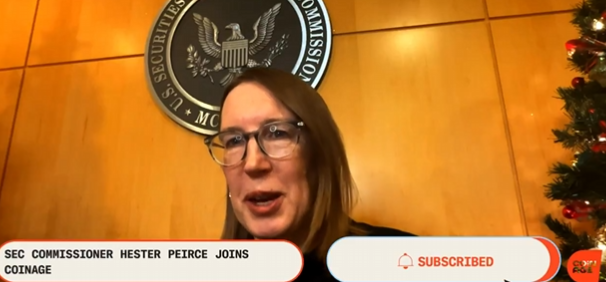

U.S. Securities and Exchange Commission (SEC) Commissioner Hester Peirce, a prominent advocate for clear and balanced cryptocurrency regulation, has shed light on a possible shift in the agency’s crypto policy. Speaking in a conversation reported by Coinage’s X account, Peirce discussed the evolving regulatory landscape, the transition period following SEC Chair Gary Gensler’s departure, and the prospects for a more pro-innovation SEC.

This potential shift signals hope for the crypto industry, which has faced scrutiny and uncertainty under the current regulatory regime.

Hester Peirce: A Voice of Reason in Crypto Regulation

Known as “Crypto Mom” within the industry, Hester Peirce has consistently advocated for pragmatic and innovation-friendly crypto policies. Her views often contrast with the SEC’s historically cautious approach to digital assets.

Peirce’s latest comments underscore the importance of fostering a regulatory environment that balances investor protection with innovation.

Peirce’s Advocacy for Clarity

- Clear Guidelines: Peirce has repeatedly called for clear, transparent regulations to prevent stifling innovation.

- Innovation-Friendly Stance: She emphasizes the need for policies that encourage growth in the blockchain and cryptocurrency sectors while addressing risks effectively.

Anticipated Changes in SEC Leadership

The impending departure of SEC Chair Gary Gensler is a pivotal moment for the agency. Under Gensler’s leadership, the SEC adopted a stringent approach toward cryptocurrencies, targeting major players and enforcing rules on various crypto activities.

What to Expect Post-Gensler

- Shift Toward Pro-Innovation Policies: Peirce’s comments suggest that the new leadership might adopt a more balanced approach, focusing on fostering innovation while ensuring compliance.

- Regulatory Modernization: The SEC could streamline outdated regulations to address the unique aspects of blockchain and digital assets.

- Industry Engagement: A more collaborative relationship between regulators and the crypto industry may emerge, paving the way for mutually beneficial policies.

Key Topics Discussed by Peirce

Peirce touched on several critical issues that could shape the SEC’s crypto policy going forward:

1. The Pace of Change

The regulatory landscape for crypto has been evolving rapidly, often leaving market participants uncertain about compliance requirements. Peirce acknowledged the need for the SEC to adapt more quickly to emerging technologies.

2. Transition Challenges

With new leadership on the horizon, Peirce highlighted the importance of ensuring a smooth transition period. This includes aligning the SEC’s goals with the broader push for U.S. leadership in blockchain innovation.

3. Balancing Risks and Opportunities

Peirce emphasized that while protecting investors remains a priority, excessive regulation could drive innovation overseas. Striking the right balance will be crucial for maintaining the U.S.’s competitive edge.

A More Pro-Innovation SEC: What It Means for Crypto

A shift toward pro-innovation policies could have far-reaching implications for the cryptocurrency market:

- Boosting Institutional Confidence: Clearer regulations would encourage institutional investors to participate in the crypto market.

- Encouraging Startups: A supportive regulatory environment could attract blockchain startups, fostering economic growth.

- Global Leadership: The U.S. could solidify its position as a leader in blockchain technology and cryptocurrency innovation.

Challenges Ahead

While optimism surrounds the potential policy shift, challenges remain:

- Legislative Coordination: The SEC’s policies must align with broader legislative efforts to create a cohesive framework.

- Fraud and Misuse Risks: Regulators must address concerns about fraud and misuse without overburdening legitimate actors.

- Global Competition: As other nations adopt crypto-friendly policies, the U.S. must act decisively to remain competitive.

The Crypto Industry’s Response

The crypto community has welcomed Peirce’s comments as a sign of potential relief from the SEC’s stringent stance. Many industry leaders are hopeful that the SEC will engage more collaboratively with blockchain innovators and prioritize clarity in its regulatory agenda.

Conclusion

Commissioner Hester Peirce’s discussion of a potential shift in the SEC’s crypto policy offers a glimmer of hope for the industry. Her emphasis on pro-innovation strategies and the transition to new leadership could herald a new era for cryptocurrency regulation in the U.S.

As the regulatory landscape evolves, the crypto industry and policymakers must work together to foster innovation while addressing risks effectively. The potential for a more balanced, innovation-friendly SEC could pave the way for sustainable growth in the blockchain sector.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on latest news, where we delve into the most promising ventures and their potential to disrupt traditional industries.