The Bitcoin-Gold Debate

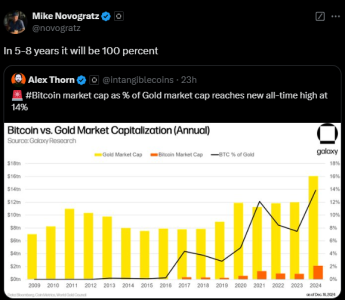

The CEO of Galaxy Digital, Mike Novogratz, has reignited discussions about Bitcoin’s long-term potential by predicting that the cryptocurrency’s market capitalization could surpass gold’s within the next 5-8 years. Novogratz shared his insights on X (formerly Twitter), highlighting Bitcoin’s rising market presence and increasing adoption as catalysts for this transformation.

As of now, Bitcoin’s market cap stands at $2.13 trillion—approximately 14% of gold’s $17.8 trillion market cap. The bold forecast underscores Bitcoin’s growing role as a store of value and its potential to challenge gold’s dominance as a global reserve asset.

Why Novogratz’s Prediction Matters

1. Bitcoin’s Growing Share of Global Wealth

Bitcoin has seen tremendous growth in recent years, transitioning from a niche digital asset to a global financial powerhouse. The cryptocurrency’s rise to 14% of gold’s market cap is a testament to its increasing adoption as a digital store of value.

2. Institutional Adoption Accelerates Growth

Novogratz’s prediction comes at a time when institutions are driving Bitcoin adoption. Companies like MicroStrategy and countries such as El Salvador have incorporated Bitcoin into their reserves, bolstering its credibility.

3. The Case for Bitcoin Over Gold

Unlike gold, Bitcoin offers unique advantages such as portability, divisibility, and resistance to physical confiscation. These characteristics position Bitcoin as a modern alternative to gold in an increasingly digital world.

Bitcoin vs. Gold: Key Comparisons

| Aspect | Bitcoin | Gold |

|---|---|---|

| Market Cap | $2.13 trillion | $17.8 trillion |

| Portability | Highly portable, can be transferred digitally | Limited to physical transportation |

| Divisibility | Infinitely divisible | Divisible but less practical |

| Supply | Capped at 21 million BTC | Practically infinite with mining |

| Storage | Digital wallets | Physical vaults or storage facilities |

Factors Fueling Bitcoin’s Rise

1. Institutional Adoption

Institutional investments have poured billions into Bitcoin, validating its role as a legitimate financial asset. Grayscale, BlackRock, and Fidelity are just a few examples of major players embracing Bitcoin ETFs and funds.

2. Digital Transformation

The world is rapidly shifting toward digital ecosystems. Bitcoin, as a native digital asset, benefits from this trend, offering seamless integration with online financial systems.

3. Decentralization and Trust

Unlike gold, which requires centralized storage and verification, Bitcoin operates on a decentralized blockchain, providing transparent and trustless value storage.

4. Scarcity and Halving Events

Bitcoin’s capped supply of 21 million coins ensures its scarcity, a trait that mirrors gold. Halving events, which reduce the reward for mining Bitcoin, further limit supply and have historically driven price increases.

Challenges Ahead for Bitcoin

While the potential for Bitcoin to surpass gold is compelling, several hurdles remain:

1. Regulatory Uncertainty

Governments and regulatory bodies worldwide continue to debate the role of Bitcoin in the financial system. Unfavorable regulations could impact its growth trajectory.

2. Market Volatility

Bitcoin’s price fluctuations can be extreme, deterring risk-averse investors who prefer the stability of gold.

3. Public Perception

Although Bitcoin’s reputation has improved, lingering skepticism and misinformation about cryptocurrencies could hinder widespread adoption.

Gold’s Enduring Legacy

Gold has been a trusted store of value for centuries, serving as a hedge against inflation and economic uncertainty. Its physical nature and established history make it a cornerstone of traditional investment portfolios.

However, Novogratz’s prediction suggests that Bitcoin could capture a new generation of investors who value digital assets’ unique advantages.

What Needs to Happen for Bitcoin to Surpass Gold?

1. Increased Adoption

Bitcoin adoption needs to extend beyond institutions and retail investors. Broader use cases, such as decentralized finance (DeFi) and global remittances, could drive significant growth.

2. Technological Advancements

Scalability solutions like the Lightning Network are critical for Bitcoin to handle higher transaction volumes efficiently, fostering mainstream adoption.

3. Education and Awareness

Educating the public about Bitcoin’s benefits and addressing misconceptions are vital for fostering trust and increasing adoption.

4. Regulatory Clarity

Clear and supportive regulations would provide the stability needed for Bitcoin to attract more investors and institutions.

Timeline to $17.8 Trillion

Novogratz’s 5-8 year timeline is ambitious but plausible. Bitcoin’s growth has historically been exponential, driven by network effects and technological advancements.

| Year | Projected Market Cap | Percentage of Gold’s Cap |

|---|---|---|

| 2025 | $5 trillion | ~28% |

| 2027 | $10 trillion | ~56% |

| 2030 | $18 trillion | ~101% |

Investor Takeaways

1. Diversification is Key

Investors should consider diversifying their portfolios to include both gold and Bitcoin. Each asset offers unique advantages and serves different purposes.

2. Long-Term Perspective

Bitcoin’s journey to surpass gold will likely be marked by volatility. A long-term investment approach can help navigate short-term fluctuations.

3. Stay Informed

Understanding the macroeconomic factors driving Bitcoin’s growth, such as inflation and institutional interest, can provide valuable insights for making informed decisions.

Conclusion: The Future of Bitcoin and Gold

Mike Novogratz’s prediction of Bitcoin surpassing gold’s market cap within 5-8 years reflects the transformative potential of digital assets. As Bitcoin continues to gain traction, it poses a legitimate challenge to gold’s long-standing dominance as the ultimate store of value.

While challenges remain, Bitcoin’s unique characteristics, combined with growing adoption and technological advancements, position it as a formidable contender in the financial landscape. For investors, the race between Bitcoin and gold presents an opportunity to diversify and capitalize on the shifting dynamics of global wealth.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on latest news, where we delve into the most promising ventures and their potential to disrupt traditional industries.