[ad_1]

- Despite the crypto market boom, Bitcoin Cash is struggling to make new ground; on-chain data suggests a drop in network activity.

- The number of active Bitcoin Cash users and new entrants has dramatically decreased, indicating a possible market demand downturn.

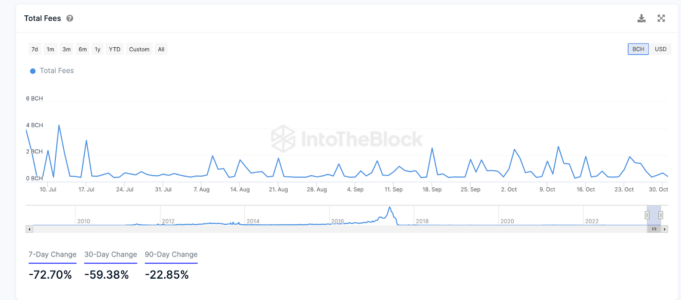

- The present fall in BCH Total Fees supports the decline in network activity, implying that Bitcoin Cash’s upward price action has lost pace.

This week, the Bitcoin Cash price has remained below the $250 resistance level. On-chain data analysis identifies the major reasons undermining BCH’s bullish momentum.

Bitcoin Cash appears to have met a price ceiling of $245, while other majors like Bitcoin (BTC) and Solana (SOL) have rushed to new 2023 highs. Will the bulls be able to survive the oncoming bearish pressure?

BCH Network Activity Declines Despite Crypto Market Recovery

Despite the latest crypto market boom, Bitcoin Cash appears to be struggling to gain traction. On-chain data trends have now identified a decrease in network activity as one of the primary reasons BCH price action has halted this week.

According to IntoTheBlock, the Bitcoin Cash peer-to-peer network has recently seen a significant decline in the number of active users.

The data below shows that BCH Active Addresses have decreased by 79% in the last seven days. Similarly, the number of new users joining the network has dropped by an astounding 85% over that time.

The metrics Active Addresses and New Addresses are critical on-chain data elements that provide a snapshot of economic activity on a blockchain network.

The number of current users who conduct viable transactions is tracked by Active Addresses. Meanwhile, the New Addresses indicator tracks how quickly the network draws new users.

When both measurements fall at the same time, it is a clear bearish signal that the underlying BCH currency may see reduced market demand in the coming days. According to this thesis, Bitcoin Cash holders can expect additional downside in the coming days as the market recovers.

Fees Generated on the BCH Network are Decreasing

Another interesting measure that confirms the drop in network activity is the current downtrend in BCH Total Fees earned daily. According to the graph below, fees earned by transactions on the Bitcoin Cash network have decreased by 73% in the last week.

This concerning pattern shows that BCH economic activity fell substantially lower than reported in September.

The Total Fees indicator calculates the total amount paid by network participants to use blockchain-hosted services over a certain time period. A decrease in generated crypto transaction fees is a traditional bearish indication, signaling declining network demand.

This shows that the recent BCH price rise has been primarily driven by bullish traders betting on the broader crypto market surge. Without a large increase in network activity, Bitcoin Cash’s upward price movement may begin to lose steam in the coming days.

Read More: Axie Infinity (AXS) Rises 15% Amid Sky Mavis and Act Games Partnership

BCH Price Prediction: $250 Resistance Could Be Difficult

Despite the strong market sentiment, BCH price appears to be on the cusp of a minor correction.

This prediction is also supported by the Global In/Out of the Money data, which is an on-chain depiction of current Bitcoin Cash holders’ historical entry prices. It demonstrates that the $250 level is the most significant resistance above current BCH prices.

As shown below, 1.25 million addresses purchased 2.09 million BCH for the minimum price of $248. If they exit their holdings too soon, the projected price correction would be triggered.

Alternatively, if the Bitcoin Cash price exceeds $300, the bulls could debunk that claim. In that case, the next resistance level would most likely be around $280.

According to the graph above, 1.51 million addresses presently own 968,000 BCH purchased at the minimum price of $293. Bitcoin Cash is unlikely to break over that obstacle without a large boost in network demand.

Disclaimer. The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

[ad_2]