[ad_1]

- Since Bitcoin’s block rewards are set to be slashed, high transaction fees are needed to ensure the sustainability of the network.

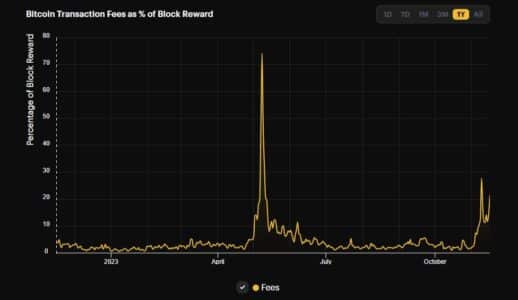

- The portion of block rewards coming from transaction fees surged to 21% on 16th November.

Bitcoin’s [BTC] bullish leap has resulted in rampant buying and selling of the asset, causing a significant spike in network transactions.

The higher the transactions, the more fees Bitcoin miners earn by validating them. This was exactly the case, as per Bitcoinworld’s analysis of Hashrate Index’s data.

Increasing Fees Make Up A Higher Share Of Rewards

The portion of block rewards coming from transaction fees surged to 21% on 16th November. In fact, the share has been consistently higher than 10% over the last one week.

In 2023, this was the second multi-week period when average fees accounted for more than 10% of the mining rewards. Such spikes were last seen during the Ordinals frenzy in early May.

Read Also: Polygon Gas Fees Spike 1000% Amid Ordinals-inspired Token Craze

Why Miners Should Celebrate These Events

Popular X user and Bitcoin enthusiast Charlie Spears termed the above developments “huge”. He basically applied the ongoing fee spike events to a post-halving scenario and came up with some intriguing findings.

2023 has been one of the least profitable years for Bitcoin miners with the exception of 2 events, both driven by Ordinals activity.

This has pretty fascinating implications for mining fees post-halving next Spring that I’ll describe below 👇

Currently we’ve seen these 2 events… pic.twitter.com/MfUsKPb7KP

— cbspears ◉ (@cbspears) November 15, 2023

Bitcoin’s block rewards were set to be slashed from the current 6.25 BTC to 3.125 after halving, tentatively scheduled for April 2024.

Spears said that since the portion of block subsidies would reduce, the share of transaction fees would go up to 20%–30% on average after the halving.

The fee revenue model of Bitcoin has been hotly debated over the years. Bitcoin is a deflationary asset, and once the 21 million limit is reached, miners will be entirely dependent on transaction fees to cover their expenses.

High transaction fees could therefore help ensure the long-term sustainability of the network.

Increase In Blockspace

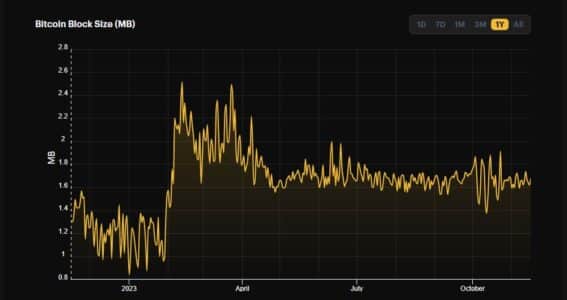

Charlie Spears stressed the importance of Ordinals-like events in expanding the use case of the Bitcoin blockchain.

Bitcoinworld observed a considerable rise in the average block amount limit since the introduction of Ordinals. From a range of 1–1.14 MB, the block size increased to an average of 1.6 MB in the last eight months. During its peak in February, it hit 2.5 MB.

Increase in blockspace meant that miners could add more transactions in a single block, helping them offset losses in a post-halving period.

[ad_2]

Source link