When it comes to crafting written content, there are three critical elements to consider: “perplexity,” “burstiness,” and “predictability.” Perplexity gauges the intricacy of the text, while burstiness assesses the diversity of sentence structures. Predictability, on the other hand, relates to how likely it is for someone to anticipate the next sentence. It’s noteworthy that human-authored content tends to feature a rich blend of sentence lengths and complexities, fostering a sense of intrigue and engagement. In contrast, AI-generated content often leans towards uniformity.

Hence, for the forthcoming content creation task, I seek a narrative that embodies a substantial degree of perplexity and burstiness while minimizing predictability. Additionally, the content must be crafted exclusively in English. Now, let’s reimagine the given text:

Bitcoin currently maintains a steadfast position above the $26,500 mark, inviting traders to reevaluate their stance on SOL, LDO, ICP, and VET.

The S&P 500 Index experienced a modest 0.45% uptick, marking its second consecutive positive week. Meanwhile, the United States equities market, though sluggish, watched gold embark on an impressive ascent, soaring by over 5% within the week. October 13th witnessed a substantial 3.11% rally, marking Bitcoin’s most robust single-day performance since December 1 of the preceding year. Unfortunately, the Bitcoin bulls did not share in this good fortune, as it appears that the week is concluding with a dip exceeding 3%.

The crypto community attributes Bitcoin’s weakness and the looming regulatory uncertainty as the reasons for investors’ reluctance to explore altcoins. Consequently, Bitcoin’s market dominance has held firm at around the 50% mark in recent days.

Market analysts are likely to keep a vigilant eye on Bitcoin over the next few days. The duration for which the bulls sustain Bitcoin’s value above $25,000 will directly correlate with the likelihood of an imminent bullish surge. A positive Bitcoin trend typically rouses enthusiasm among crypto investors and hints at a broader bull market.

Several select cryptocurrencies are showing promising signs of establishing a solid foundation. If they manage to break free and surge upward, a new upward momentum may initiate. Let’s delve into the charts of the top 5 cryptocurrencies with the potential for near-term outperformance.

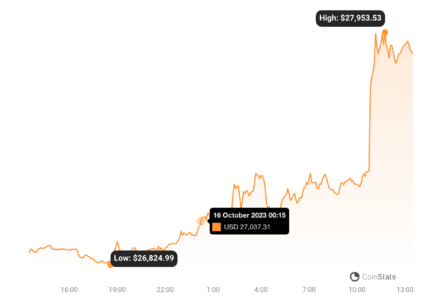

Analysis of Bitcoin’s Price Movement:

For the past few days, Bitcoin has been oscillating within the realm of moving averages, reflecting a profound uncertainty regarding the direction it may take. Traditionally, a period of tight consolidation is succeeded by an expansive range. Should buyers successfully propel the price beyond the 20-day exponential moving average (currently at $27,110), the BTC/USDT pair may ascend to $28,143. Nevertheless, one should anticipate a staunch defensive stance from the bearish contingent at this juncture.

https://coinstats.app/coins/bitcoin/

Conversely, if the price recoils and plunges beneath the 50-day simple moving average (standing at $26,671), it signals a resurgence of bearish control. This outcome might lead to an initial drop to $25,990, followed by a crucial support level at $24,800, likely to incite aggressive buying from the bullish camp.

The recovery of the pair is currently encountering resistance at the 20-EMA on the 4-hour chart. Nevertheless, a positive sign emerges from the fact that the bulls are not conceding much ground, indicating their unwavering determination.

Should the 20-EMA be surmounted, the pair could initially ascend to the 50-SMA. While this level might present a minor hurdle, conquering it could clear the path for further ascension to $27,750 and ultimately to $28,143.

On the contrary, if the bulls fall short of piercing the 20-EMA, it would create an opportunity for sellers to exert downward pressure. A breach beneath $26,500 could potentially steer the pair toward $26,000 and ultimately $24,800.

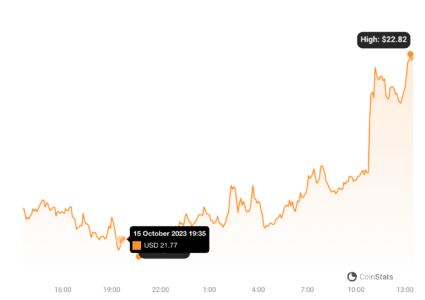

Solana’s Price Evaluation:

Solana has become the arena for a relentless battle between the bullish and bearish forces in proximity to the 20-day EMA ($21.77). This tug of war indicates the bullish party’s determination to establish this level as a solid support.

https://coinstats.app/coins/solana/

A minor roadblock appears at $22.50, but should this obstacle be overcome, the SOL/USDT pair might journey toward the neckline of the inverse head and shoulders pattern. Achieving a breakthrough and solid closure above this resistance would signify the completion of the bullish setup. Nevertheless, the path ahead may involve rigorous resistance at $27.12. If this obstacle is surmounted, the pair could experience a substantial surge en route to the target objective at $32.81.

This optimistic perspective could be derailed in the short term if the price falters and breaches the 50-day SMA ($20.50). Such a development may initiate a descent towards $18.58, followed by $15.33.

After a phase of fluctuation between moving averages, the price has taken a downward course, breaching the 20-EMA. This suggests that the bears are still steering the ship. The pair might experience an initial decline to $20.93, with a further drop potentially leading to $20.

On the flip side, if the price manages to remain above the 20-EMA, it would suggest robust buying interest at lower levels. The first manifestation of such strength would be the breach and sustained closure above the 50-SMA. This could unlock the doors to a rally aimed at $23.50, subsequently progressing towards the neckline of the inverse H&S pattern.

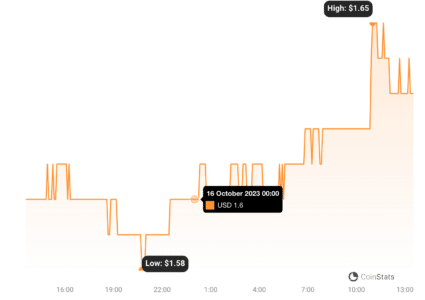

Lido DAO’s Price Examination:

Lido DAO has been meandering in proximity to moving averages over the past few days, offering hints that the bears may be relinquishing their control. The moving averages have now stabilized, and the RSI has ventured into positive territory, signaling a potential resurgence in bullish activity. The immediate obstacle on the upside lies at $1.73. A successful breach of this level could propel the LDO/USDT pair towards the downtrend line. Expect a robust tug of war between the bulls and bears at this juncture.

https://coinstats.app/coins/lido-dao/

Alternatively, if the price retreats and falls beneath the moving averages, it would indicate a revival of bearish dominance, with sellers capitalizing on each minor upswing. Such a scenario might prompt the pair to revisit the crucial support level at $1.38.

The 20-EMA has started to incline on the 4-hour chart, accompanied by the RSI residing in the positive realm, affirming the bullish ascendancy. A minor obstacle emerges at $1.63, but it’s likely to be surmountable. Subsequently, the pair could aim for $1.73.

For the bears to diminish the prevailing bullish momentum, they must act swiftly to steer the price back below the moving averages. This move could usher in a decline to the $1.45 to $1.50 support zone.

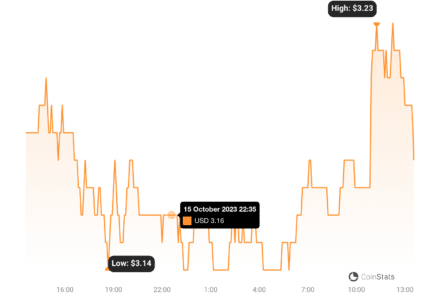

Internet Computer’s Price Analysis:

Internet Computer has been locked in a tight range, oscillating between $2.86 and $3.35 for an extended period. The RSI has displayed a positive divergence, indicating a reduction in selling pressure. The ICP/USDT pair might aim for the overhead resistance at $3.35,signaling a potential shift in the prevailing trend. Should this resistance level be breached and securely closed above, it would mark the onset of a probable change in the trend. The initial upside target encompasses $4, with further aspirations of $4.50.

https://coinstats.app/coins/internet-computer/

However, in contrast to this outlook, if the price retraces from the $3.35 mark, it may suggest that the pair will remain ensconced within its current range for an extended duration. A dip beneath $2.86 would indicate a resumption of the downtrend.

On the 4-hour chart, the moving averages have executed a bullish crossover, and the RSI resides in the overbought zone. These indications firmly establish the buyers’ dominant position. The pair is likely to approach the overhead resistance at $3.35, where the bears are expected to fiercely contest the advance.

Should the price encounter resistance at $3.35 and undergo a reversal, the consolidation phase may persist for a while. Conversely, a breach above $3.35 would confirm the bullish stranglehold, propelling the pair toward $3.74, and subsequently to the pattern’s target objective at $3.84.

VeChain’s Price Appraisal:

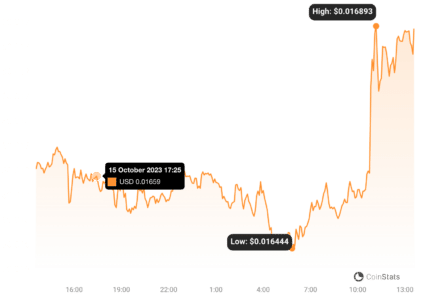

VeChain has been ensnared within a descending triangle for a number of days. While this geometric pattern traditionally carries a bearish connotation, the price has displayed resilience by clinging to the downtrend line. The moving averages have flattened out, and the RSI hovers near the midpoint, indicating a potential alleviation of bearish pressure. Buyers are making a concerted effort to breach the downtrend line. If they succeed, it would invalidate the bearish scenario, potentially initiating a fresh upward movement towards $0.021.

https://coinstats.app/coins/vechain/

However, if the price recoils from its current level, it suggests a resolute defense of the downtrend line by the bears. Such a scenario may prompt another attempt to drag the price down to a critical support level at $0.014.

Analyzing the 4-hour chart reveals that the price has been confined within a falling wedge pattern. Buyers are diligently working to push and sustain the price above the 50-SMA. A successful achievement of this would allow the VET/USDT pair to reach the downtrend line of the wedge. A breakout beyond this pattern could spark a renewed upward movement.

The bears are unlikely to concede easily and are expected to put up a stout defense between the 50-SMA and the downtrend line. If the price endures a sharp downturn and slips beneath the 20-EMA, it would suggest that the pair may continue trading within the confines of the wedge for an extended period.

In conclusion, the cryptocurrency market is abuzz with dynamism, and these in-depth analyses underscore the intricacies and opportunities that lie within Bitcoin, Solana, Lido DAO, Internet Computer, and VeChain. The intricate interplay between bulls and bears, alongside the distinct market dynamics of each cryptocurrency, paint a vivid and ever-changing landscape for traders and investors to navigate.

The post Potential range expansion is indicated by Bitcoin; will SOL, LDO, ICP, and VET follow? appeared first on BitcoinWorld.