[ad_1]

- In Binance and Coinbase hearings, the SEC argued that crypto tokens may be classified as security and non-security simultaneously.

- Interestingly, the SEC lawyers see no contradiction in their positions.

Recently, renowned pro-crypto attorney James Murphy (a.k.a. MetaLawMan) weighed in on the U.S. regulator’s inconsistency in classifying crypto assets as security.

The SEC seems to have a hard time keeping its story straight on crypto.

Let’s take a closer look at statements by SEC lawyers at the recent @Coinbase and @Binance hearings.

SEC v. @Coinbase (Jan. 17):

Court: “You’re saying that as to these 12 or 13 tokens, when they were…

— MetaLawMan (@MetaLawMan) February 8, 2024

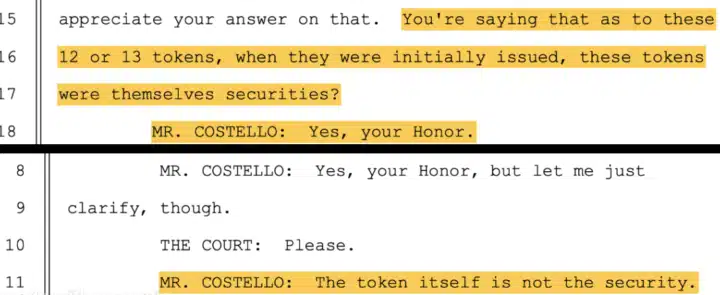

Specifically, Murphy highlighted recent court hearings wherein the Securities and Exchange Commission’s (SEC) legal counsels presented conflicting arguments.

The first cited instance was a January 17 hearing in the lawsuit against the US-based exchange Coinbase.

During the proceedings, the court sought clarification from the SEC on whether some 13 tokens in contention were themselves securities at their initial issuance.

See Also: US Treasury Secretary, Janet Yellen, Calls For Crypto Legislation On ‘Non-Security’ Tokens

In response, the SEC lawyers said, “Yes, your Honor,” affirming the tokens were security. However, in the same court session, the SEC lawyer added, “The token itself is not the security.”

Furthermore, attorney Murphy cited a second instance in the hearing concerning the suit against leading trading platform Binance.

Similarly, the court asked the SEC counsel if it agreed that there is a difference between the coins, the subject of the investment contracts, and the contracts themselves.

In response, the SEC lawyers remarked positively, acknowledging that the crypto assets are merely a line of code.

However, they again contradicted themselves by saying, “The token itself represents the investment contract” during the same hearing.

The court countered, expressing uncertainty about having heard from the SEC before that tokens represent the investment contract.

In defending its position, the SEC lawyer asserted that the asset embodies the investment contract. Moreover, they disagree that any contradiction exists in their positions so far.

See Also: Former Zipmex Thailand CEO Akalarp Yimwilai Charged with Fraud by Thai SEC

In essence, attorney Murphy highlighted that according to the SEC, the crypto token is both considered a security and not a security, and these two statements are not viewed as contradictory.

“The SEC seems to have a hard time keeping its story straight on crypto,” he remarked.

#Binance #WRITE2EARN

[ad_2]

Source link