Ethereum (ETH) has been struggling in the market recently, but some experts believe its future could be similar to tech giants like Amazon, Microsoft, and Tesla in their early days. They argue that buying Ethereum now could be like investing in those companies a decade ago—potentially leading to huge gains in the future as adoption grows.

Ethereum: A High-Growth Asset?

In a recent post on X (formerly Twitter), crypto analyst DeFi Dad pointed out that many investors are misjudging Ethereum. He believes ETH is being valued like a slow-growth stock instead of the high-potential asset it could become.

“Stop analyzing ETH like it’s Procter & Gamble. Buying ETH now is more like buying Amazon, Microsoft, or Tesla in their early days.”

DeFi Dad suggests that this is a key moment to get ahead of the curve before Ethereum’s dominance in the blockchain space becomes obvious. He emphasized that Ethereum has prioritized security over rapid user growth, making it the most trusted blockchain network.

“Ethereum’s strategy is similar to Amazon’s. They focus on long-term dominance instead of short-term profits.”

He also pointed out the importance of Layer 2 (L2) solutions, which help reduce transaction costs and increase speed. While these L2s aren’t highly profitable yet, he believes they expand Ethereum’s reach, just like Amazon’s distribution network helped it dominate e-commerce.

Another crypto analyst, Ignas, compared Ethereum’s growth strategy to that of companies like Uber and Netflix.

“First, you focus on getting users. Then, the money follows,” he explained.

Ethereum’s Market Struggles

Despite this optimistic outlook, Ethereum has been on a downward trend for months. Since late 2024, ETH has lost 29.4% of its value in the last month alone.

At the time of writing, ETH is trading at $1,948, a small 2.6% increase in the last 24 hours.

Ethereum has also seen a decline in daily active users, hitting a yearly low. Investor confidence has weakened, and Ethereum’s market dominance has dropped to levels last seen in 2020.

Adding to the bearish sentiment, Standard Chartered Bank recently cut its 2025 ETH price prediction by 60%, lowering it from $10,000 to $4,000.

“We expect Ethereum to continue declining and are lowering our 2025 price target,” said Geoffrey Kendrick, the bank’s head of digital assets research.en accumulating the coin increasingly.

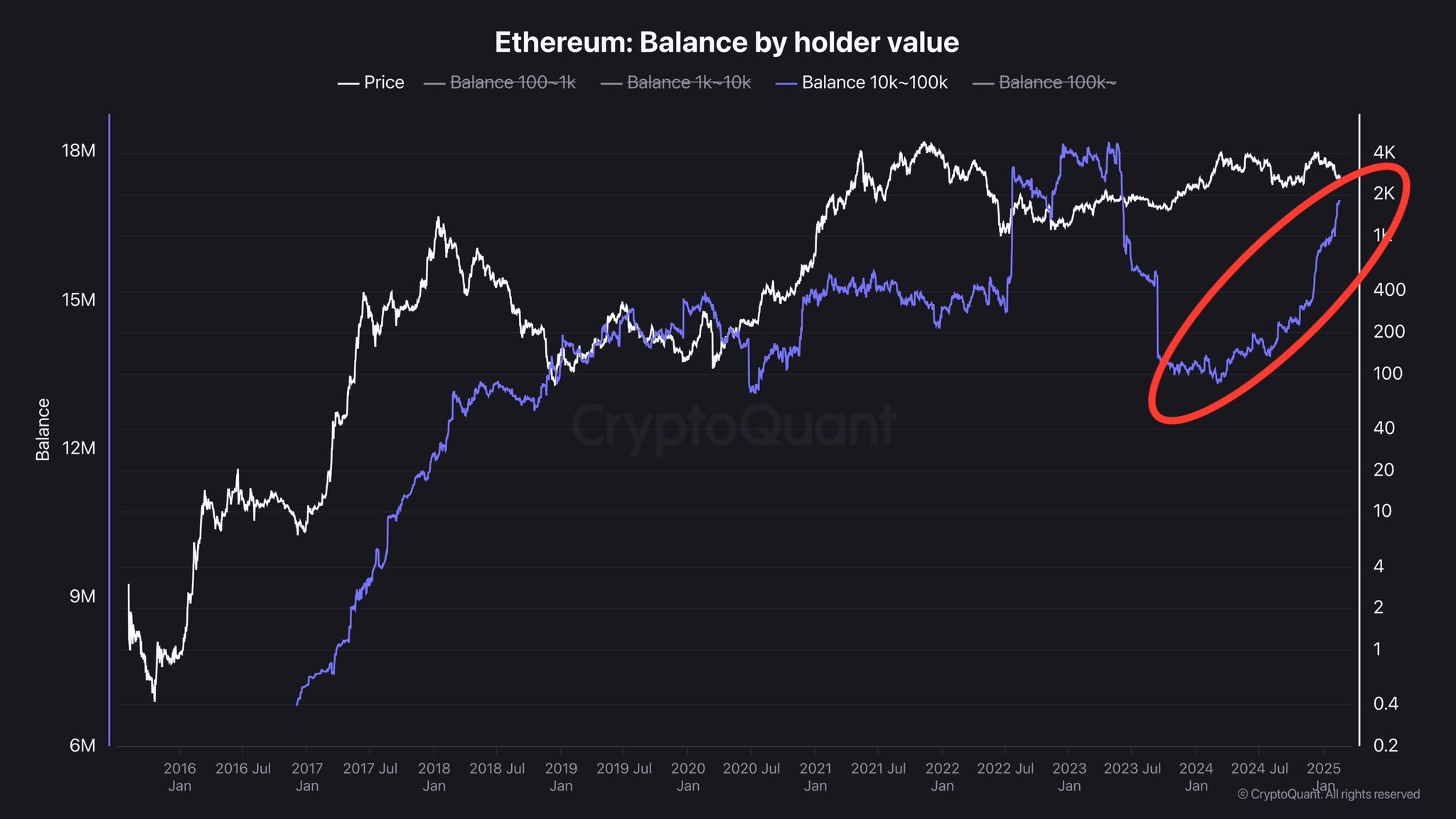

Big Investors Are Quietly Buying Ethereum

Despite the recent decline, some large investors (whales) have been buying more ETH, signaling potential long-term confidence.

Crypto analyst Quinten Francois pointed out that whale wallets are accumulating Ethereum.

“Big players are buying aggressively. They’re playing the market while everyone else panics,” he noted.

This suggests that while short-term traders may be selling, wealthy investors and institutions still believe in Ethereum’s future.

Will Ethereum Follow the Path of Tech Giants?

Right now, Ethereum is at a crossroads. On one hand, its price has been falling, adoption is slowing, and some major analysts are predicting further declines. On the other hand, long-term investors and institutions are still buying in, seeing ETH as a high-growth asset with massive potential.

Will Ethereum overcome these struggles and rise like Amazon and Microsoft, or will it face more market challenges? Only time will tell.

What do you think—is Ethereum a great long-term investment, or is its best growth behind it?