–>

The founder of Cardano has provided detailed insights into the impacts of the Binance CEO’s exit. He emphasized the shift in Binance’s management structure as it falls under the supervision of the US government. He also highlighted the possibilities of increased regulatory scrutiny in the growing crypto space.

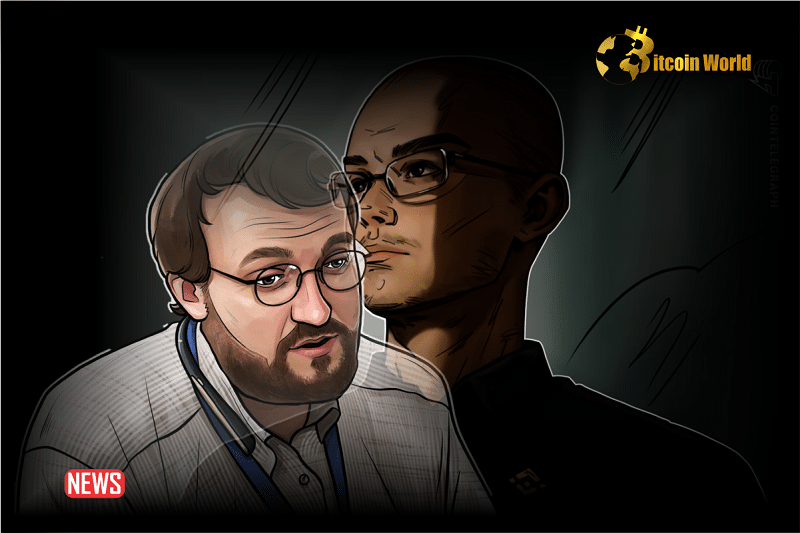

The End Of An Era, Says Cardano Founder

Charles Hoskinson posted a YouTube video titled “The end of an era.”

In the video, Hoskinson describes the resignation of Binance’s former CEO, Changpeng Zhao as the end of an era. He described Zhao from his early days when he grew Binance to becoming one of the world’s largest crypto exchanges.

“The era of the Crypto industry I grew up in is over and Binance was the last hold out to that, and I’ve kind of watched one by one many people fall through,” Hoskinson stated.

See Also: Cardano Founder Hoskinson Speaks Out On Ethereum Insider Revelations

Hoskinson revealed that Zhao had not resigned because of fraud charges like FTX founder Sam Bankman-Fried. Instead, he was guilty of opening up markets which enabled American criminals to trade and make transactions through his exchange.

“CZ wasn’t brought down like SBF where there was some sort of massive fraud and he was just stealing from his customers, he had no intention of running a business,” Hoskinson stated.

He added:

“At the end of the day, he opened up markets that allowed the enemies of America to basically trade and do things. Open permission-less protocols tend to invite that and the United States has a financial regime that basically has been weaponized.”

Hoskinson has predicted that Binance will keep operating; however, it would do so under the radar of the US government. He stated that all decisions made in the exchange would be “in consultation directly or indirectly with the US Treasury Department.” He also revealed that the exchange would have a long time out, as they restructure and change their management.

See Also: Cardano Founder Seeks Collaboration With Kraken To Develop The L2 Network

“Binance will continue on and it’s gonna be under a leadership that will basically work with the US government as a partner moving forward,” Hoskinson stated.

Hoskinson Predicts Higher Regulatory Scrutiny In Crypto Industry

In his YouTube video, Hoskinson stated that the present situation with Binance would most likely catalyze a high level of regulatory scrutiny in the crypto industry. He explained that the industry is presently changing and predicted the US government planning enforcement actions against liquidity providers and non-custodial wallets such as Metamask.

“I suspect that the US government is going to start hitting more providers of liquidity, and also non-custodial wallets will likely get hit at some point, for a variety of reasons especially if they integrate Metadexes and these types of things and so perhaps Metamask and others are gonna get hit at some point,” Hoskinson said.

Hoskinson has stated that Cardano foresaw the changes in the crypto ecosystem, which is why the blockchain had ensured it underwent its innovative processes with integrity. He revealed approaches, such as the Midnight protocol, through which Cardano will achieve a balance between preserving its decentralized freedom and facilitating regulatory compliance.

“I think we predicted this with Cardano and we predicted this as an ecosystem and we understood the need for how to innovate with integrity and to comply with Integrity.”

He added:

“Midnight gives all those components for data confidentiality required for handling of PII in a regulated context and a lot of deep thought on how to build Dapps and DeFi in a way that can make people happy but still preserves the tenets of decentralization.”

The post Cardano Founder Shares What To Expect After Binance CEO’s Exit appeared first on My Blog.