[ad_1]

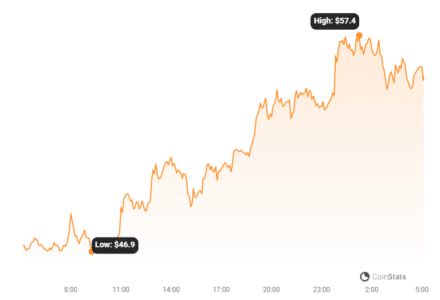

- Solana price rose to $54 on Friday, its highest level since May 2022.

- SOL has outperformed top altcoins as positive catalysts aid bulls’ push, with price up 40% this past week and 138% over 30 days.

- How far can the price of SOL rise?

Solana continued with its amazing performance on Friday with another massive green candle, rising 24% to $54 highs. The cryptocurrency’s value has increased by more than 40% in the last week and by 138% in the last 30 days. This is good news for Solana holders.

Solana’s price has grown by 220% in the last year, according to Coinstats data, recovering levels it traded at before the bankruptcy of crypto exchange FTX.

The Price of Solana Rises Above $54

Despite recent sell-off pressure, bulls have managed to drive the price of SOL to its highest level since May 2022.

The break to this 17-month high comes after buyers reclaimed control at the crucial $30 level, allowing for further gains to $38. A retest and new motivation enabled this week’s parabolic rise to $50.

According to Santiment, a crypto analytics and market intelligence portal, Solana’s advances are accompanied by a significant increase in audience talks regarding the coin.

While financing rates have risen, they have not yet reached the danger zone. Can SOL make greater progress?

📈 #Solana has now surpassed $54 for the first time since May, 2022. Discussion rates on $SOL have again spiked, indicating the mainstream crowd recognizes the asset’s decoupling from other assets. Funding rates are high, but not in a ‘danger zone’ yet. https://t.co/Tl9jlAsOx5 pic.twitter.com/sG97sCU9Br

— Santiment (@santimentfeed) November 10, 2023

As previously stated, Ethereum, Solana, and other cryptocurrencies skyrocketed today following news that BlackRock had filed for a spot Ethereum ETF.

The statements made this week by Gary Gensler, chairman of the US Securities and Exchange Commission (SEC), also contributed to the price increase. During an interview with CNBC, Gensler stated that efforts to relaunch FTX may work if all involved followed the rules.

Gensler’s remarks came at a time when reports indicated that groups wanting to restart the bankrupt exchange had narrowed their search to three companies. Bullish, a digital asset platform developed by a former New York Exchange executive, is among them.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

[ad_2]

Source link