- Crypto markets are up today following the negative weekend effect.

- The surge is largely attributed to Pro-bitcoins advocate Javier Milei winning Argentina’s elections.

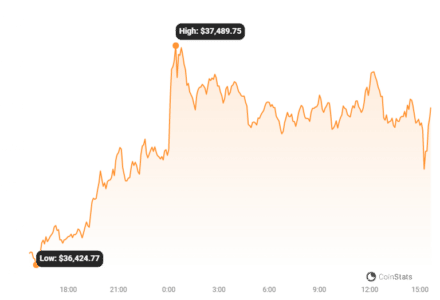

As of today, the crypto market is witnessing a notable surge, with Bitcoin (BTC) holding a position above $37,000. Why is that? Well, there are a number of reasons for the current market win. This follows the negative weekend effect. Historically, weekends have a reputation for wiping out weekly gains in the crypto market. That is true for Bitcoin and altcoins.

Crypto Markets Recover After The Weekend Effect

On Monday, November 20, crypto prices have been trending upward as investors appear to have recovered trust in the sector. The market has been on a positive streak recently, owing to anticipation and speculation over the introduction of a Bitcoin Spot ETF.

However, as traders remained cautious, the market reversed its upward trend last week, wiping off some of its previous gains. Meanwhile, BlackRock filed the Spot Ethereum ETF last week, but the SEC appears to be delaying its judgment on all ETFs in the US, causing market fears.

Over the last 12 hours, crypto markets have gained 2.3%. This has increased the entire crypto market worth to $1.45 trillion during Monday morning trade in Asia. BTC has gained a similar percentage to reach $37,135 at the time of writing. It spent the majority of the weekend hanging around $36,500.

Also, the Ethereum price rose 1.96% to $2,003.62, but trading volume declined 5.46% to $7.73 billion in the preceding 24 hours. Simultaneously, the XRP price increased by 1.29% to $0.6179, while the one-day trading volume increased by 21.75% to $1 billion.

At this time, the Solana price increased by 3% to $59.45, while the Cardano price increased by 1.98% to $0.3846. The former’s one-day trading volume increased 11.47% to $2.04 billion, while the latter’s dropped 21.86% to $282.61 million.

Concerning the meme coin section, Dogecoin‘s price grew by 2.1% to $0.08078, but its volume decreased by 55.99% to $541.48 million. Furthermore, the Shiba Inu price increased by 2.13% to $0.000008515, but the volume decreased by 28.54% to $107.61 million.

The surge of Bitcoin has been tied to the outcome of Argentina’s elections, as noted by Michael Saylor. Argentina’s persistent inflation crisis has been a notable concern in the South American country, with the Argentine peso seeing annual inflation rates topping 140% in the previous 12 months.

#Bitcoin is hope for Argentina. Congratulations @JMilei.

— Michael Saylor⚡️ (@saylor) November 20, 2023

Many crypto supporters have also advocated for Argentina to use Bitcoin as an inflationary hedge. As a result, some of the most prominent Bitcoin supporters are also rejoicing over Milei’s victory.

Events Crypto Investors Should Look Out For This Week

On November 20, the macroeconomics publication The Kobeissi Letter published a list of this week’s significant economic happenings in the United States. Notably, investors will be eagerly following the FOMC minutes, which are set to be released on Tuesday, November 21.

Key Events This Week:

1. Existing Home Sales data – Tuesday

2. Fed Meeting Minutes – Tuesday

3. Core Durable Goods Orders – Wednesday

4. Initial Jobless Claims – Wednesday

5. US Markets Closed for Thanksgiving – Thursday

6. US Markets Close at 1 PM ET – Friday

Happy…

— The Kobeissi Letter (@KobeissiLetter) November 19, 2023

This is a crucial event this week since it will provide insight into the present economic health and the Fed’s probable move with its rate rise intentions in the coming days. The Fed minutes are likely to emphasize central bank policy for the rest of the year.

Read Also: Is Michael Saylor The Ultimate Bitcoin Spokesperson?

The US leading economic indicators report will be released on Monday, and it is likely to be unchanged from the previous month.

The key message from the most recent Fed policy meeting was how dovish Chairman Jerome Powell was. Analysts and markets are hoping for more dovishness this week, but the Fed may reverse some of it.

Furthermore, recent statistics imply that economic activity rose steadily in the third quarter, and last week’s inflation report was good. However, the Fed is prepared to tighten policy even further if necessary, and another rate hike could be on the horizon.

There may be some short-term market volatility on the day, but no significant impact is anticipated. In addition, Nvidia’s earnings report is set to be issued on Tuesday.

Initial unemployment claims are projected to fall on Wednesday. Durable goods orders are likely to fall 3.5% in October as well.

Markets in the United States are closed on Thursday for Thanksgiving but will return for half a day on Friday. S&P Flash US services and manufacturing PMI statistics will be announced on Friday. They have both been hovering around the 50 level for the previous few months, showing no signs of expansion or contraction.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.