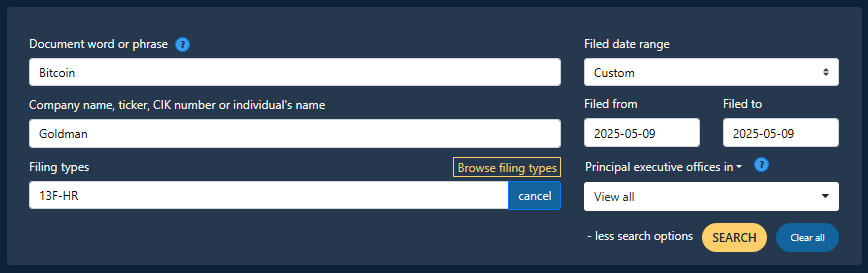

Goldman Sachs has boosted its investment in Bitcoin ETFs in a big way. The bank’s latest report to the US Securities and Exchange Commission shows it has added nearly 6 million more shares in BlackRock’s iShares Bitcoin Trust (IBIT). That brings its total holdings to about 31 million shares—up from 24 million in its previous filing.

With Bitcoin’s recent rally above $100,000, that huge stake in IBIT is now worth more than $1.4 billion. According to the financial analyst MacroScope, Goldman Sachs is currently the biggest holder of IBIT among institutional investors.

Goldman Bets Big on Bitcoin

Goldman’s new SEC filing shows a 28% jump in its IBIT shares. Those 30.8 million shares are worth over $1.4 billion at today’s market price. That puts it ahead of hedge fund Brevan Howard, which has about 25 million IBIT shares worth nearly the same amount.

What’s interesting is that last December, Goldman was using options—bets on the future price of IBIT—to hedge its exposure. Back then, it had about $157 million in call options and over $527 million in put options. It also had $84 million in put options for Fidelity’s Bitcoin ETF (FBTC).

But those hedges don’t appear in this latest report, which suggests that Goldman is now focusing on holding Bitcoin directly through these ETFs rather than using options.

Spot Bitcoin ETFs on the Rise

BlackRock’s IBIT has grown to nearly $63 billion in assets, according to Farside Investors. The fund has attracted about $44 billion in net inflows since it launched, and just last week it pulled in another $674 million. On Friday, IBIT shares rose $1.04 to close at $58.66, thanks to Bitcoin’s strong performance above $60,000.

Goldman isn’t the only big player jumping in. Other major Wall Street firms, like Jane Street, D.E. Shaw, and Symmetry Investments, also have significant holdings in IBIT. In February, Goldman had already reported owning $1.2 billion in IBIT and $288 million in FBTC.

What It All Means

This move by Goldman Sachs and other large firms shows growing confidence in Bitcoin as a mainstream investment—at least within regulated, transparent ETFs instead of riskier exchanges or futures markets.

Bitcoin ETFs are still relatively new. The first Bitcoin ETF was launched in Canada in 2021. In the US, spot Bitcoin ETFs were only approved in early 2024. Since then, they’ve quickly become popular with big investors. As of now, IBIT alone has over $60 billion in assets, showing just how much interest there is from traditional finance.

It’s clear that institutional investors see Bitcoin as more than just a passing trend. How other big banks react, and what that does to Bitcoin’s price, will be something to watch in the months ahead.