[ad_1]

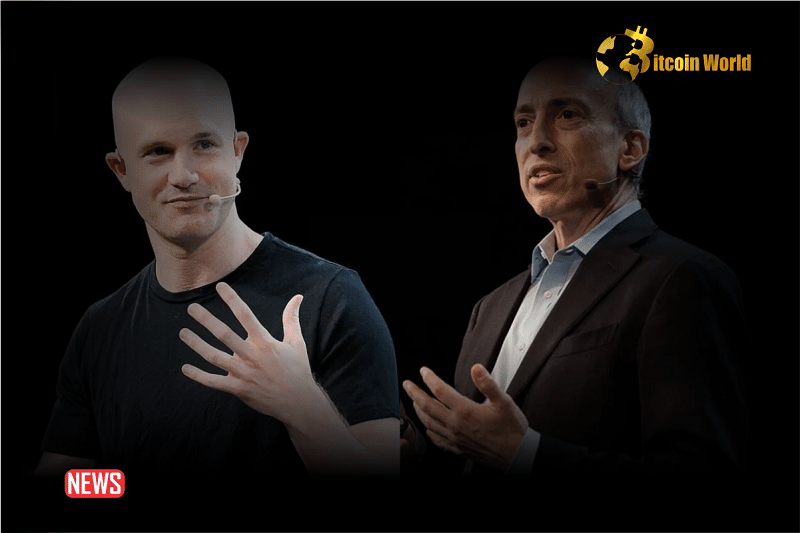

According to an analysis from Bloomberg, Coinbase has a strong chance of winning over the SEC in the agency’s lawsuit against the company for selling unregistered securities and operating a staking-as-a-service program.

What differentiates a security from a collectible?

That question is at the heart of the Securities and Exchange Commission’s lawsuit against Coinbase, as the agency is accusing the company of selling unregistered securities and operating an unlicensed staking-as-a-service program.

But after the SEC’s lawyers faced pointed questions from New York District Judge Katherine Polk Failla, who wondered aloud whether or not the agency’s definition of collectibles was too broad, a Bloomberg analyst has estimated that Coinbase currently has the edge in the case.

See Also: Binance vs. SEC Case Is Tomorrow: Here Is What To Know

“The judge wanted a limiting principle to the SEC definition of “investment contract” that wouldn’t encompass collectibles. We view the one offered by Coinbase as more compelling, requiring investment in a business vs. just an ecosystem, along with an enforceable obligation,” Bloomberg senior litigation analyst Elliott Stein wrote.

I went into SEC v. Coinbase hearing thinking $COIN would, on this motion, win dismissal of SEC’s primary claims (concerning trading) but maybe not staking and broker claims. I left thinking COIN would win full dismissal. Snippet below and full note here: https://t.co/UfjiByMLzS https://t.co/7Y2Z93Nrwt pic.twitter.com/yLUUEwdVkl

— Elliott Z. Stein (@NYCStein) January 19, 2024

Coinbase’s lawyers argued that not all cryptocurrency purchases constituted investment contracts, likening the difference to “investing in Beanie Baby Inc. and buying Beanie Babies.”

Also in question was whether or not the tokens had an “ecosystem” behind them; lawyers on both sides differed on whether or not Bitcoin constituted an ecosystem, for example, with the SEC’s lawyers arguing that it does not.

Judge Faila did not rule from the bench at the end of the four-hour hearing, saying she needed more time to consider the questions at hand.

If Coinbase’s motion is dismissed, either whole or in part, the case will continue on to discovery. Stein’s analysis notes that Coinbase may not win this motion, but projects that the company will win eventually.

See Also: The Role Of Crypto In The Forthcoming US Elections: Former US SEC Official John Reed Stark

“Our Thesis: Coinbase is 70% likely to beat the SEC, if not outright on this motion, then later,” Stein wrote.

“Even if the case survives, it likely reaches the Supreme Court, which we think will narrow Howey,” Stein also argued, referring to the standard for deeming assets as securities under U.S. law.

[ad_2]

Source link