[ad_1]

Binance, the world’s leading digital asset exchange, has exhibited resilience and growth following its recent settlement with the US regulatory bodies.

The settlement, which addressed allegations of money laundering and sanctions evasion, marked a pivotal moment for Binance.

Since November 21, when the settlement was reached, Binance has experienced a surge in net inflows, amounting to roughly $4.6 billion.

This data, revealed in a post by Satoshi Club on X, shows the platform’s resilience amid these challenges.

“Despite recent legal challenges and leadership changes, @binance has seen net inflows of $4.6 billion since its November settlement with US agencies.

See Also: CFX Price Surges 8% As Conflux Launches EVM-Compatible Bitcoin L2 Solution

In January alone, it attracted $3.5 billion, marking its strongest month since November 2022.”

📊 Despite recent legal challenges and leadership changes, @binance has seen net inflows of $4.6 billion since its November settlement with US agencies.

In January alone, it attracted $3.5 billion, marking its strongest month since November 2022. pic.twitter.com/hMZZB3kK3U

— Satoshi Club (@esatoshiclub) January 18, 2024

Binance Inflow Resurgence Post-Settlement

January 2023 emerged as a particularly prosperous month for Binance, witnessing net inflows of $3.5 billion.

This figure surpasses any full month’s inflow since November 2022 and signifies a substantial rebound from the exchange’s myriad challenges towards the end of last year.

These challenges were not insignificant; they included notable fines imposed by a US court on Binance and its CEO, Changpeng Zhao (CZ), for charges related to alleged money laundering operations initiated by the US Commodity Futures Trading Commission (CFTC).

To put into perspective how much Binance has recovered following a tumultuous period last year:

After former CEO Changpeng Zhao stepped down and the exchange agreed to a substantial $4 billion fine with US regulators, the exchange experienced a significant outflow of over $1 billion in a single day.

Subsequently, weekly inflows struggled to exceed $800 million, culminating in a net outflow of $-1.63 billion in November, according to data from DeFillama.

However, a turnaround began in December, and the exchange’s weekly inflows consistently surpassed $1 billion weekly, totaling over $3 billion monthly.

This upward trend has continued into the current month, with inflows nearing $4 billion, signaling a robust recovery for the leading crypto exchange.

See Also: Ethereum Layer 2 Network Public Goods Network (PGN) Is Closing Down

Global Expansion And BNB’s Resilience

Despite Binance’s hurdles last year, the exchange has continued to make its presence known.

The exchange has recently extended its global footprint by launching Gulf Binance in Thailand, a joint venture with Gulf Innova.

This move aims to cater to the Thai market by offering a platform for trading digital assets with local currency pairs.

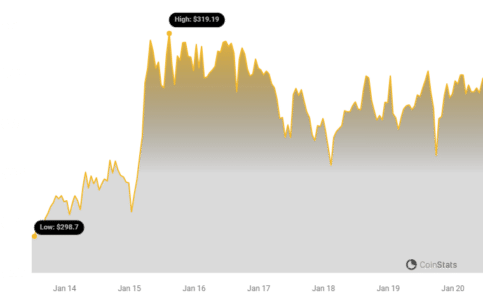

The exchange’s native token, BNB, has also demonstrated resilience. After a dip below $230 in November, BNB has steadily climbed, trading slightly above $300 at the time of writing.

This upward trajectory of BNB, with its trading volume exceeding $1 billion, mirrors the exchange’s recovery and growth trajectory.

Furthermore, Binance continues to lead the crypto exchange market, as evidenced by data from Coinstats.

With a 24-hour trading volume surpassing $14 billion, Binance comfortably outperforms rivals such as Coinbase and Kraken, which recorded $2.7 billion and $999 million in trading volume in the past day.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

[ad_2]

Source link