[ad_1]

- Avalanche (AVAX) token outperforms high-cap brethren, gaining 10% in 12 hours, driven by real-world asset tokenization.

- Avalanche has partnered with JP Morgan and Citi, both experimenting with RWA tokenization using Avalanche tech.

- ASC-20 ordinals minting has surged to account for 96% of transactions on the network.

One of the best-performing crypto assets at the moment is the layer-1 blockchain Avalanche (AVAX). The token is outperforming its high-cap brethren for yet another day, but what is driving momentum?

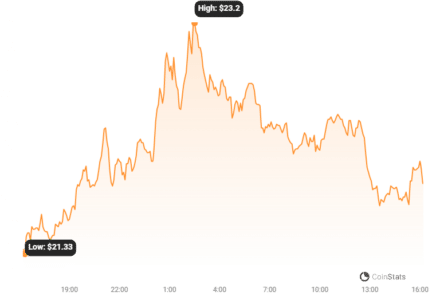

AVAX prices made almost 10% over the past 12 hours or so, returning the token to the $23 price level. It has outpaced other altcoins and overall crypto market gains, which are up around 2.3% on the day.

Avalanche Hype Driven by RWA Tokenization

There is a lot of narrative surrounding the layer-1 high-throughput blockchain at the moment, so much so that it has driven AVAX prices a whopping 80% over the past fortnight.

Moreover, a series of recent announcements, partnerships with major institutions, and a surge in GameFi and NFTs have propelled AVAX by more than 140% in the past month.

Read Also: Avalanche Shines With A 31% Rally – Can AVAX Bulls Maintain Push To $22?

One of the main narratives is the pivot to real-world asset tokenization, which Avalanche aims to become the standard chain for.

In recent days, it has announced partnerships with JP Morgan and Citi. Both are experimenting with RWA tokenization using Avalanche technology.

DeFi researcher ‘Emperor Osmo’ said that this,

“Resurgence of excitement will trickle across the ecosystem from both retail and institutions looking to get exposure.”

Avalanche made a strategic shift to become the RWA and FX chain.

Providing the necessary infrastructure to onboard the trillions in assets that remain on the sidelines, and it’s starting to pay off.

Some notable Partnerships:

– JPM

– Citi

– Wisdom Tree

– T. Rowe Price

– KKR pic.twitter.com/umfMKekKfQ— Emperor Osmo🧪 (@Flowslikeosmo) November 19, 2023

RWA tokenization has been touted as the next big thing in crypto. It essentially involves putting traditional assets such as gold, commodities, treasuries, and real estate on the blockchain.

Read Also: AVAX and Near Attract New Investors As They Outshine Bitcoin, Ethereum

Earlier this year, private wealth management firm Bernstein estimated that roughly 2% of the global money supply, or around $3 trillion, could be tokenized over the next five years.

The big banks clearly want a slice of that tokenization pie and can turn to existing technology, such as Avalanche, rather than building systems from scratch.

In July, the Avalanche Foundation announced the launch of Avalanche Vista, a $50 million initiative to invest in RWA tokenization.

Furthermore, on Nov. 20, Blockworks researcher Dan Smith reported that Avalanche has its own ordinals standard called ASC-20.

Over the past day, ASC-20 minting has surged, accounting for 96% of transactions with over 170,000 wallets minting ordinals.

Avalanche AVAX Price Outlook

The positive momentum pushed AVAX prices to an intraday high of $23.18 during the Monday morning Asian trading session.

[ad_2]

Source link