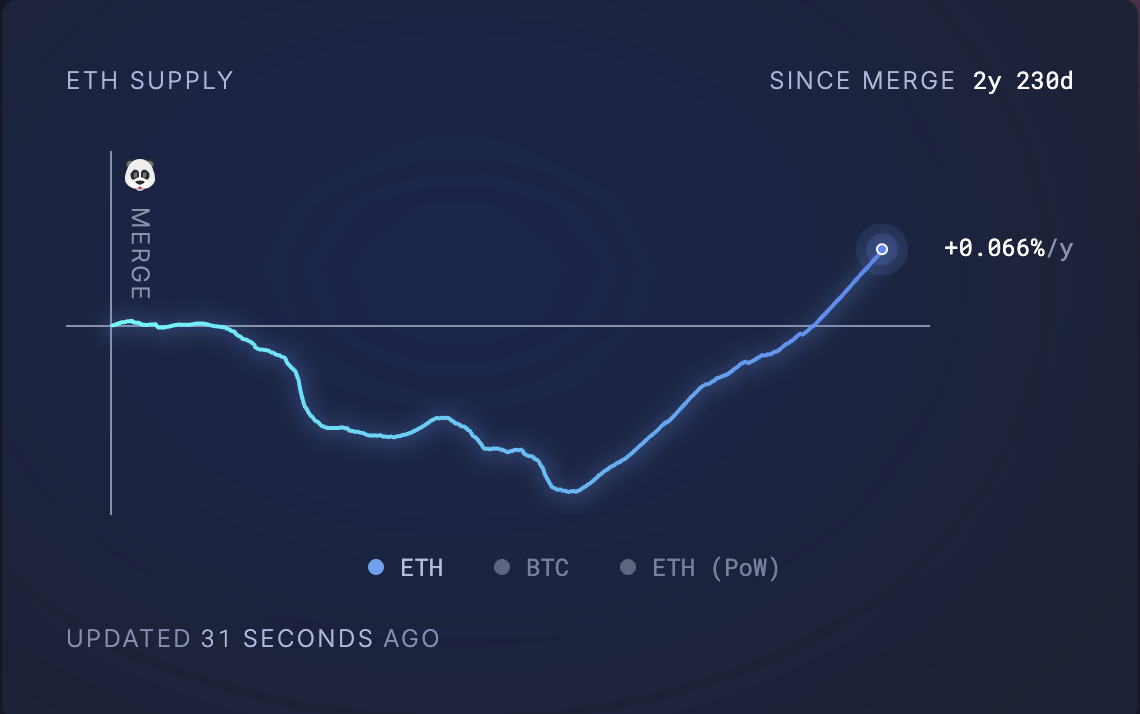

In April alone, around 73,000 new ETH (worth about $134 million) were added to the supply, according to data from Ultrasound.money. The total amount of ETH now stands at over 120 million coins, which is even higher than it was before Ethereum’s big “Merge” update in 2022.

ETH Burning Has Dropped 95%

Ethereum’s daily burn rate has fallen by 95% this year, according to Etherscan. On April 20, it hit the lowest burn rate since this system began. Less burning means more ETH flooding the market, which can put pressure on the price.

Why Are People Using Ethereum Less?

Many people are now switching to faster and cheaper alternatives like Optimism and Arbitrum. These are called Layer-2 networks. They still use Ethereum in the background but allow users to pay much lower fees.

For example, on April 30, it cost just 2 cents to use Optimism, while doing the same thing directly on Ethereum cost 18 cents.

At the same time, other blockchains like Solana have gotten popular too, especially during the recent meme coin craze. Solana is known for its speed and very low costs, so it’s pulling more users away from Ethereum.

Because of all this, there are fewer transactions happening on Ethereum’s main network, which means less ETH is being burned—and more ETH is being added to the market.

Is Ethereum Still Strong?

Even though activity has dropped, experts say Ethereum is still one of the strongest blockchains out there.

Vincent Liu, from Kronos Research, says Ethereum has over $368 billion worth of value locked in its system. That’s more than any other blockchain.

But he also pointed out that Ethereum now ranks fifth when it comes to how much it earns in daily transaction fees, behind other blockchains like Tron, Solana, and BNB Chain.

Temujin Louie, CEO of Wanchain, says Ethereum is still a leader when it comes to security and trust. Unlike other blockchains that constantly add more coins (causing inflation), Ethereum can actually reduce its supply over time—but only when there’s a lot of activity on the network.

What’s Happening With ETH’s Price?

ETH is currently trading at around $1,834, slightly down for the day. But some signs suggest it might go up soon.

A technical indicator called the RSI (Relative Strength Index) is at 57.68, which shows there’s growing interest from buyers. If this continues, ETH could rise above $2,000 and maybe reach $2,027.

But if buying slows down, the price could fall again to around $1,733.

What It All Means

A few years ago, when Ethereum was very active and burning a lot of ETH every day, its price went above $4,000. But now, with lower activity, more ETH is being added to the market—and that’s not great for the price.

Ethereum still has a strong reputation and big developer support. But to stay on top, it will need to keep growing and maybe improve how its main network works or rely more on its Layer-2 networks.