[ad_1]

- India leads in global grassroots crypto adoption, surpassing countries with higher trading and mining activities, securing 2nd place in raw value received.

- Global crypto adoption has declined over the last 2 years, but India’s adoption remains robust despite regulatory challenges.

- Indian investors face high taxes, encouraging offshore exchange usage, and stablecoins gain popularity in Pakistan due to economic instability.

Global Crypto Adoption Index Recently Published by Chainalysis

India has claimed the top rank in grassroots cryptocurrency adoption, according to the 2023 Global Crypto Adoption Index recently published by blockchain analytics platform Chainalysis. This indicator, which appears in Chainalysis’ yearly ‘Geography of Cryptocurrency’ report, evaluates cryptocurrency acceptance among the broader population rather than just transaction volumes.

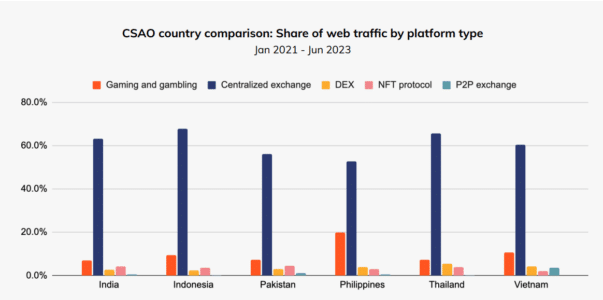

Majority Of India’s Crypto Traffic Goes To Centralized Exchanges

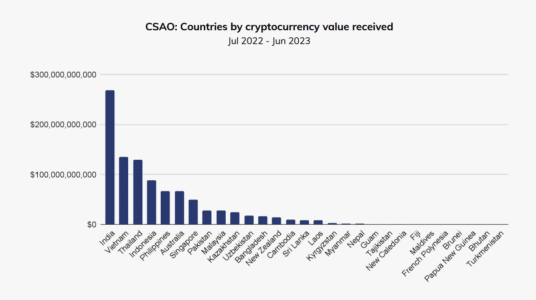

In this indicator, India ranked higher than other countries with significant amounts of bitcoin trading and mining activity. Furthermore, when the top countries were examined based on the raw estimated cryptocurrency value received between July 2022 and June 2023, India came in second place.

According to the Chainanalysis research, India got approximately $250 billion in cryptocurrency value over the past year, trailing only the United States, which received approximately $1 trillion in cryptocurrency value during the same period.

India ranked first in the overall index ranking, second in the centralized service value received ranking, third in the retail centralized service value received ranking, and fifth in the P2P exchange trade volume rating. Nigeria, Vietnam, the United States, Ukraine, the Philippines, and Indonesia follow India.

How Chainalysis Calculated Crypto Adoption?

Chainalysis estimates transaction volumes for various types of cryptocurrency services and protocols to measure global cryptocurrency adoption. This volume is computed using regional traffic on websites that offer crypto services and protocols. Despite the fact that online traffic is not a good measure of total crypto usage, it allows Chainalysis to add layers to the overall trustworthiness of its data, which is further supported by trends documented in millions of online 3 transactions.

Chainalysis also works with local cryptocurrency specialists and operators around the world, according to the official report. This consultation process adds assurance and validity to their methodology for assessing worldwide cryptocurrency adoption.

Read Also: India Undertakes Cyber Police Training To Tackle Crypto Crimes

Global Adoption Declines While India Moves Ahead

According to the survey, worldwide crypto use in the country has decreased dramatically over the last two years. After reaching an all-time high in Q1 2021, crypto usage continued to fall, reaching its lowest point in the fourth quarter of FY2023. Despite slight advances in adoption rates over the last two quarters, it could not get any closer to the old numbers.

Despite the prevalence of acute FOMO in the business as a result of rising fears of a worldwide recession, crypto adoption in India has continued to expand. This finding from the Chainalysis analysis may come as a surprise to many, given that the Indian government already taxes domestic investors left, right, and center.

However, this could also be due to Indian investors’ lack of exposure to the major crypto losses of 2022, such as the huge FTX collapse. According to the graph below, Chainalysis studies show that lower middle income countries, including India, improved significantly after Q2 2022 and were able to maintain the levels until Q2 2023.

On the other side, high-income countries such as the United States and other European countries have seen a reduction. According to the research, institutional adoption in the region appears to have increased, with transactions valued at $1 million or more accounting for 68.8% of total transaction volume, up from 57.6% in the previous time period.

Despite tax law uncertainties, there has been an unprecedented surge in transaction volume.

According to the Chainalysis analysis, India has surpassed some of the world’s richer countries to become the second largest crypto market.

Unprecedented Increase In Transaction Volume Despite Ambiguity In Tax Laws

According to the research, “India leads the world in grassroots adoption…but perhaps even more impressively has become the second-largest crypto market in the world by raw estimated transaction volume, beating out several wealthier nations.”

According to the report, “India taxes cryptocurrency activity at a much higher rate than most other countries, with a 30% tax on gains — a rate unique to crypto Central & Southern Asia and Oceania 56 and higher than the country’s tax rate on other investments such as equities.”

Along with that, Indian consumers must pay an additional 1% tax on all transactions when using Indian centralized exchanges, which may be one of the reasons why Indian investors prefer offshore exchanges to save that 1% fee on every transaction.

The data above shows the gradual increase in traffic from Indian IP addresses on foreign exchanges, indicating that more Indian users are visiting international exchanges and performing transactions.

The survey also emphasizes the appeal of stablecoins in Pakistan due to the country’s very volatile economy. In Pakistan, stablecoins are utilized as a hedge against the country’s constantly failing native currency and unpredictable inflation.

Conclusion

As stakeholders in the cryptocurrency business ask the Indian government to adopt comprehensive cryptocurrency rules, they highlight the potential benefits for entrepreneurs and investors.

Despite the government’s reservations about the growing nature of finance, crypto usage in India is increasing on a daily basis, paving the way for the establishment of comprehensive and industry-centric legislation in the future.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

[ad_2]

Source link