“Amidst Bitcoin’s predictable trading range, there emerges a tantalizing question: Will the sideways price action beckon altcoin traders to embark on fresh ventures? The allure of a trending move within an asset class often draws traders into the fold, while a stagnant price action compels investors to bide their time. Bitcoin, for the past several months, has found itself ensnared within a confining range. This may well explain the significant drop in spot trading volumes, a matter highlighted by Bloomberg’s report on October 11, citing a 52% plunge in Coinbase’s spot trading volume for Q3 2023 compared to the same quarter in 2022.

Although the immediate future remains cloaked in uncertainty, traders must remain vigilant, as protracted consolidations typically precede a surge of intense price activity. Yet, the conundrum lies in predicting the direction of this inevitable breakout. Notably, the bulls have steadfastly defended Bitcoin’s position, preventing it from slipping below the $25,000 threshold for the past few months, thereby amplifying the prospects of an imminent bullish breakout.

The renowned investor, Paul Tudor Jones, recently shared his perspective during a CNBC interview, expressing a bearish sentiment toward the equities markets. Jones’ apprehensions revolve around the Israel-Hamas conflict escalation, which, if materialized, could induce a risk-averse atmosphere. In such a scenario, assets like gold and Bitcoin might bask in a bullish glow, as per Jones.

The key question that lingers is whether the bears will manage to sink Bitcoin beneath its immediate support and, subsequently, set in motion a more profound market shift. Let us now embark on an exploration of the charts of the top 10 cryptocurrencies to uncover the unfolding narrative.”

1.Bitcoin Price Analysis-

On October 11, Bitcoin elegantly sliced through the 20-day exponential moving average at $27,148. However, the relentless bears found themselves unable to pull the price beneath the 50-day simple moving average, stationed at $26,634. The bulls, with unwavering determination, successfully defended this 50-day SMA on both October 11 and October 12. Despite their resolve, they find themselves grappling to initiate a noteworthy rebound, signifying a conspicuous lack of demand at the higher levels.

https://coinstats.app/coins/bitcoin/

The next strategic move on the part of the bears would involve a concerted effort to drive the price below the 50-day SMA and claim victory. Should this crucial level capitulate, the BTC/USDT pair might then pivot toward testing the robust support located at $26,000, a level anticipated to witness a fervent buying spree orchestrated by the bullish cohort.

A glimmer of optimism emerges with the prospect of a rally above the 20-day EMA, serving as the initial indicator of renewed strength. Should this materialize, the pair could ascend towards the formidable overhead resistance at $28,143, a threshold of immense significance, as breaching it could herald the commencement of a short-term upward trajectory.

2.Ether Price Analysis-

Ether found itself hovering perilously close to the critical support at $1,531 on October 12, but the bulls, in a commendable display of resilience, managed to uphold this crucial level. The RSI exhibits the early stirrings of a positive divergence, hinting at the gradual weakening of bearish momentum. However, the battle lines are likely to form once again as the bulls endeavor to push the price towards the moving averages, with the bears poised to mount a robust defense.

https://coinstats.app/coins/ethereum/

Should the price witness a sharp downturn from the 20-day EMA, presently at $1,606, it would signify that the bears still retain their grip on the proceedings. This might spell a descent below $1,531, commencing a journey toward the formidable $1,368 threshold. The potential for a resolute bull counteroffensive rests in their ability to overcome the moving averages, a feat that could propel the pair towards $1,746, although they may encounter vigorous opposition from the bearish contingent.

3.BNB Price Analysis-

BNB encountered a stark descent towards the sturdy support at $203, bearing the scars of a tumultuous struggle. The extended tail on the candlestick reflects the fierce determination of the bulls in guarding this critical level. Their next course of action necessitates a swift surge above the moving averages and the downtrend line, indicative of the diminishing grip of the bears. Such a maneuver could set the stage for an upward trajectory, initially targeting $235 and later $250.

https://coinstats.app/coins/binance-coin/

In contrast, a reversal from the moving averages would affirm the bearish sentiment, marking each minor ascent as an opportunity to vend. A breach beneath the $203 support would complete the formation of a descending triangle pattern, possibly initiating a downward movement towards $183.

4.XRP Price Analysis-

The turbulent winds of the market led XRP below the uptrend line on October 11, a telling sign that bullish pressure was waning. This descent foretells a period of oscillation, where XRP is expected to dance between the boundaries of $0.41 and $0.56 for an extended duration. Positioned at $0.46, a support level looms, one that carries the weight of expectations. A breach of this line could result in a precipitous drop to the critical support at $0.41, where bullish forces are primed for an aggressive resurgence, staunchly preserving the range-bound narrative.

https://coinstats.app/coins/ripple/

Conversely, a breakthrough and a secure close above the moving averages would constitute the first beacon of strength. Such an event would propel buyers to make another spirited attempt at elevating the price to the formidable overhead resistance at $0.56. The realignment of these stars could usher in the dawn of a new potential uptrend.

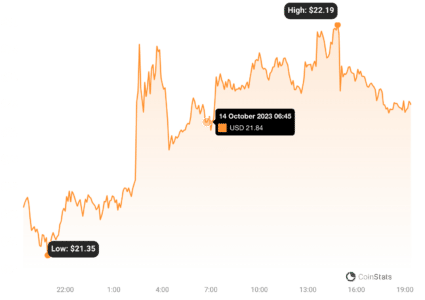

5.Solana Price Analysis-

October 12 saw Solana slipping beneath the 20-day EMA at $21.72, a clear indication of the sustained pressure imposed by the bears. Both moving averages have now levelled, with the RSI positioned near the midpoint, reflecting an equilibrium between supply and demand. The bears, undeterred, are poised to consolidate their advantage, aiming to pull the price below the 50-day SMA, residing at $20.44. Such an outcome could result in a slump for the SOL/USDT pair, descending to the crucial juncture at $17.33.

https://coinstats.app/coins/solana/

However, the scenario could pivot if the price veers upwards, scaling past $22.50. Such a move would rekindle the short-term advantage for the buyers, potentially igniting a surge towards the neckline of the inverse head-and-shoulders pattern.

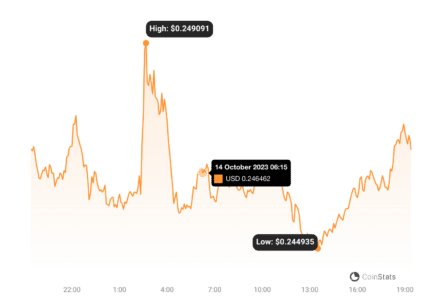

6.Cardano Price Analysis-

Cardano, since October 9, has displayed prolonged tails on consecutive candlesticks, offering tantalizing glimpses of recovery. However, the bulls’ attempts to ignite a rally seem to have faltered, hinting at an underlying lack of demand at higher levels. The ADA/USDT pair currently hovers near the support line of $0.24, with the RSI showcasing a positive divergence, indicative of diminishing selling pressure and the potential for a relief rally. The first checkpoint in this ascent is expected to be the moving averages, and a successful breach could see the pair reaching $0.27, and subsequently $0.28.

https://coinstats.app/coins/cardano/

Nevertheless, a contrary trajectory may unfold should the price descend further, plummeting below $0.24. Such a move would affirm the prevailing bearish sentiment, potentially paving the way for a fall to $0.22, and even $0.20.

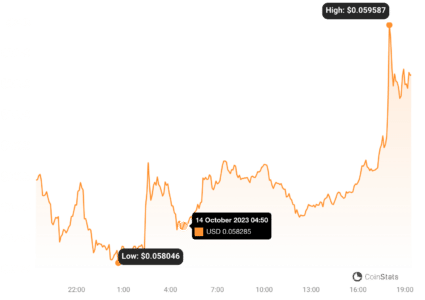

7.Dogecoin Price Analysis-

Dogecoin, trapped beneath the $0.06 support level since October 9, seems to have acclimated to its lower confines. The bears are plotting to test the crucial support at $0.055, a stronghold likely to encounter staunch resistance from bullish forces.

https://coinstats.app/coins/dogecoin/

If the price rebounds from this level, we might anticipate a consolidation between $0.055 and $0.06 for an extended interval. With the moving averages slanting downward and the RSI flirting with the oversold territory, it is apparent that the bears currently wield the upper hand. The bulls’ resurgence would necessitate a swift rise above the moving averages, potentially catalyzing a recovery towards $0.07.

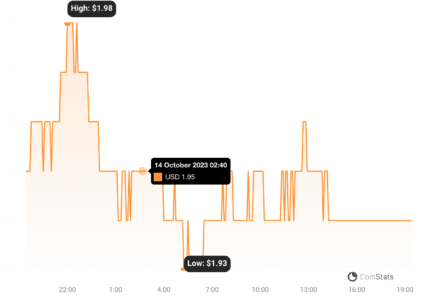

8.Toncoin Price Analysis-

Toncoin (TON) has been ensnared in a corrective phase for the past few days, as profit booking by traders wrenched the price below the 50-day SMA at $1.98 on October 12. Bulls now grapple to recapture this level, striving to propel the price above the moving averages in the days to come. A successful resurgence in this regard would signify that the drop below the 50-day SMA might have been a bear trap, paving the way for a potential rise towards $2.31.

https://coinstats.app/coins/the-open-network/

Conversely, a downturn from the moving averages would signal a shift in sentiment, with relief rallies rapidly converted into selling opportunities. This would escalate the risk of a descent to $1.60, setting a challenging course for TON.

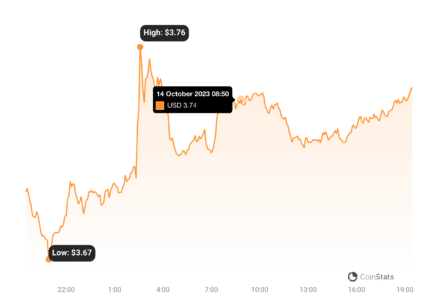

9.Polkadot Price Analysis-

The Polkadot token continued its downward trajectory in the past few days, ultimately reaching the sought-after objective at $3.50 on October 12. This level now emerges as a robust support, acting as a bulwark against further declines. In the journey ahead, the 20-day EMA at $3.95 becomes a pivotal level to watch closely. Should the price encounter resistance and turn down from this level, it will serve as a clear signal that traders are leveraging relief rallies to vend, potentially increasing the likelihood of a decline below $3.50.

https://coinstats.app/coins/polkadot/

Contrarily, the bulls might spark a reversal, ensuring the price sustains itself above the 20-day EMA. Such an outcome would underscore a market’s rejection of the lower levels, potentially ensnaring aggressive bears and kindling a short squeeze towards the downtrend line.

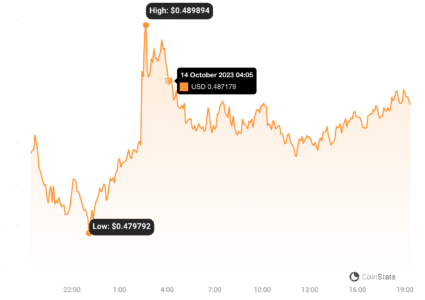

10.Polygon Price Analysis-

Polygon’s trajectory seems to gravitate towards the critical support at $0.49, marking a notable reluctance among bulls to initiate buys at higher price points. In a confined range, traders typically engage near the support line and exit near the resistance. For Polygon, this translates to an expectation of a robust buying effort as the price descends to $0.49. A vigorous upward move from this level could see the MATIC/USDT pair touching the moving averages.

https://coinstats.app/coins/matic-network/

However, if the price sharply declines from the moving averages, it could potentially catalyze a break below $0.49, a scenario that might propel the pair down to $0.45. Conversely, an upward rally beyond the moving averages would indicate an extension of the range-bound market action for a few more days.

In this extensive exploration of cryptocurrency markets, we encounter a landscape replete with dynamics and potential. Each coin’s journey and the intricacies of these narratives are vital for both seasoned traders and new enthusiasts navigating the world of digital assets. Amidst the sways and fluctuations, one thing remains constant – the need for astute vigilance and anticipation to thrive in the realm of cryptocurrencies.