Dubai, United Arab Emirates, April 9th, 2025, Chainwire

Bybit, the world’s second-largest cryptocurrency exchange by trading volume, played a role in restoring market stability and regained significant trading volume, following the largest hacking incident known to crypto. According to an in-depth postmortem liquidity analysis by Block Scholes, the exchange implemented comprehensive measures to safeguard the liquidity of its marketplace in times of crisis, and the efforts paid off despite challenging macroeconomic market conditions.

The case study offers insights into the immediate impact and Bybit’s rapid recovery from the incident, diving into technical indicators and trading data, and benchmarking Bybit against peers as liquidity returned after the initial panic. In retrospect, the exchange experienced only “a sharp but brief disruption in volumes and order book depth,” with key market metrics showing robust recovery within weeks of the incident. Following the dip both attributed to the incident and the broader market downturn, Bybit reversed course and almost doubled its market share from its lowest point after the hack.

“While the hack triggered a sharp but brief disruption in volumes and order book depth — particularly in the BTC and ETH markets — bid-ask spreads across major tokens remained largely intact,” the report noted. “Aided by the timely rollout of Retail Price Improvement (RPI) orders, Bybit stabilized liquidity conditions and began to rebuild its share of overall crypto spot trading,” it said.

RPI: Deeper Order Books, Tighter Spreads for Retail Traders

Block Scholes’ analysis highlights Bybit’s deployment of the Retail Price Improvement (RPI) mechanism as a critical factor in the exchange’s swift recovery. Introduced just days before the security incident, RPI orders provide Bybit users with a specialized liquidity tool designed exclusively for retail traders operating through Bybit’s user interface.

Unlike traditional orders, RPI orders create a privileged liquidity pool accessible only to manual retail traders, while excluding institutional and algorithmic traders using API channels. This means a deeper liquidity pool which may allow retail traders to get better prices than big institutional traders when they buy or sell. The segmentation gives individual traders a unique advantage, diversifying the exchange’s sources of capital inflows.

This innovative approach resulted in significantly deeper order books and tighter bid-ask spreads for everyday traders. According to the report, RPI orders quickly accounted for a substantial portion of liquidity in major assets like BTC, ETH, SOL, and DOGE, with data showing they comprised over 50% of the order book depth at 5–10 bps from the mid-price, and up to 30% within 5 basis points. Bybit was the first crypto exchange to prioritize retail access through this liquidity enhancement.

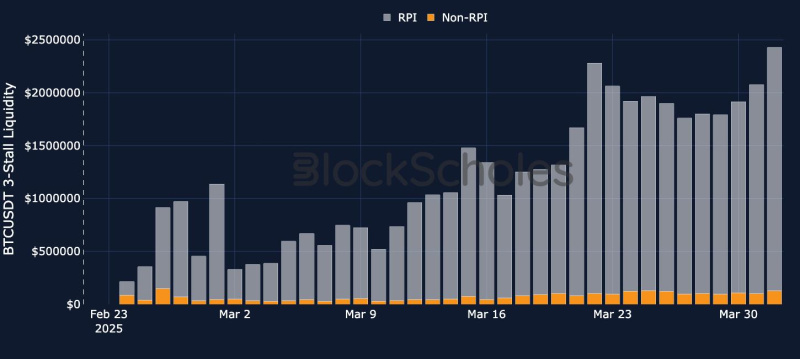

Further, RPI also features 3-stall liquidity—three levels on both the bids and asks sides of the order book. Since its introduction on Feb. 20, 2025, RPI orders have dominated critical price zones, resulting in an immediate liquidity boost for retail traders.

BTCUSDT spot 3-stall liquidity by order type, RPI, and non-RPI, from Feb 24–Apr 1, 2025. Source: Bybit data analytics

Regaining Spot Market Share

At the time of writing of the Block Scholes study, data revealed that Bybit’s market share exchanges rebounded to 7% from its post-incident low at 4%, with metrics such as bid-ask spread and order book depth for major cryptocurrencies returning to normal levels within a week of the incident.

These technical improvements collectively contributed to Bybit’s rapid recovery from the security incident, helping restore market confidence and trading volumes within weeks of the hack.

#Bybit / #TheCryptoArk

About Bybit

Bybit is the world’s second-largest cryptocurrency exchange by trading volume, serving a global community of over 60 million users. Founded in 2018, Bybit is redefining openness in the decentralized world by creating a simpler, open, and equal ecosystem for everyone. With a strong focus on Web3, Bybit partners strategically with leading blockchain protocols to provide robust infrastructure and drive on-chain innovation. Renowned for its secure custody, diverse marketplaces, intuitive user experience, and advanced blockchain tools, Bybit bridges the gap between TradFi and DeFi, empowering builders, creators, and enthusiasts to unlock the full potential of Web3. Discover the future of decentralized finance at Bybit.com.

For more details about Bybit, please visit Bybit Press

For media inquiries, please contact: [email protected]

For updates, please follow: Bybit’s Communities and Social Media

Discord | Facebook | Instagram | LinkedIn | Reddit | Telegram | TikTok | X | Youtube

Contact

Head of PR

Tony Au

Bybit

[email protected]

[ad_2]

Source link