Ethereum’s switch from Proof of Work (PoW) to Proof of Stake (PoS) in 2022 was praised as a revolutionary step. The transition cut energy consumption by over 99%, making Ethereum more sustainable.

However, Meltem Demirors, General Partner at Crucible Capital and former CoinShares executive, believes this shift cost Ethereum a trillion-dollar opportunity.

Why PoS Could Have Been a Mistake

💡 Demirors argues that Ethereum’s transition to PoS weakened its ecosystem by allowing the rise of Layer-2 scaling solutions (L2s).

🔹 She believes Ethereum would have been stronger under PoW, similar to Bitcoin, benefiting from a robust energy-computation economy.

🔹 PoS has led to the rise of MEV (Maximal Extractable Value), which extracts billions from users and apps, making Ethereum less efficient.

🔹 Under PoW, Ethereum could have driven advancements in GPU computing—similar to how Bitcoin mining revolutionized hardware technology.

🗣️ “Ethereum could have been a trillion-dollar protocol with its own robust energy-computation ecosystem. Instead, MEV extracts billions in value from users and apps,” Demirors said.

Ethereum’s Inflation Problem

🔹 In 2022, Ethereum was hailed as “ultra-sound money” due to its deflationary nature after EIP-1559 started burning transaction fees.

🔹 However, data now suggests that Ethereum is experiencing its longest inflationary period since switching to PoS.

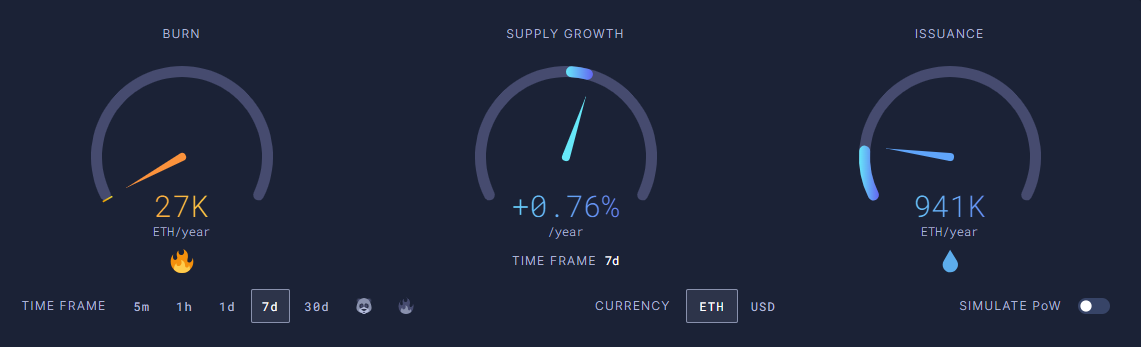

🔹 According to Ultrasound Money, Ethereum’s current annual inflation rate is 0.76%, with 943,000 ETH issued annually while burning only 27,000 ETH.

📉 What does this mean? The narrative that Ethereum is a better store of value than Bitcoin might no longer hold true.

Was Ethereum Ever Meant to Be Money?

🤔 Ethereum lead developer Peter Szilágyi recently stated that ETH was never meant to be money.

🗣️ “ETH was meant to support a decentralized world… None of the OGs wanted ETH to be money, ever,” he said.

📌 This challenges the idea that PoS would make Ethereum more valuable as a deflationary asset. If ETH isn’t meant to be money, what is its ultimate purpose?

Ethereum’s Scaling Boom

Despite these concerns, Ethereum’s network is growing fast:

🚀 Ethereum scaling activity is at an all-time high, thanks to the EIP-4844 upgrade, which significantly lowered gas fees for Layer-2 transactions.

📊 Ethereum’s combined transactions have jumped from 140 to 285 TPS, according to zkLink CEO Vince Yang.

🔹 This could solidify Ethereum’s role as the leading smart contract platform, even if its economic model remains a subject of debate.