London, United Kingdom, November 23rd, 2023, Chainwire

- Socrates is a web3 social media and entertainment platform, combining the best of Social-Fi and Game-Fi

- Accessible on multiple blockchains, including Polygon, Ethereum, BNB Smart Chain (BSC), Arbitrum One & Optimism

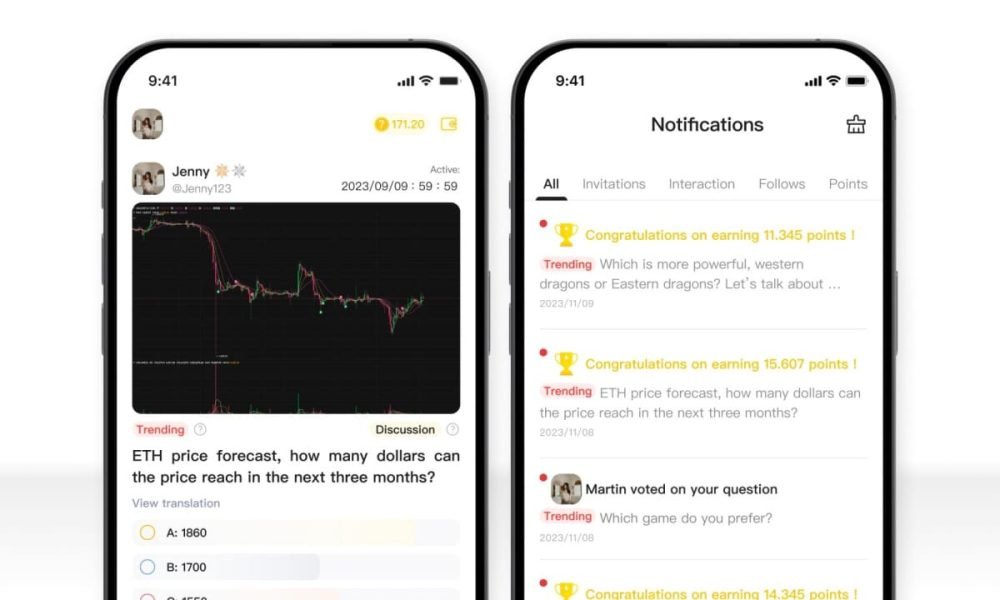

- Allows anyone to participate in multiple-choice question and answers, empowering people to voice honest opinions and unique perspectives

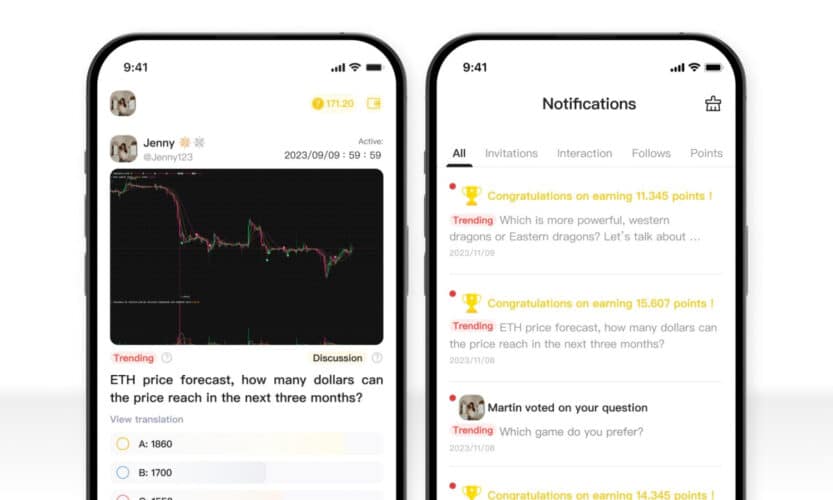

- Offers large rewards for simple in-app interactions, easily redeemable

Socrates, a web3 social media and entertainment platform, has launched on multiple blockchains following a successful testing phase. With thousands of signups already, the revolutionary app will offer users globally the ability to earn substantial rewards by actively participating in multiple-choice Q&As, debating openly and sharing knowledge.

Socrates empowers individuals to discuss any topic, including politics, sports, crypto and entertainment. Utilising an innovative and intuitive UI, users can easily create and answer multiple-choice questions in-app, giving and liking reasons to further support their viewpoints.

The organisation combines the best of Social-Fi and Game-Fi, built on the principle of rewarding knowledge-sharing and promoting dialogue, with a mission to engage dialogue and foster community. With mainstream media controlling narratives and directing much of collective human thought, Socrates gives users a platform to think freely about issues and combat misinformation common in web2 social media.

Built on the principles of decentralisation and inclusivity, Socrates integrates the benefits of blockchain technology and NFTs to establish a unique incentivised ecosystem. User interactions contribute to a question’s prize pool, already reaching over 1000 points, with potential rewards distributed upon the question’s closure. Meaningful discussions and unique perspectives during deep debates can earn users higher rewards, a key feature in provoking meaningful discussions and new levels of engagement.

This week, Socrates has further improved accessibility, enabling access via multiple blockchains, including Polygon, Ethereum, Arbitrum One, Optimism, and BNB Smart Chain (BSC), where points earned on the platform can be easily redeemed 1:1 for USDT.

“With question and answers driving today’s conversation, we created Socrates to provide a fun platform where you can earn large rewards for sharing knowledge, learning of diverse opinions, and networking with like-minded communities. In response to the rise of AI language technology providing standardised answers to questions, our platform addresses a clear need for individuals, businesses and governments to seek human answers to their questions,” said Lottie Wells, Head of PR at Socrates.

Since launch, the 200+ Socrates team members from leading web3 and social media companies have continued to develop the product and improve the user experience. Nevertheless, the organisation has ambitious development plans imminently, including the release of an algorithm tailoring content to specific users, and a cutting-edge UI update.

The platform invites users to join the debate by signing up and experiencing Socrates at app.socrates.com using the invitation code 8k6ze4s6.

About Socrates

Socrates is a global web3 social media and entertainment platform based on multiple blockchains, where users earn rewards by participating in multiple-choice Q&As, debating and sharing knowledge. Combining the best of Social-Fi and Game-Fi, the organisation aims to pioneer a new era of dialogue and knowledge beyond borders, empowering and rewarding individuals to share their vision and shape the future through diverse perspectives.

In an age where social and mainstream media heavily influence collective thought, Socrates encourages individuals to think freely, challenging issues and dispelling misinformation. Users can shape conversations in-app by crafting their Pen and selecting a sphere of interest, actively contributing to meaningful dialogues. The platform has established an incentivised ecosystem, where valuable contributions and interactions can earn large rewards.

Featuring an innovative and intuitive user interface coupled with decentralised blockchain technology, Socrates prioritises transparency and security. Socrates is dedicated to empowering individuals to share their unique vision and shape the future through diverse perspectives, fostering a community-driven platform that transcends geographical boundaries.

Website | Twitter | Discord | Telegram | Whitepaper | Medium

Contact

Head of PR

Lottie Wells

Socrates

[email protected]