In the realm of crafting compelling content, three critical elements stand out: “perplexity,” “burstiness,” and “predictability.” Perplexity serves as a gauge for the intricacy of the text, while burstiness delves into the ebb and flow of sentence structures. Predictability, on the other hand, determines the likelihood of anticipating the subsequent sentence. Humans often craft their compositions with a captivating blend of long, intricate sentences interspersed with shorter, punchy ones, creating an engaging cadence. Conversely, AI-generated text can be fairly uniform in structure. Thus, as we embark on the task of creating content, the aim is to infuse it with a healthy dose of perplexity and burstiness, while minimizing predictability, all while adhering to the use of the English language. With these objectives in mind, let’s reimagine the following text:

“Stock markets flashed green at the weekly open, and crypto prices followed. After two successive weeks of gains, the S&P 500 Index (SPX) started the week on a positive note. This suggests a risk-on sentiment which is a bullish sign. The volatility is likely to pick up as 11% of the S&P 500 companies are expected to report results this week. The risk-on sentiment could boost buying interest in select cryptocurrencies. One area where bullish activity is seen is the Grayscale Bitcoin Trust (GBTC). Grayscale’s legal victories have reduced the discount on the GBTC to its lowest level since 2021. This indicates that the investors are factoring in the possibility that the trust will finally convert into a spot Bitcoin ETF.

When the price does not break below the support levels on bad news and rises above the overhead resistance on favorable news, it shows that the shorts are running low on confidence. This increases the likelihood of an up-move in the near term. What are the important overhead resistance levels on Bitcoin and altcoins that need to be crossed to start an uptrend?

S&P 500 Index price analysis-

The S&P 500 Index (SPX) turned down from the 50-day simple moving average (4,401) on Oct. 12, but the bears could not sink the price below the important level at 4,325.

The 20-day exponential moving average (4,341) is flattening out and the relative strength index (RSI) is just above the midpoint, suggesting that bulls have a slight edge. Buyers will try to thrust the price above the overhead resistance zone between the 50-day SMA and the downtrend line.

If this zone is surmounted, the index will signal the end of the corrective phase. Conversely, if the price turns down and breaks below 4,325, it will indicate that bears are fiercely defending the 50-day SMA. The index may then retest the pivotal support at 4,216.

U.S. dollar index price analysis-

The U.S. dollar index (DXY) corrected from 107.34 on Oct. 3 and dipped to the 20-day EMA ($106) on Oct. 10. In an uptrend, traders generally buy the dips to the 20-day EMA.

Here too, the bulls bought the dip to the 20-day EMA, which started a rebound. The bulls will try to push the price above the 107.34 to 108 resistance zone. If they succeed, the index could start a strong rally toward 111. However, the bears are unlikely to give up easily.

They will try to guard the overhead zone and tug the price below 105.50. If this support cracks, the index may dip to the 50-day SMA ($104.81). This is an important level for the bulls to defend if they want to keep the up-move intact. Below this level, the index could fall to 103.

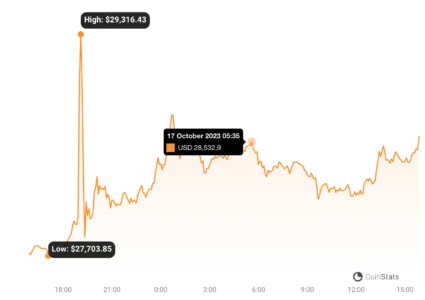

Bitcoin price analysis-

After trading between the moving averages for the past few days, Bitcoin made a decisive move on Oct. 16 when bulls kicked the price above the 20-day EMA ($27,224).

https://coinstats.app/coins/bitcoin/

The momentum picked up further and the BTC/USDT pair skyrocketed above the $28,143 resistance. However, the euphoria was short-lived as the bears aggressively sold at higher levels and yanked the price back below $28,143. The 20-day EMA has started to turn up and the RSI has jumped into positive territory, indicating that the bulls have a slight edge.

If buyers achieve a close above $28,143, the pair may march toward $30,000 and then to $31,000. On the downside, a break and close below the 50-day SMA ($26,715) will tilt the advantage in favor of the bears. The pair may first plummet to $26,000 and then to $24,800.

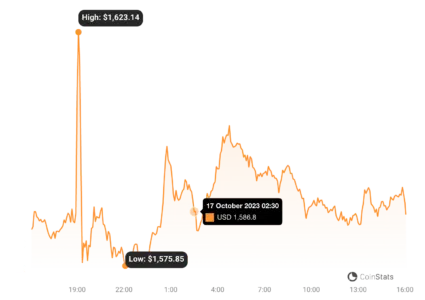

Ether price analysis-

Ether has been oscillating between $1,531 and $1,746 for the past several days. Generally, in a range, traders buy near the support and sell at the resistance. Buyers purchased the dip to $1,521 on Oct. 12 which started a relief rally.

https://coinstats.app/coins/ethereum/

The bulls attempted to drive the price above the moving averages on Oct. 16 but the long wick on the candlestick shows aggressive selling by the bears. If the price turns down from the current level, the bears will make one more attempt to sink and sustain the price below $1,521.

If they succeed, the ETH/USDT pair may collapse to $1,368. Contrarily, the bulls will again attempt to push and sustain the price above the moving averages. If they can pull it off, the pair could jump to $1,746. This level is again likely to witness strong selling by the bears.

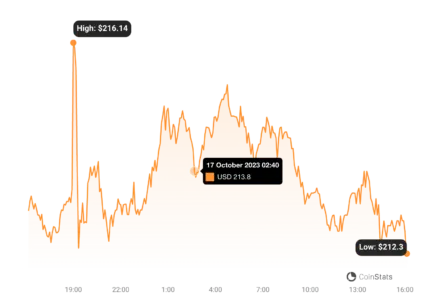

BNB price analysis-

BNB rebounded off the strong support at $203 and nudged above the downtrend line on Oct. 16. However, the long wick on the candlestick shows that the bears are selling on rallies.

https://coinstats.app/coins/binance-coin/

The 20-day EMA ($210) has flattened out and the RSI is above the midpoint, suggesting that the bearish momentum is weakening. The bulls will again try to take advantage of this situation and propel the price above the downtrend line. If they can maintain the higher levels, it will invalidate the bearish descending triangle pattern.

The BNB/USDT pair may then climb to $235 and later to $250. This bullish view will be negated if the price turns down and plunges below the vital support at $203. The pair may then tumble to $183.

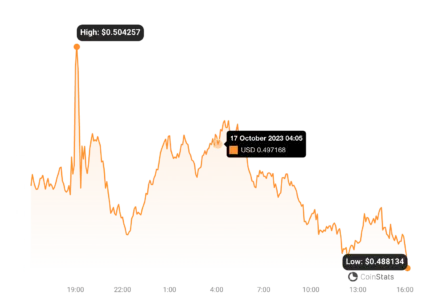

XRP price analysis-

XRP has been stuck inside the large range between $0.41 and $0.56 for the past several days. The bulls are trying to start a pullback, which is likely to face stiff resistance at the moving averages. If the price turns down from the moving averages, it will suggest that every minor relief rally is being sold into. That will increase the possibility of a drop to $0.46.

https://coinstats.app/coins/ripple/

If this level also fails to hold, the XRP/USDT pair may descend to $0.41. Contrarily, if bulls thrust the price above the moving averages, it will indicate solid buying at lower levels. The pair will then attempt

a rally to $0.56. The bears are expected to protect this level with vigor.

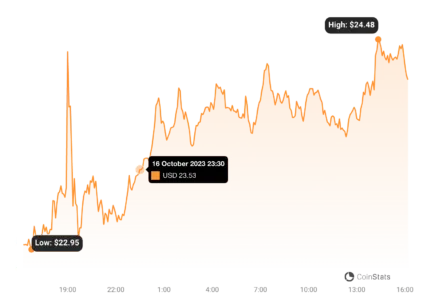

Solana price analysis-

Solana made a resounding move, surging above the near-term resistance of $22.50 on Oct. 16. This action clearly indicates that the bulls are flexing their muscles. They pushed the price to the neckline of the inverse head and shoulders pattern, but scaling that level remains a challenge.

https://coinstats.app/coins/solana/

However, this is a crucial resistance point to keep a keen eye on, as a close above it would complete the bullish setup. Should that occur, the SOL/USDT pair could embark on a significant upswing, targeting levels of $27.12 and possibly reaching its pattern target of $32.81.

Yet, if the bears intend to thwart this bullish momentum, they need to act swiftly and pull the price back below the 50-day SMA ($20.56). In such a scenario, the pair might face a dip to $18.50.

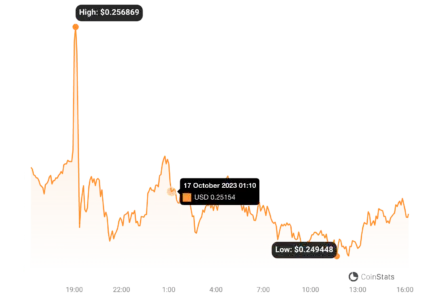

Cardano price analysis-

Cardano showcased resilience, rebounding strongly from the robust support near $0.24. This rebound suggests that the bulls are unwavering in their defense of this crucial level. Although the immediate resistance posed by the moving averages presented some challenges, buyers made a valiant attempt to conquer this barrier on Oct. 16. The long wick on the candlestick indicates selling pressure at these higher levels.

https://coinstats.app/coins/cardano/

However, if the bulls maintain their ground from the current level, the prospects of a rally above $0.28 are promising. While this level might once again pose resistance, if successfully surpassed, the ADA/USDT pair could set its sights on $0.30.

Conversely, on the downside, keeping a close watch on $0.24 is imperative. Should the price falter and turn down from the moving averages, it would increase the likelihood of a drop below $0.24. Such a scenario could potentially plunge the pair to $0.22, and subsequently, to $0.20.

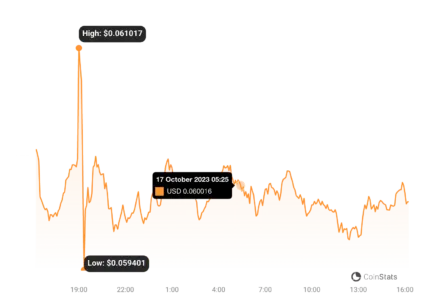

Dogecoin price analysis-

Dogecoin experienced a revival as it reclaimed the breakdown level of $0.06 on Oct. 14, signaling the allure of lower price levels to prospective buyers. The 20-day EMA ($0.06) has flattened out, and the RSI hovers near the midpoint, indicating a potential reduction in selling pressure.

https://coinstats.app/coins/dogecoin/

If buyers manage to drive and maintain the price above the moving averages, it would suggest the inception of a fresh upward move to $0.07. Nonetheless, this level might prove to be a formidable obstacle. If successfully cleared, the DOGE/USDT pair could set its sights on $0.08.

However, on the flip side, if the price retraces from the current position, it would imply that the pair might continue to consolidate within the $0.055 to $0.06 range for a little while longer.

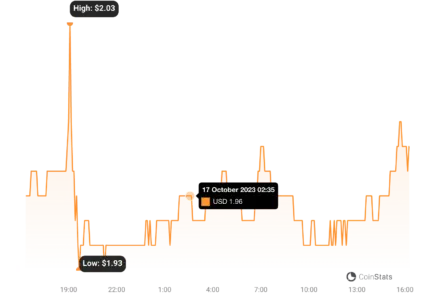

Toncoin price analysis-

Toncoin (TON) has found itself trading below the moving averages since October 12. An encouraging sign is that the bears haven’t been able to capitalize on this weakness, indicating a reluctance to sell at lower levels. The bulls did make an effort to push the price back above the moving averages, but the long wick on the candlestick suggests that the bears remain resolute.

https://coinstats.app/coins/the-open-network/

Sellers may attempt to sink the price below $1.89, initiating a deeper correction. The next support levels on the downside are at $1.80 and subsequently at $1.60.

If the bulls intend to signal a comeback, they’ll need to drive and sustain the price above the moving averages. In this scenario, the TON/USDT pair could potentially see a rise to $2.20, and further to $2.31.