[ad_1]

Here are a brief crypto market analysis for the week:

TRON (TRX) Market Analysis

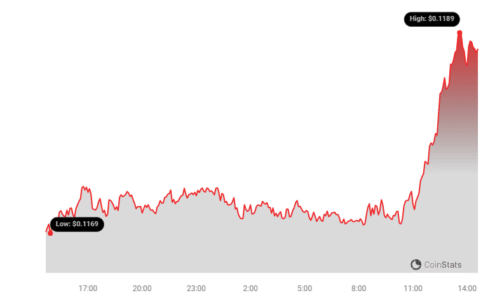

The TRON (TRX) market continues to hover around the moving average lines, struggling to breach the $0.1190 resistance level.

Since January 13, 2024, buyers have faced challenges in maintaining positive momentum above this critical barrier.

The current TRX price stands at $0.1187, with a long-term forecast suggesting a fluctuating trajectory.

Although TRON (TRX) is in an uptrend, evidenced by price bars consistently above the moving average lines, the market has encountered resistance at $0.1150.

The presence of doji candlesticks and consolidation hints at limited price movement.

Key supply zones for TRON (TRX) include $0.09, $0.10 and $0.11, while key demand zones are identified at $0.06, $0.05, and $0.04.

See Also: Don’t Miss The Kelexo (KLXO) Presale

USD Coin (USDC) Faces Fee Changes

Coinbase has recently revealed updated charges for institutional customers engaged in converting USD Coin (USDC) to USD, surpassing $75 million over a consecutive 30-day span.

The fees vary from 0.1% to 0.2%, contingent on the transaction amount.

Notably, Coinbase Prime patrons possessing considerable assets or maintaining substantial USD/USDC volumes might not be subject to these fees.

These modifications align with Coinbase’s dedication to advancing technology and taking into account user input.

Internet Computer (ICP): Struggling With Volatility

Internet Computer (ICP) emerged as a beacon in the decentralized finance (Defi) realm, offering a platform for innovative decentralized applications.

With its blockchain-based computer, Internet Computer (ICP) streamlined smart contract computation and data storage, fostering flexible software architectures for programmers.

Despite its historic price run, the future trajectory of Internet Computer (ICP) remains uncertain, with projections hinting at potential highs and regulatory risks.

See Also: PYTH Price Surged 20% After Binance Listing Announcement – Will This Momentum Last?

Ethereum Classic (ETC): Moderate Volatility Amidst Market Flux

Ethereum Classic (ETC) maintains a relatively stable stance amidst crypto market volatility.

With a moderate volatility rank and price trading above key support levels, Ethereum Classic (ETC) navigates the market’s uncertainties.

Investors observe its moderate price swings and resilience against manipulation, positioning Ethereum Classic (ETC) as a steady contender in the crypto space.

#Binance #WRITE2EARN

Disclaimer: The information provided is not trading nor financial advice. Bitcoinworld.co.in holds no liability for any trading or investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any trading or investment decisions.

[ad_2]

Source link