[ad_1]

BlackRock, the asset management firm, has confirmed its intention to launch an Ethereum exchange-traded fund (ETF).

BlackRock announced its proposal for a “iShares Ethereum Trust” in a filing with the Nasdaq stock exchange on Thursday, allowing investors to obtain exposure to Ethereum’s price swings through a traditional stock exchange.

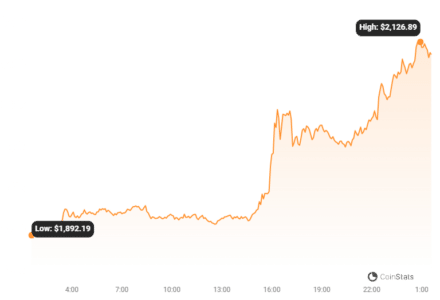

According to Coinstats, the price of Ethereum increased by 10% in response to the announcement, bursting beyond $2,100, a level not seen since April. Indeed, ETH was at this level in May 2022, during the protracted slump that began in November 2021.

ETH is already up more than 30% for the month and up 85% year to date.

BlackRock also filed an Ethereum trust in Delaware, which analysts saw as a precursor to requesting for regulatory permission for an ETF.

An Ethereum ETF would enable individual investors to obtain exposure to the second-largest cryptocurrency by market capitalization without holding the asset directly. It has the potential to attract billions of dollars in fresh investment.

According to the filing, the fund’s shares will be traded under the ticker “ETH” and will closely track the price of Ethereum held by the trust. The sponsoring entity would be BlackRock subsidiary iShares.

Read Also: Bitcoin and Ethereum Outperform Gold Significantly This Year

It is unclear when BlackRock plans to formally apply to the Securities and Exchange Commission (SEC) for ETF clearance. Several proposals for spot Bitcoin ETFs have been rejected by the regulatory agency due to worries about potential manipulation.

However, the SEC recently approved the first Bitcoin futures ETFs in the United States, considered as a step toward the adoption of funds owning digital assets itself. The agency also permitted the first Ethereum futures ETFs to trade last month.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

[ad_2]

Source link