Grayscale Research Predicts Current Bull Run Could Extend Into 2025 and Beyond

Grayscale Research, a leading authority in cryptocurrency market analysis, has released a report suggesting that the current crypto bull run could potentially extend into 2025 and beyond. Unlike previous market cycles that adhered to a predictable four-year pattern, Grayscale believes the market’s trajectory could be influenced by new developments such as the launch of spot Bitcoin and Ether exchange-traded products (ETPs) and evolving macroeconomic conditions.

This outlook signals an optimistic future for crypto assets, provided that key fundamentals—like application adoption, institutional interest, and supportive macro trends—continue to drive growth in the market.

Breaking the Historical Four-Year Crypto Cycle

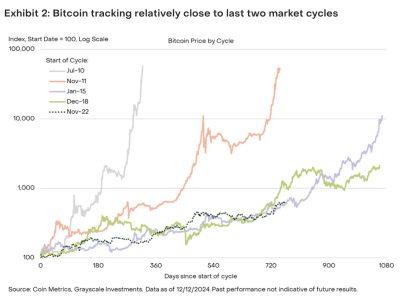

Historically, cryptocurrency valuations have followed a recurring four-year cycle, marked by periods of intense growth (bull markets) followed by corrective phases (bear markets). This cycle has often been closely tied to the Bitcoin halving events, which occur roughly every four years and reduce the rate of new Bitcoin supply entering the market.

However, Grayscale Research indicates that the crypto market is now undergoing significant structural changes, driven by:

- The Introduction of Spot Bitcoin and Ether ETPs: These investment vehicles allow investors to gain exposure to cryptocurrencies through regulated markets without holding the underlying asset.

- Growing Political Support: The entry of crypto-friendly officials into the U.S. Congress is likely to pave the way for favorable regulatory frameworks.

With these factors in play, Grayscale predicts that the market could see a longer and more sustained bull run that breaks away from the traditional four-year cycle.

Spot ETPs: A Game-Changer for Crypto Adoption

One of the primary drivers behind Grayscale’s bullish outlook is the launch of spot Bitcoin and Ether exchange-traded products (ETPs). These financial instruments allow institutional and retail investors to trade Bitcoin (BTC) and Ethereum (ETH) in traditional markets, creating a bridge between the crypto ecosystem and mainstream finance.

The benefits of spot ETPs include:

- Increased Institutional Participation: Institutional investors, such as hedge funds and pension funds, can gain exposure to cryptocurrencies through a regulated and familiar investment vehicle.

- Enhanced Liquidity: Spot ETPs can attract significant capital inflows, improving overall market liquidity.

- Greater Accessibility: Retail investors can invest in cryptocurrencies without dealing with complex wallets and exchanges.

By broadening access to Bitcoin and Ethereum, these ETPs are expected to fuel demand and support higher valuations, further extending the bull market.

Macro Market Conditions Supporting the Crypto Bull Run

Grayscale also highlights the importance of broader macroeconomic factors that could sustain the current bull run. Some of the key drivers include:

- Inflation and Monetary Policy:

- Cryptocurrencies, particularly Bitcoin, are often seen as a hedge against inflation. With global concerns over rising inflation and potential shifts in monetary policy, investors may continue to flock to crypto as a store of value.

- Global Economic Uncertainty:

- Economic instability and currency devaluations in various countries could boost demand for decentralized assets like Bitcoin and Ethereum.

- Improving Regulatory Clarity:

- With the entry of crypto-friendly lawmakers in the U.S. Congress, regulatory clarity around crypto investments and digital assets could encourage further adoption.

If these macroeconomic trends remain favorable, Grayscale believes the crypto market will continue to experience sustained growth through 2025 and beyond.

Application Adoption: A Fundamental Growth Driver

Another key pillar of Grayscale’s bullish thesis is the increasing adoption of crypto applications across various industries. Blockchain technology is rapidly gaining traction in areas such as:

- Decentralized Finance (DeFi): Platforms that offer lending, borrowing, and trading services without intermediaries are continuing to attract users.

- Non-Fungible Tokens (NFTs): NFTs have emerged as a major trend in gaming, digital art, and entertainment.

- Enterprise Blockchain Solutions: Businesses are increasingly integrating blockchain for supply chain management, payments, and data verification.

The growing real-world utility of blockchain applications provides a strong foundation for long-term crypto market growth. Grayscale emphasizes that as adoption expands, valuations will be supported by tangible use cases and increasing demand.

The Role of Ethereum and Bitcoin in the Next Growth Phase

Grayscale’s report pays special attention to the leading cryptocurrencies, Bitcoin (BTC) and Ethereum (ETH), as critical drivers of the market’s continued expansion.

- Bitcoin (BTC):

- Often referred to as “digital gold,” Bitcoin remains a dominant asset class and a reliable hedge against economic uncertainty. The introduction of spot Bitcoin ETPs is expected to attract significant institutional investment, driving further price appreciation.

- Ethereum (ETH):

- Ethereum remains the backbone of the blockchain ecosystem, powering smart contracts, decentralized applications (dApps), and ERC-20 tokens. The ongoing improvements to Ethereum, such as the move to Ethereum 2.0, are enhancing scalability and efficiency, which will further boost its adoption.

Both Bitcoin and Ethereum are poised to play pivotal roles in extending the current bull run.

Crypto-Friendly Officials: A Regulatory Boost for Adoption

The entry of crypto-friendly officials into the U.S. Congress is another critical factor highlighted by Grayscale. Regulatory uncertainty has historically been a major hurdle for crypto adoption. However, with increasing political support, the regulatory landscape may shift in favor of digital assets.

Potential impacts include:

- Increased Institutional Confidence: Clearer regulations will attract institutional investors who have previously been hesitant to enter the crypto market.

- Innovation and Growth: A supportive regulatory framework will encourage further innovation in blockchain technology and decentralized finance.

Grayscale believes that this shift could act as a catalyst, extending the bull market into 2025 and beyond.

Conclusion

Grayscale Research’s latest report offers an optimistic outlook for the cryptocurrency market, predicting that the current bull run could extend well into 2025 and beyond. Factors such as the launch of spot Bitcoin and Ether ETPs, favorable macro market conditions, increasing application adoption, and growing political support are expected to drive this extended growth phase.

By breaking free from the traditional four-year cycle, crypto valuations could enter a new era of sustained growth. Investors, both retail and institutional, are watching closely as the market evolves with promising developments that bridge the gap between blockchain technology and mainstream finance.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on latest news, where we delve into the most promising ventures and their potential to disrupt traditional industries.