[ad_1]

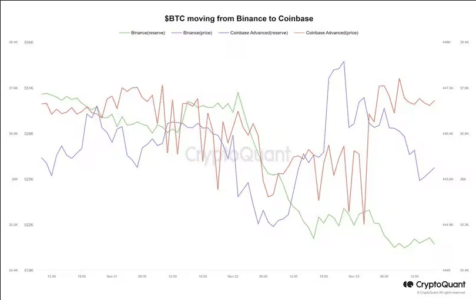

According to on-chain data compiled by CryptoQuant, Binance’s Bitcoin reserves drop as retail flow moves to Coinbase.

Since yesterday, Coinbase’s reserves have increased by around 12,000 BTC, while Binance’s have decreased by 5,000 BTC, the research firm wrote in a recent note.

“The decrease in Bitcoin reserves on Binance appears to be due to retail outflows,” Bradley Park, a Web 3 analyst at CryptoQuant wrote in a note.

“The market is still nervous about the recent legal implications against Binance,” Greta Yuan, head of research at Hong Kong-based digital-asset platform VDX said in a note to CoinDesk. “In the short term, we will see more users move funds to compliant or licensed exchanges for peace of mind.”

“Coinbase has stood the test of time,” she said.

Some analysts say that Binance’s recent settlement with the U.S. Department of Justice was the last hurdle to getting approval for a spot bitcoin ETF, and that is also affecting fund flows.

See Also: Bitcoin User Mistakenly Paid 83.6BTC As Fee For 55.77BTC Transfer

“With this plea deal, the expectations for a spot Bitcoin ETF might have increased to 100% as the industry will be forced to follow the rules that TradFi firms must follow,” crypto services provider Matrixport wrote.

CryptoQuant identified a 1,000 BTC withdrawal from Coinbase, and Park suggested the transaction was an “institutional over-the-counter (OTC) trade and can be seen as anticipation of approval of ETFs.”

CryptoQuant data shows that exchange reserves of bitcoin have been steadily decreasing throughout the year, which is considered to be a bullish sign. However, some analysts say that since last year’s collapse of FTX, trust in centralized exchanges has diminished and investors are keeping their holdings elsewhere.

[ad_2]

Source link